Forex Weekly Forecast & FX Analysis January 11 - 15

EUR/CHF

For the euro against the Swiss franc, the main movement remains sideways. This sideways movement can be clearly seen both in the price chart and in the moving averages, which develop almost horizontally. This movement is also confirmed by the oscillator, which is mainly traded in the area of the 50 level. During the last week, we draw attention to the fact that the 1.0820 level was tested twice and the last testing took place quite recently. Therefore, here and now we can consider options for upward trading with a target at 1.0860.

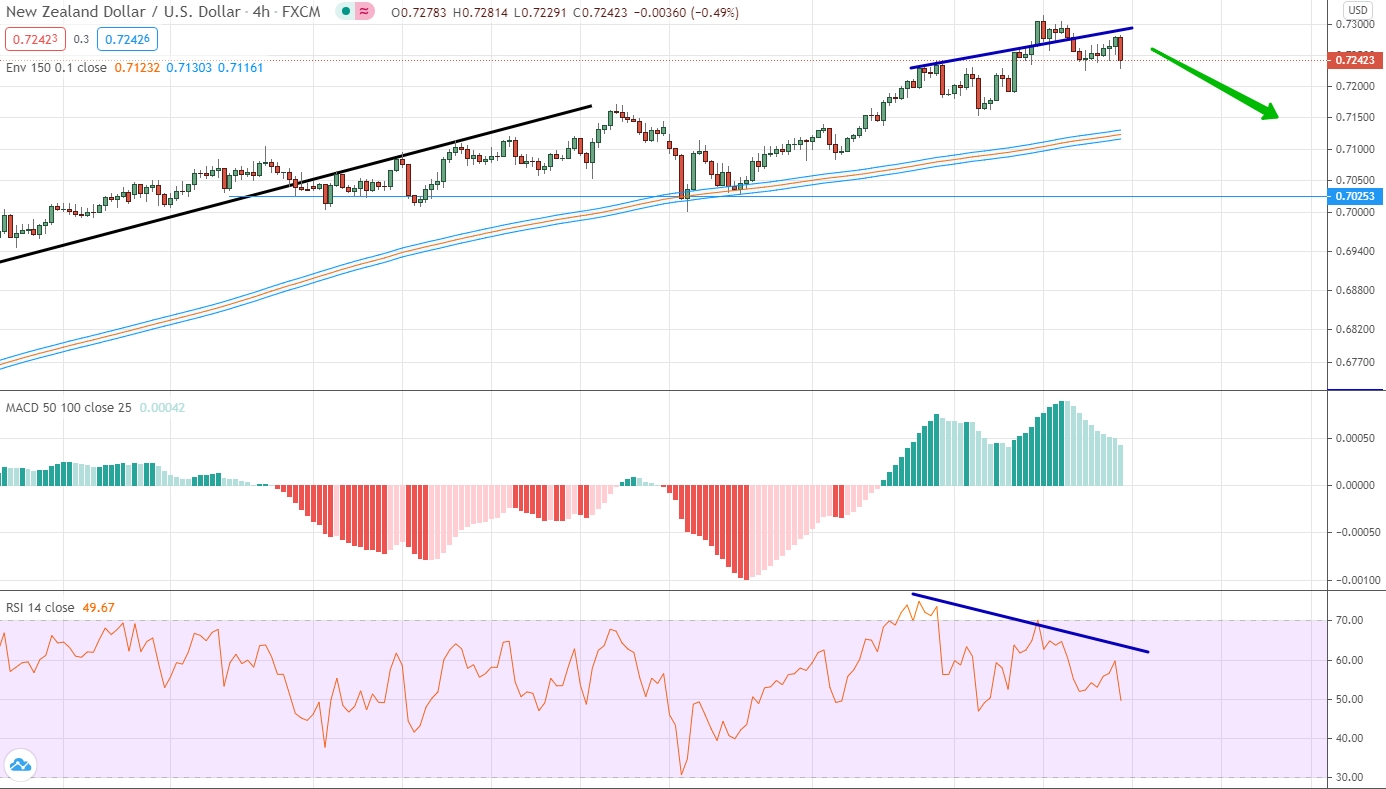

NZD/USD

For this currency pair, the main dynamics is still upward. An uptrend has been forming for a very long time and quite strongly. Almost every week we talk about the local maximum indicators being updated on the price chart. Now we can say that the price comes into some conflict with the indicators, since the market continues to grow in one way or another, and the indicators mostly look down, or are in neutral positions, which do not speak about specific trading opportunities. Therefore, we can expect a downward correction, which means we open the contract down with the target at about the level of the moving averages.

EUR/RUB

The euro against the Russian ruble is developing within a side corridor with borders at 89.84 and 91.70. It is very important here to pay attention to indicators that have practically stuck to their neutral values and cannot even move away from them minimally. This confirms the sideways movement and confirms the fact that there are no dynamics here and now on the market. At such a dangerous stage, where the dynamics are clearly not traced, it is impossible to trade, therefore we do not trade and wait in which direction the market will break through the indicated range, and in the direction of this breakdown, you can open a contract.

AUD/CHF

The Australian dollar continues to rise against the Swiss franc. To demonstrate this, simply look at the price chart, which updated its local maximum values last week. The main trend is also traced by the indicators, each of which is in the positive area, and at rather high positions. Theoretically, we can consider options for trading up, but the market is already at its maximum and therefore it is dangerous to open a contract here and now. You need to wait for a downward correction in the area of the trend line, and only then open a contract.

GBP/CAD

The past week has led to a slight downward correction of the British pound against the Canadian dollar. The downward movement is clearly traced, including on the histogram, which has passed from the maximum positive value to the minimum negative value. It is also very important to note here that within the framework of this movement the price reached the level of the moving averages and stopped there. Practically, the level of 1.7177 and the downtrend line form a triangle between themselves, and you cannot trade while it is inside this figure. If the price turns out to be above the trend line, we trade for an increase, and if the market falls below the level of 1.7177, we trade a decrease.

NZD/CHF

The New Zealand dollar rose significantly last week against the Swiss franc. There was an exit upward from the side channel, which we talked about in the previous weekly reviews, and this made it possible to form a fairly strong upward trend. This dynamics is well traced, including by indicators that are in the positive area and continue to grow. Nevertheless, we note the fact that, in general, a sideways movement prevailed for this currency pair, and at the top of the current movement, an absorption pattern was formed. Therefore, we can expect a downward correction.

USD/CNH

The dollar continues to lose its positions against the Chinese yuan, which can be traced both in the price chart and in the positions of all indicators. If we look at the indicators, we would like to draw your attention to the fact that each of them recently updated the minimum local value, but immediately after that it went up to neutral indicators. The same can be said about the price chart. Therefore, we can expect that the market will still need to test the level of moving averages, which means that we can consider options for trading up, but take into account that we are trading against the trend.