Forex Weekly Forecast & FX Analysis July 6 - July 10

EUR/USD

Last week, the U.S. labor market showed a continued recovery. 4.8 million jobs were created outside the agricultural sector, unemployment fell to 11.1%, but at the same time, wages, which in annual terms, that in monthly terms, continue to fall.

Therefore, the reaction of the market may seem twofold to many people. On the one hand, strong statistics gave the bulls on U.S. stock indices an opportunity to raise the market, but at the same time, the dollar itself rose.

But, let's face it. The European economy will surely recover faster than the American economy. The epidemiological situation in Europe is much better than in the United States, and the success of European medicine and the scale of incentives is impressive.

Europe is in the deepest recession since World War II and must agree on a multi-year budget of more than one trillion euros, create a recovery fund for the EU economies most severely affected by COVID-19, and clarify its future relationship with Britain after Braxit.

This week's meeting of EU finance ministers could be a revelation ahead of the upcoming summit of 17-18 June, which is crucial to reaching agreement on a recovery fund.

Germany wants to use its time as EU chair to make the EU strong again. A recovery fund agreement will certainly help. Markets are hoping that solidarity will prevail and the euro will continue to rise in value. But the optimism may fade if there are disputes. The next six months will be difficult for Berlin and the EU in particular.

USD/CAD

Canada should focus on accelerating economic growth after the Coronavirus crisis hit the world. Due to concerns over the country's debt, Fitch downgraded the country's rating, which reduced the attractiveness of buying Canadian dollar.

Canadian Finance Minister Bill Monroe will present a "financial report" on Wednesday. Which will outline the current balance sheet and may give an idea of the funds that the country is saving for the future.

The IMF expects that the Canadian economy will shrink by 8.4% this year. Ottawa has already allocated over 150 million Canadian dollars in direct economic assistance, including payments to workers affected by COVID-19.

Further stimulus measures may include a "green growth" strategy as well as infrastructure spending, including smart infrastructure, economists believe. Smart Infrastructure will use the latest digital technologies.

Canada lost one of its desired triple-A ratings last month when Fitch's international rating agency first downgraded it. Standard & Poor's, Moody's and DBRS still give Canada's debt the highest rating. However, leading sovereign analyst for Canada DBRS Michael Heydt noted that he is concerned about potential structural damage to the economy if the slowdown will last too long. "Fiscal policymakers should be confident that the recovery is well underway before they start talking about debt consolidation," Heydt said.

Thus, Canada's labor market data on Friday is key to the future prospects for both the Canadian dollar and the country as a whole.

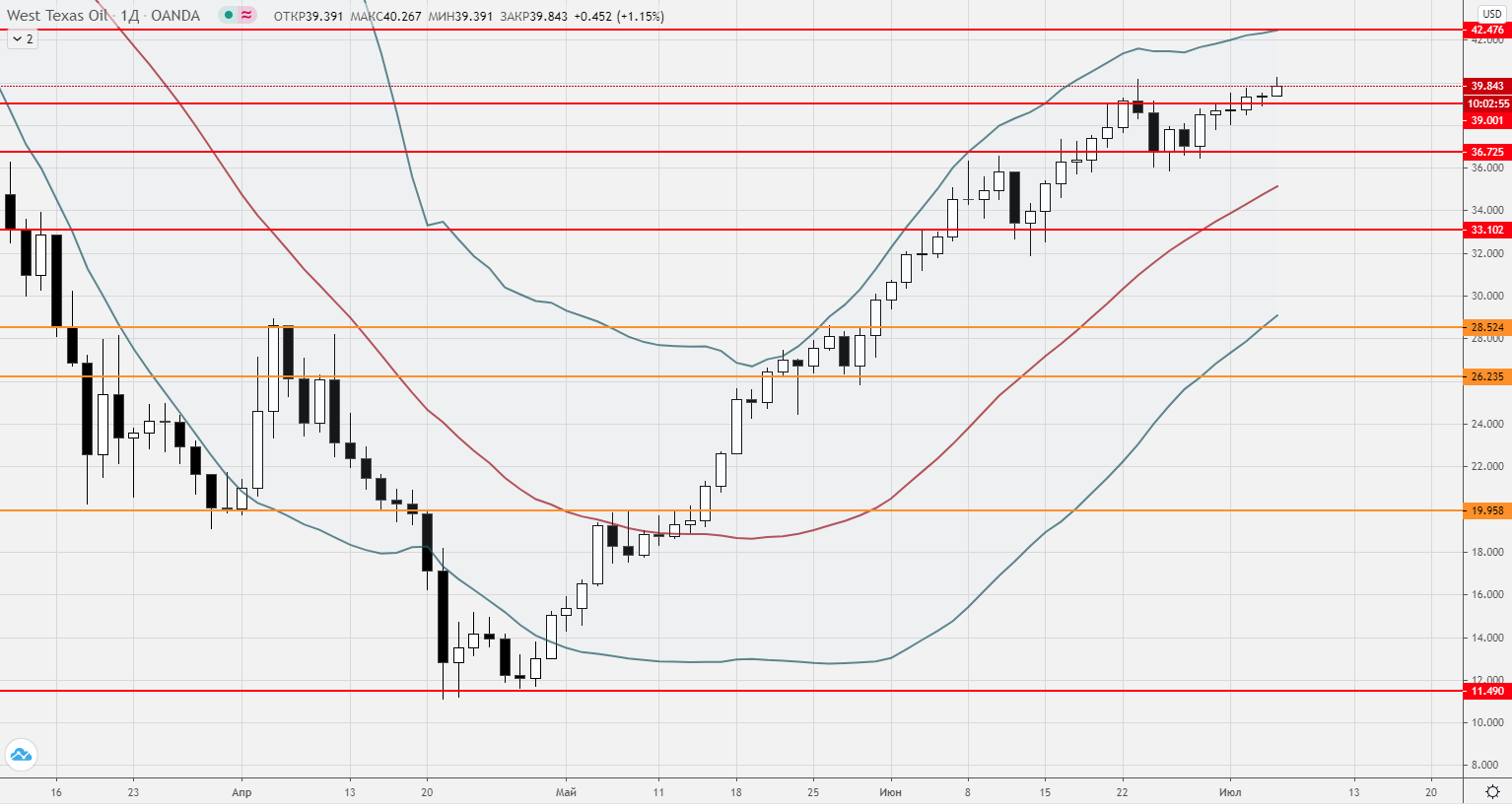

Oil

Black gold at the beginning of the week shows a mixed mood, even though the bulls prevail. The trades are keeping within last month's highs, but there are no signs that they are going higher. At least not yet.

The reason for that is the growing number of coronavirus cases in 39 states. Statistics show that in the first four days of July, 15 states reported a record increase in the number of new infections of COVID-19. As we know, last weekend was the Independence Day holiday in America, and it could lead to another jump.

"If the number of people getting sick increases, there will be a clear decline in demand," said Howdy Lee, an economist at the OCBC Singapore bank. "The pace of demand recovery in the U.S. will not be as strong as previously expected".

At the moment, an analyst of the bank ING say that data on several cities in the affected states do not show a significant reduction in traffic per week.

"We will get a clearer picture of how tougher restrictions in some states have affected gasoline demand from the EIA (Energy Information Administration) report this week," ING said.

OPEC and its allies, including Russia, together promised to cut production by a record 9.7 million barrels per day this month. From August to December, the reduction should remain at 7.7 million barrels per day. Production in the U.S. is also declining. The number of operating oil and gas plants in the U.S. has dropped to record lows. The decline continued for the ninth consecutive week, although the decline has slowed as higher oil prices encourage some producers to resume drilling.

Thus, everything is back to demand. Market participants want to know how record growth in the US will affect demand in the near term.