Selecting your own investment strategy: the essentials

Anyone who wants to turn the investment into their primary source of income must understand the essence of this multifaceted process and the principles based on which it should be approached. This article will help you better understand the most relevant strategies that a person can use when dealing with investments.

Relevant strategies you can use for investment

If you want to be serious about investing, it is advisable for you to consider one of the following strategies:

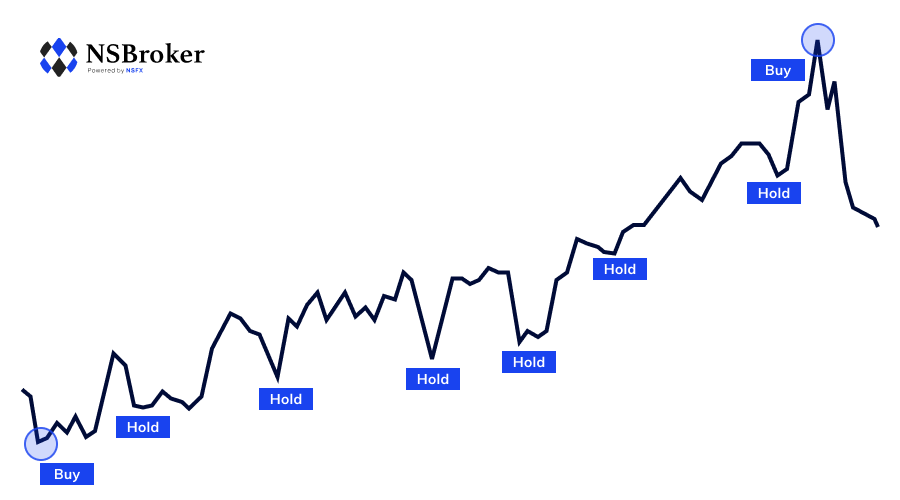

1.Buying and holding

The central elements on which this strategy relies are patience and endurance. Those traders that select it as their fundamental operating model acquire stocks and then hold them for a prolonged period. The stocks of some companies may increase in price significantly in the long run. Investors who prefer buying and holding look for such cases with the help of the fundamental and technical analysis and subsequently focus on them in their activities.

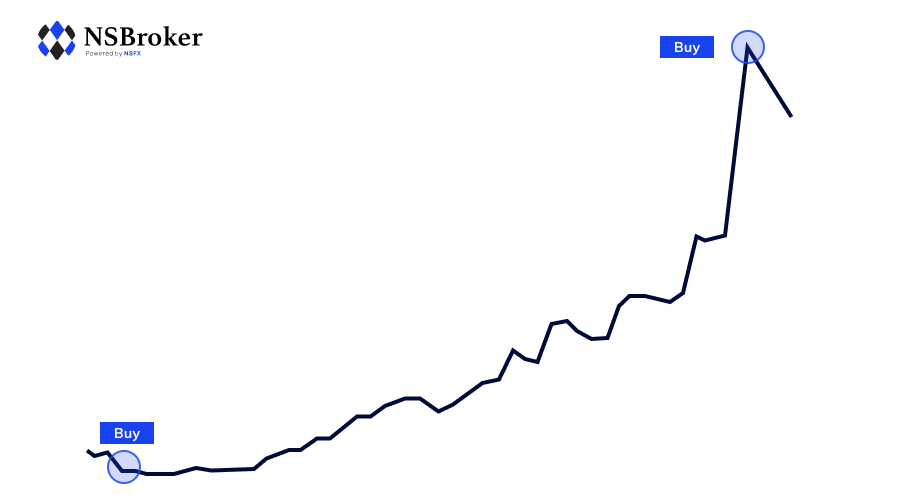

2. Buying low and selling high

Like the previous strategy, this one also involves buying stocks and selling them when their price is the most favorable. However, one distinctive feature that distinguishes buying low and selling high is the investors' attempt to purchase assets when their price is the lowest possible. To capture this moment most accurately, investors use fundamental analysis, focusing, among other things, on aspects such as the behavior of the company's leaders, the situation in the sector in which the organization operates, the company's profits during recent reporting periods, and other similar items.

3. Using breakouts

The third strategy usually requires the longest waiting time from investors. Within it, an investor opens a position only after the stock's price breaks through a value known as the "historical resistance level," which is the highest value that the stock has ever had historically. Overcoming this barrier is perceived as a central indicator that predicts a further increase in the price of the stock. When such a situation occurs, an investor opens a position.

Selecting a strategy for your investment activities

The choice of investment strategy is determined by the individual characteristics of a person interested in this activity. However, there are several factors that everyone should take into account, regardless of his or her personal traits and visions. The central aspect that is to be considered is the potential risk to which a person exposes him- or herself and its correlation with the reward that can be obtained. Also, it is advisable to take into account the time during which the investor seeks to make a profit because it can be radically different for various strategies.

Getting the highest returns

All the strategies described above have specific features that make them applicable in different situations. However, based on the experience of investors available for analysis, it is possible to determine which of them bring higher returns than others. The existing information demonstrates that buying and holding usually yields greater returns than other strategies. In turn, if an investor buys stocks only when their value reaches the level he or she expects, the chances of getting high returns are lower. However, they still exist. Therefore, you should not neglect existing strategies based solely on statistical generalizations.

The importance of research for the success of the investment

Given that investing is a complex and multifaceted phenomenon, it is not surprising that it should never be based on conjectures or intuition. Diligent and meticulous research is behind every investor's success. If you want to choose the right investment strategy and determine the time to open a position, you should conduct a technical and fundamental study of the company whose stocks you are interested in. It is the main tool that will help you make the right decision.

In addition, you can always use a variety of specialized platforms, such as various stock screeners, to identify potential opportunities and take advantage of them. In any case, no matter which way you go, remember that in any investment activity, you should submit to the following principles: research, choose a strategy, manage risks, and keep your position open. Follow these steps, and you will get a chance to succeed in investing.