Forex Weekly Forecast & FX October 05-10

EUR/CHF

Euro vs Swiss franc continues to be traded within the side range. This range can be most clearly seen in the oscillator, which is not capable of moving away from its neutral position for a long time. The top level of this channel is 1,0800, which is the most interesting. If we consider this level together with the last uptrend line, we can clearly see the triangle figure formation. The price is close to the top of this figure. At the same time to the top are close and the levels of moving averages So while the price is inside the triangle can not trade. We wait for the market to break this pattern and trade in the break-up direction.

NZD/USD

Last week led to the formation of the next stage of upward movement in the currency pair New Zealand dollar to the U.S. dollar. The market continues to look up, and the histogram barely entered the positive area. If you look at the oscillator, recently it has been testing the oversold area, and now it keeps growing to the overbought level. This level has not yet been reached. Thus, it is possible to consider options to trade upward. It is possible that the uptrend line will be broken through to the right, and then it will be possible to trade downwards.

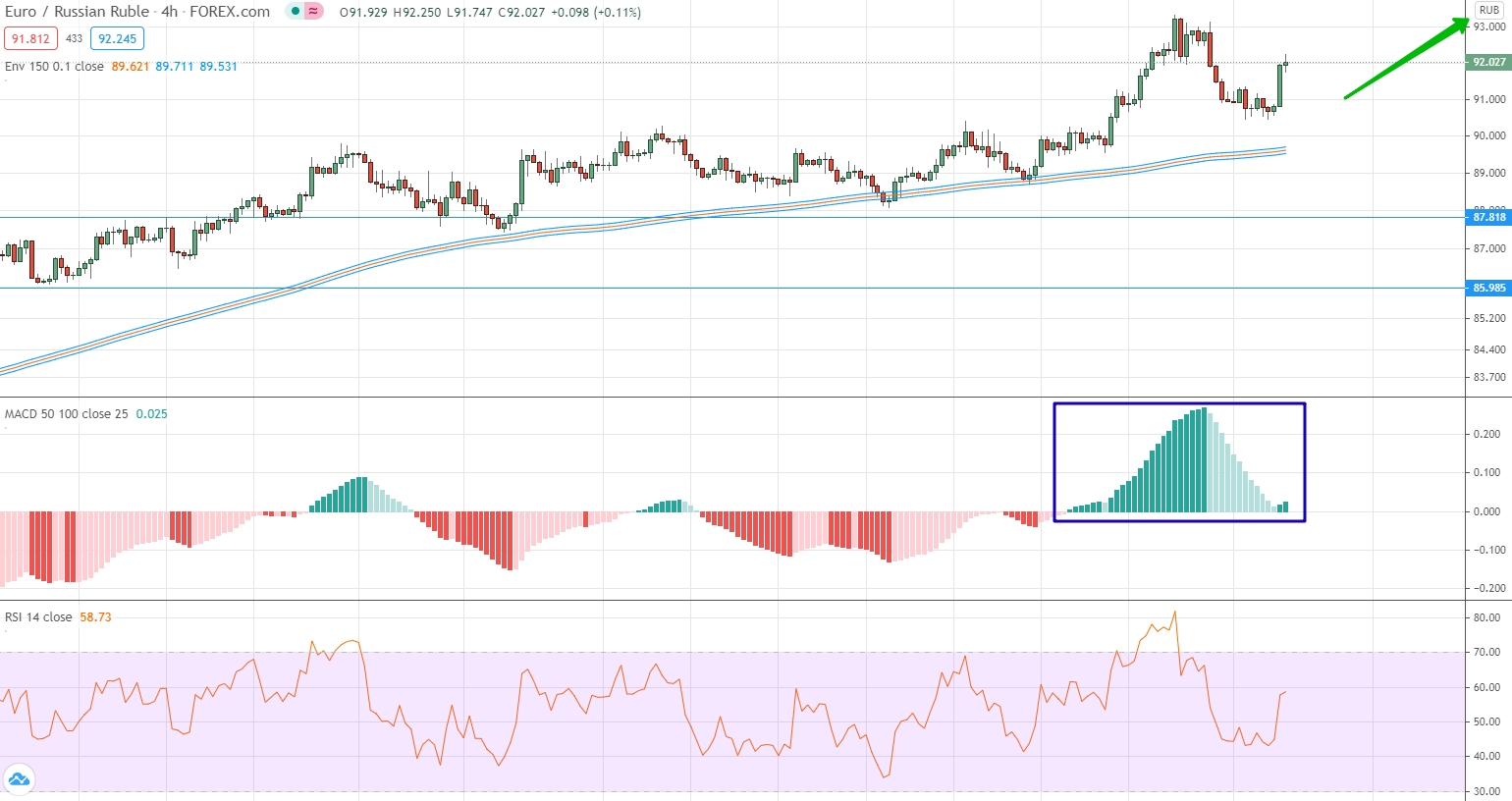

EUR/RUB

The Euro continues to grow against the Russian rouble, and last week led to another stage of growth in which the price went up to 93.00. All the indicators have shown their maximums. On the one hand, we are in the market segment where upward movement has been formed and the price is at the top of the market. Now it is dangerous to trade up, as the growth has been going on for quite a long time. On the other hand, the upward trend of this currency pair is very strong, which means that we should consider only options to trade up. Thus, we can expect another downward correction and then open an upward contract.

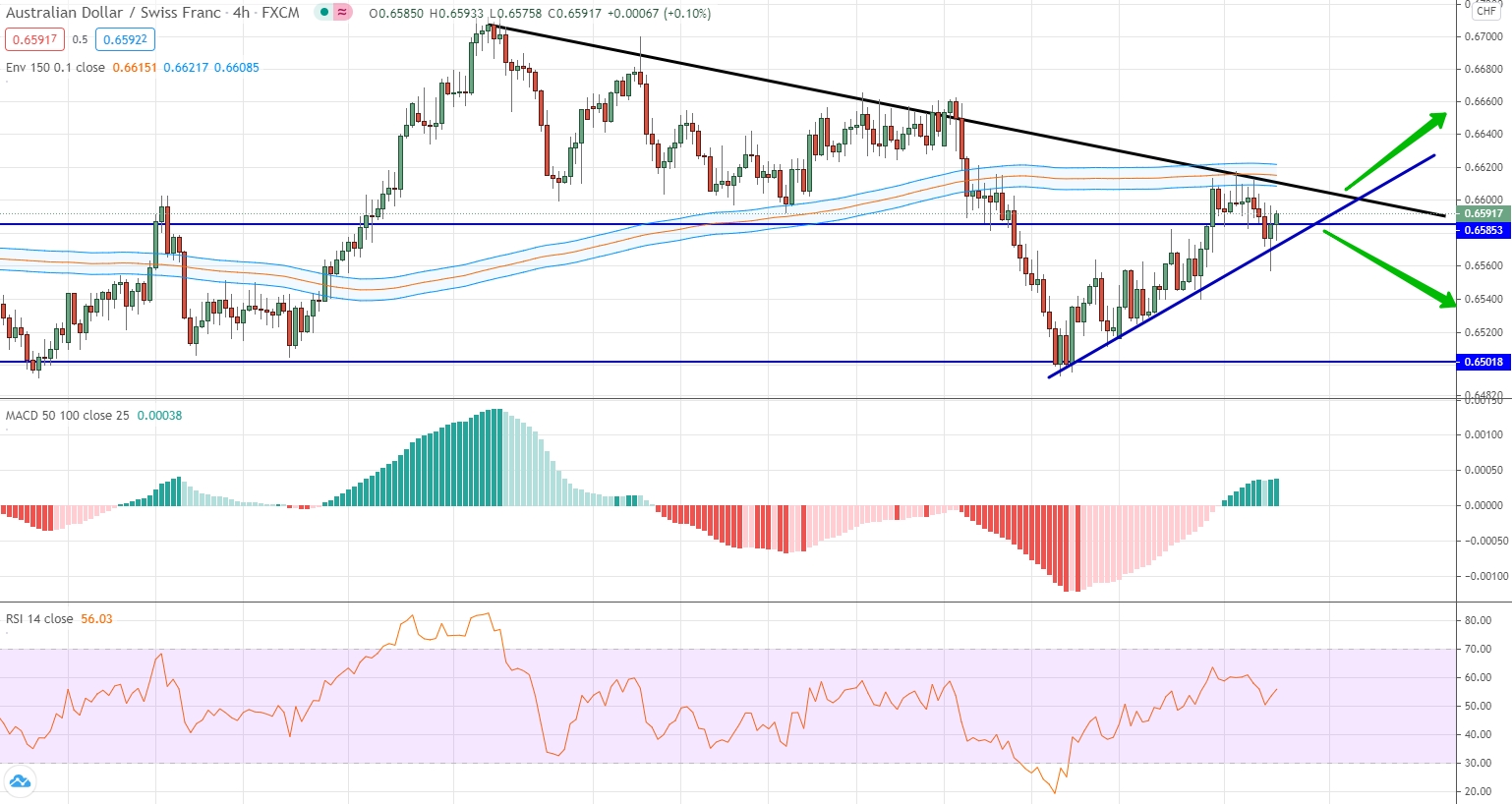

AUD/CHF

To analyze this currency pair, we will need a graphical analysis and the last 2 trend lines. We have a global downtrend and a local upward trend. If you put them on the price chart, a triangle or wedge will be formed. The price is close to the top of this figure, which means that it is very dangerous to trade the currency pair here and now. We expect the market to work out in which direction this figure will be worked out, in that direction and it will be possible to trade. The most probable scenario is that the price will be below the triangle and simultaneously below 0.6 85. Then it will be possible to trade down.

GBP/CAD

NZD/CHF

The global price development of the New Zealand dollar against the Swiss franc is developing within a fairly wide range with the boundaries of 0.6037 and 0.6149. The indicators are close to neutral values and do not give any specific signals for trading. If we consider the price chart, we can see that after the last testing of the lower level, an upward movement has been formed, and a clear upward trend can be traced. Thus, it is possible to trade upwards until the upper level of the sideways channel is reached.

USD/CNH

The U.S. dollar continues to make unsuccessful attempts to change the main trend against the Chinese yuan. In previous reviews, we talked about several attempts, but they all ended up at the level of moving averages, followed by a strong decline. However, any declines in recent weeks consistently stopped at 6,7400. The current price stage is very close to the designated level. The indicators do not give any specific signals for trading, except that the scintillators have tested the oversold area many times in a row. Thus, you can try to play up again and open an upward contract.