Forex Weekly Forecast & FX Analysis May 11 - 15

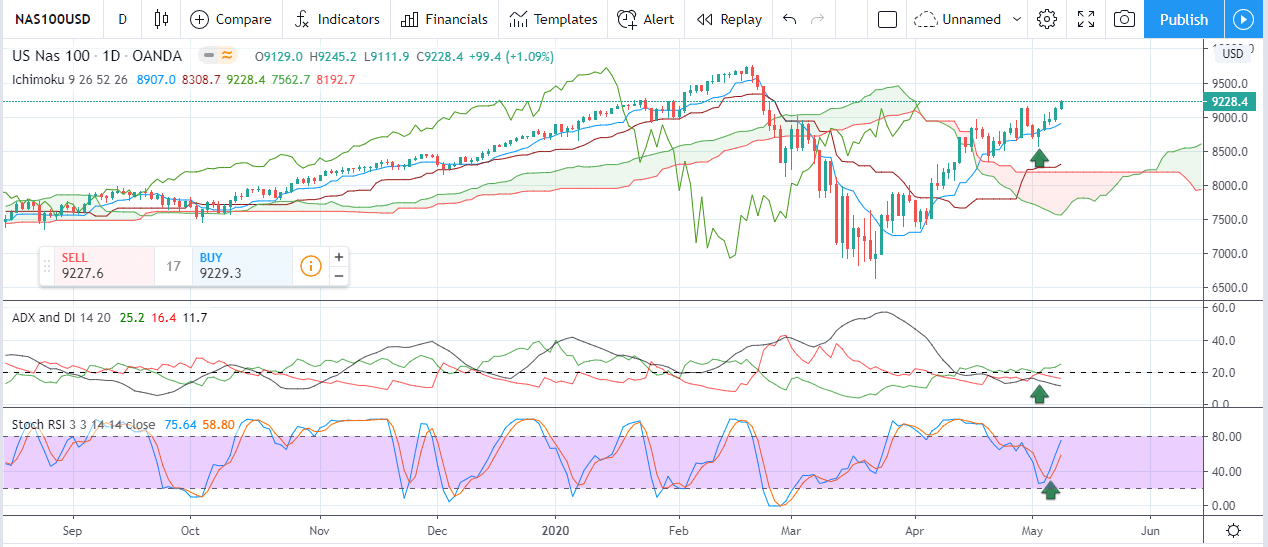

NASDAQ: Bullish

The teach-heavy index was leading the equities market in the bullish recovery. NASDAQ Composite rallied +5.88%, entering into the positive territory for the first time since the market crash started this year. The key fundamental background of that impressive rally is that tech companies appeared to be less vulnerable to the lockdown and quarantine. On top of that, several leading tech companies managed to find advantages of the global lockdown, adopting their strategy for a new business environment. As a result, NASDAQ Composite has all chances to continue the long-term uptrend, and here is why.The daily chart below has several signs of the bullish reversal pattern. The index is trading above both Ichimoku support curves, which are headed North. The leading span performed the bullish crossover and continued enlarging the positive surplus. On top of that, two other technical indicators delivered bullish signals last week. The Average Directional Index turned positive after +DI line (green) crossed -DI line (red) from below, while the mainline kept edging higher, signaling a growing bullish momentum. Stochastic RSI had a bullish crossover near the oversold territory as well.

On the other hand, the upcoming trading week is full of fundamental events that might add risks for the global equities market in general and NASDAQ Composite in particular. Many leading countries are still far from the exact date to cancel the lockdown and reopen the economy. Therefore, a high level of volatility and sudden bearish reversals are still possible in the week ahead. The best trading strategy remains to wait for a bearish rebound and open longs on intraday reversal signals.

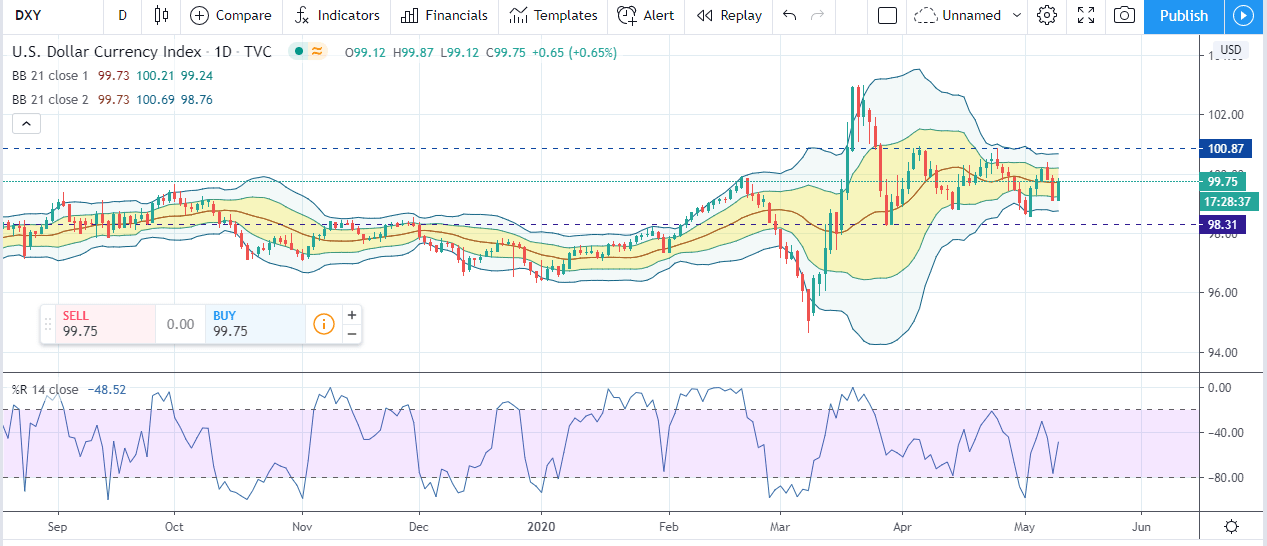

DXY: Neutral

The US dollar index measuring the greenback’s strength versus the volume-weighted basket of six major currencies failed to maintain the bullish bias last week, losing most of the mid-week gains. As a result, DXY closed the trading week at 99.10 points, while the weekly high was registered at 100.40 points. The technical sentiment is mixed with a clear sideways consolidation range on the daily timeframe (see below), so FX traders might see another directionless action in the week ahead.

The Double-Bolli chart setup has a horizontal direction, pointing to quite a low volatility and rather stable trading range. Upper and lower bands of the BB indicator are not widening nor squeezing the distance between them, which shows that the market might not go out of the highlighted borders for quite a while. On top of that, Monday's trading session started with another bullish rebound in Asia, helping the index to jump back to the middle of the trading range. Williams %R oscillator is reflecting bullish and bearish rallies, so FX traders might consider playing ping-pong with the greenback, selling on upside spikes, and buying on bearish rebounds. However, the long-term outlook is neutral and no breakout is eyed in both sides of the range.

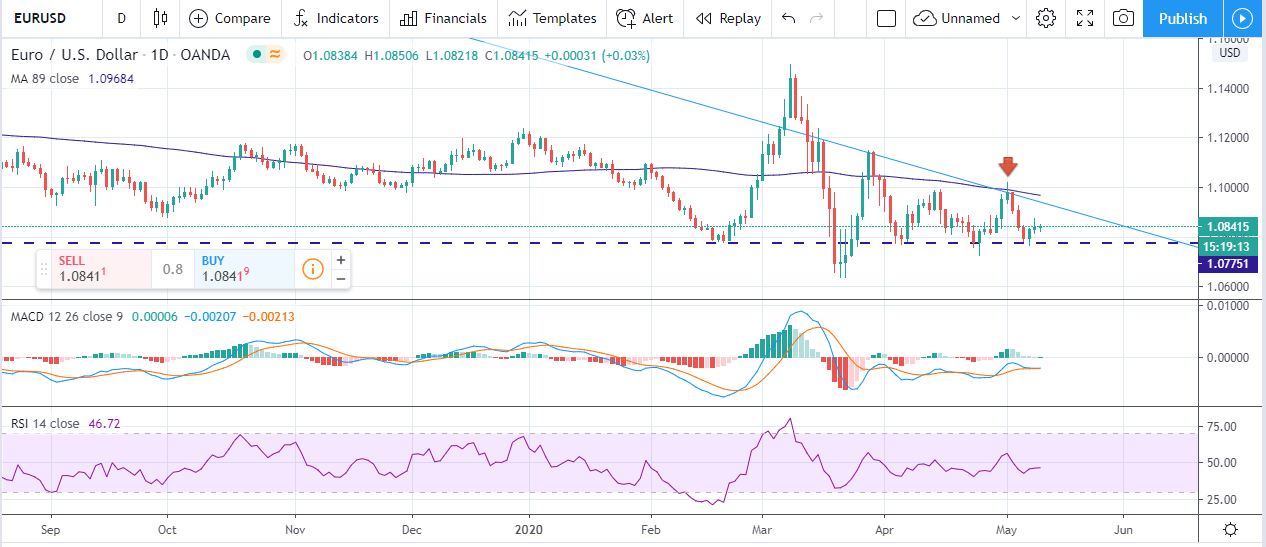

EUR/USD: Bearish

The most popular currency pair in the foreign exchange market -- EUR/USD -- tested the horizontal support line of the long-term downtrend at 1.0767 last week. However, the bulls lifted the exchange rate back to 1.0834 handle on Friday after better-than-expected US Non-Farm Payrolls report. The long-term outlook remains negative for the single European currency, but short-term bullish rallies are still possible in the week ahead.

The daily chart below has a descending triangle pattern with a clear horizontal baseline and resistance trendline connecting several recent peaks. For example, the red arrow points to a brilliant opportunity to short EUR/USD on a bullish rally as the bulls failed to break the double resistance level through. There was the descending trendline and 89-days simple moving average, which limited the upside action. That short position gave more than 250 pips of net profit in three days.

On the other hand, there is a divergence between the price chart and MACD trend indicator as both lines keep drawing higher lows, while the rate has lower peaks. The MACD histogram shows nothing but uncertainty as the latest bars are hovering around the zero level. The Relative Strength Index bounced up to 50%, confirming the uncertainty with a slightly bearish bias.

Two trading strategies look the most reasonable for the week ahead. The first one suggests waiting for another bullish rally and selling EUR/USD at another local peak. The second one offers a breakout approach, setting postponed sell orders on the breakout of the support range at 1.0750/30. Long positions are also possible but they will be against the long-term downtrend, which is risky.

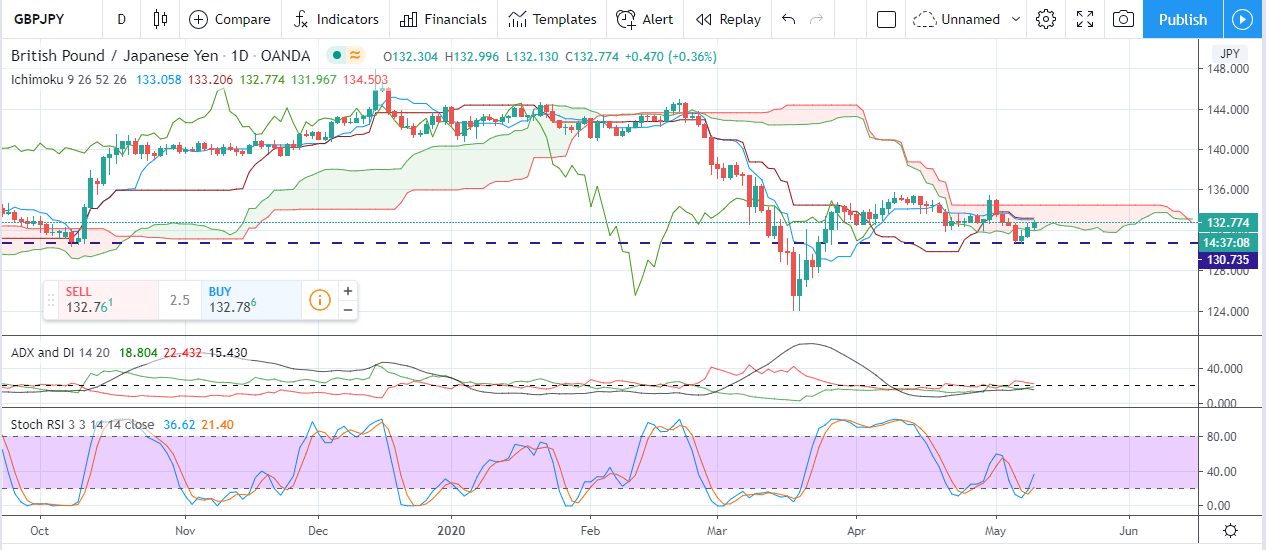

GBP/JPY: Bearish

The British Pound was vulnerable to the weakness across the board as the Bank of England published its quarterly inflation report and left the interest rate unchanged, promising further supportive measures. Since the Japanese yen was strengthening versus the US dollar at the same time, the GBP/JPY cross-rate printed a bearish acceleration towards the long-term technical support level at 130.66 (weekly low). However, the risk appetite supported the currency pair after better-than-expected data from the US Labor market, and GBP/JPY bounced back up to 132.30 on Friday night.

The daily chart setup below shows a mixed technical sentiment with a bearish bias. The latest breakout of the bottom of the Ichimoku cloud seems to be fake as the exchange rate went back into the span, while both curves remained in there. The upside action might be limited by the Ichimoku Conversion line, acting as the resistance curve. The next resistance and target to take profits from long positions are coming at the upper band of the cloud at 134.50. That level might be attractive for fresh shorts as well.

The Average Directional Index points to a sideways consolidation, while the surplus between -DI and +DI remains bearish. The ADX mainline is far below the threshold, which means quite a weak momentum and low volatility. Stochastic RSI printed a bullish reversal signal recently.

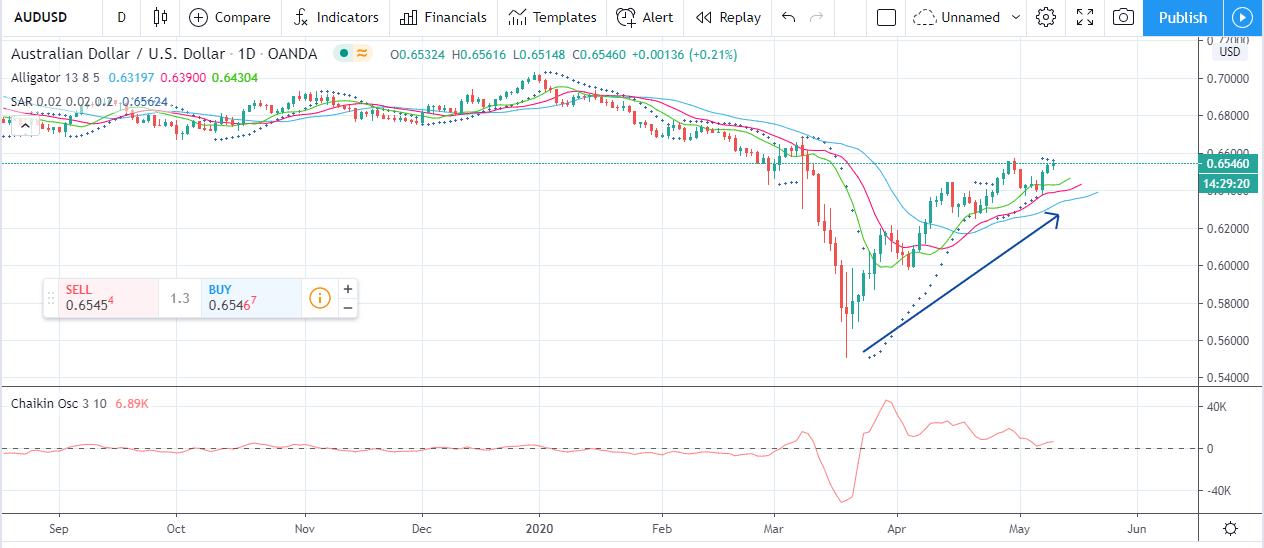

AUD/USD: Bullish

The Australian dollar was supported by risk-on sentiment across the board, stronger-than-expected macroeconomic data in the country, and hawkish comments of the RBA regulator. As a result, AUD/USD gained strength of +1.77% or 113 pips last week. The rate approached mid-term technical resistance, a breakout of which might lead to a bullish acceleration in the week ahead.

According to the daily chart setup below, the technical sentiment is bullish. Williams Alligator turned into the bullish eating mode with all lines placed in the correct order to proceed with the uptrend, while the middle line acts as the support level to implement the buy-lows trading strategy. The Chaikin Oscillator remained in the accumulation zone, although the momentum eased significantly. The only concern for the bulls is that the Parabolic SAR indicator’s dots are still above the current price, which might lead to bearish retracements in the week ahead. Buying the pair at the very top of the market might not be a good idea, so it’s recommended to wait for a bearish bounce before adding long positions. Pivot points are as follows: support 0.6400/50, resistance 0.6700.

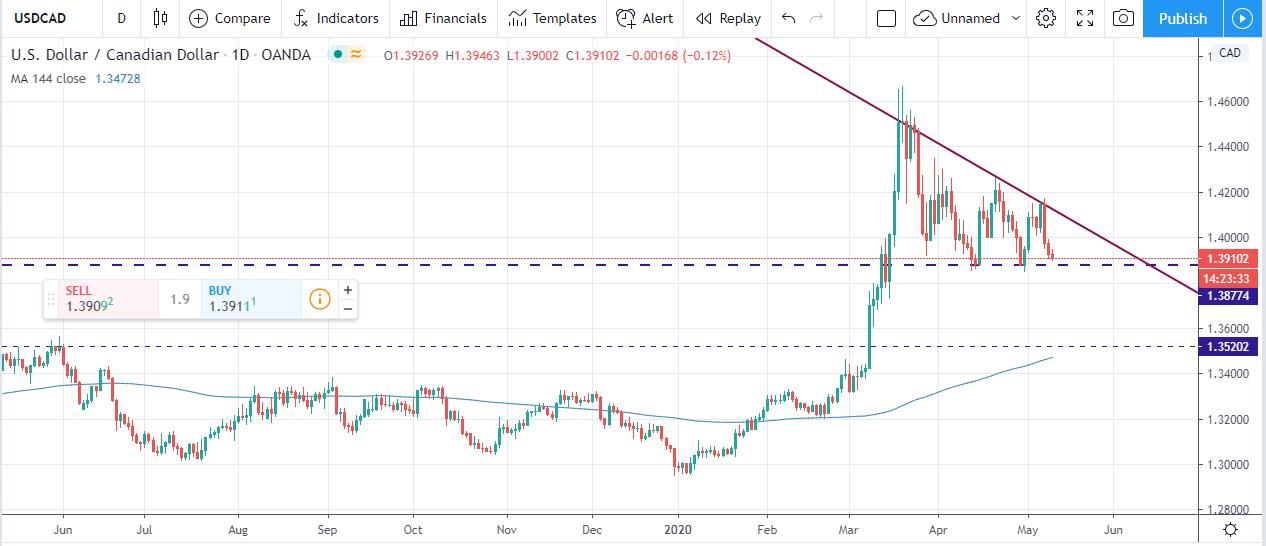

USD/CAD: Bearish

The Canadian dollar was supported by solid economic reports and the growing price of oil last week. As a result, USD/CAD dropped to the mid-term technical support level slightly above the 1.3900 handle. The series of lower peaks on the daily chart point to a high likelihood of a bearish breakout in the upcoming week. If the sellers were strong enough to push the rate through the support, then the technical analysis would highlight the absence of any further support until the next mark of 1.3520. The long-term simple moving average with a period of 144 days is still ascending, and it currently comes at around the same range, so a bearish retracement could extend the slide of the rate.