Selling and buying Forex: a comprehensive guide for beginners

Based on its popularity and involvement rates, forex can justly be attributed to the list of the world's most active trading markets. This comprehensive guide will help you better understand how to sell and buy forex online, even if you are new to this field.

Selling and buying in Forex

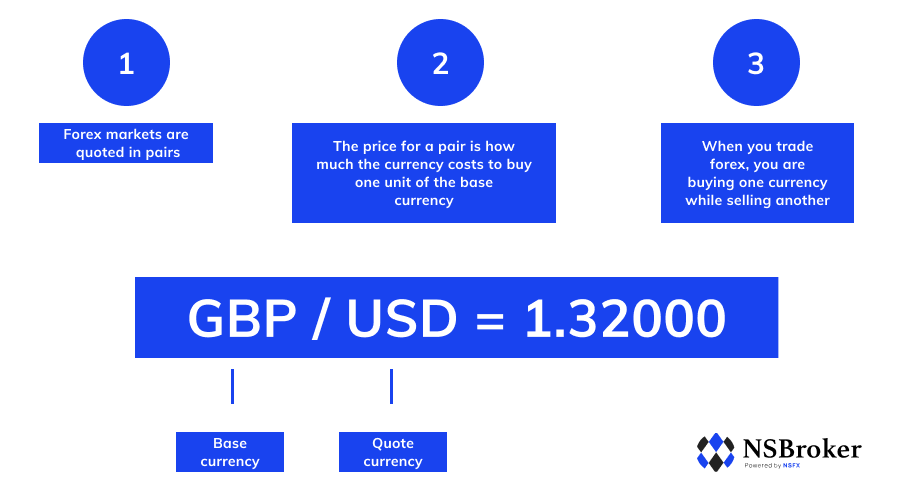

In the context of forex trading, the concepts of selling and buying do not denote precisely what they mean in other spheres. Hence, they are used to characterize the speculations on the downward and upward price movements for the sake of profit. Forex trading always relies on buying a currency and vending another one. This is why they are usually quoted as pairs. If you expect that the base currency will strengthen compared to the quote currency, you buy the pair and vice versa. The forex pair's price represents the extent to which base currency is more expensive than the quote currency. Thus, if a GBP/USD pair has a cost of 1.23000, then £1 is worth $1.23.

Can one sell Forex while not buying it?

Beginners in trading frequently ask whether they can sell forex while not buying it. The answer to this question is "yes." This process is called going short (or short-selling). It is applied if a person believes the currency's price is going to fall, so he or she sells it. The larger the price deterioration, the bigger the profit of a trader.

For instance, let's model a hypothetical situation in which the relevant trading price of GBP/USD is 1.2300, with 1.2301 and 1.2299 as a buying and selling price, respectively. If a trader assumes that the price will deteriorate, he or she goes short with the pair at 1.2299. In the case of USD's strengthening compared to GBP, the pair's cost will fall, so the trader will make a profit.

Acquiring and vending currency pairs

To acquire currency pairs and sell them, one needs to consider this set of steps:

- Make a decision on whether you want to trade through spot forex or a broker.

- Learn the peculiarities of the forex market's functioning. Pay attention to the fact that it is acquired and vended through a network of banks. This process is known as an over-the-counter market (OTC).

- Create your trading account. You are not obliged to add funds to it immediately; the account can be empty for as long as you need to plan your further steps.

- Come up with a trading plan. It may help you eliminate the influence of emotions on your decisions and make your strategy more structured.

- Select a forex trading platform and customize it to your preferences and trading style.

- Open the position. Select whether you'd like to acquire or sell forex, determine your position's size, and take measures for managing your risk.

You should keep in mind that the currency's price is affected by a whole bunch of different factors. Therefore, it is always advisable to conduct fundamental and technical analysis on a pair before deciding to trade. Your forex position should rely on economic and political events, as well as crucial price levels.

The timing for acquiring and selling Forex

Many factors influence the most appropriate time for buying and vending forex. For instance, the times of market opening and the trader's particular strategy have a considerable impact in this regard.

According to many traders, it is best to acquire and sell currency in the periods of the market's peak activity, when volatility and validity are high. Thus, in the UK, the forex market begins its sessions at 8 AM (according to the UK time), so the decrease in liquidity usually occurs at about 10 AM. It later peaks again at around 12 PM, when the US markets open.

In addition to the opening and closing times of the markets, one may also make a decision on buying and selling forex based on his or her personal trading strategy. There are three strategies that can be helpful in determining the suitable timing for buying and selling forex currency:

Trend trading

This strategy is based on the use of technical indicators, such as the RSI (relative strength index) or moving averages. These indicators are used to define the direction in which the market develops. In other words, this strategy can be used to determine whether the market is bullish (uptrend) or bearish (downtrend). Although it can be applied to any time period, trend trading is usually utilized in the long run.

Trend reversal trading

The concept of trend reversal usually refers to the turnaround in a currency pair's price movement. For instance, it occurs when a bearish trend becomes bullish and vice versa. The reversal may be predicted through the use of technical indicators; for example, the stochastic oscillator can be helpful in achieving this goal.

Range trading

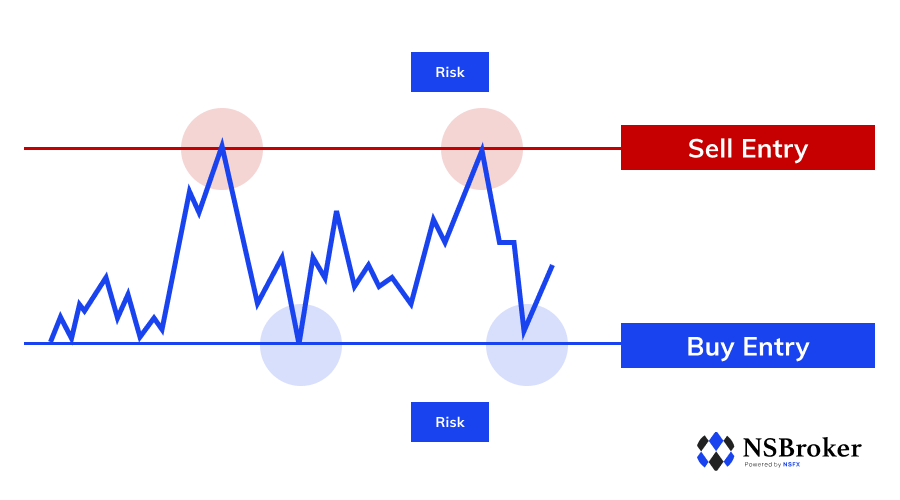

This strategy relies on the notion that markets are characterized by a consistent movement between two price points that lasts for a definitive time period, without any downward or upward progress. A range trader can go both short and long - it depends on how the market price moves within the current range.

Keep in mind that your trading style is important, but it should not go against your initial trading plan, which is highly significant for keeping your overall strategy organized.

Managing risks when conducting Forex operations

In the forex setting, the concept of risk management denotes the rules, principles, and measures used by a trader to mitigate the possible influence that any negative factors may have on the trading process. An effective strategy of risk management enhances the level of a trader's control over his or her profits and losses from forex operations.

To manage your risk in the process of forex trading, keep in mind the following steps:

- Study the forex market as thoroughly as you can.

- Get acquainted with leverage and derivative products.

- Create a trading plan.

- Establish a ratio of risks and rewards.

- Implement limits and stops for the sake of risk mitigation.

- Keep your emotions under control.

- Monitor the news and keep current events in mind.

- At first, try creating a demo account and practicing forex trading without actual risks.