Wöchentliche Forex-Prognose und FX-Analyse 29. März - 02. April

EUR/CHF

The trades of the past weeks for this currency pair allow drawing an upward trend line. It is very important to note that last week the price again reached the level of 1.0860, but could not gain a foothold above it, and an engulfing figure was formed. Indicators do not give specific signals for trading and are mainly traded with low volatility, albeit in a positive area. It is important to note here that the main trading opportunity for the coming week is a downtrend, although if you want to enter into a safer contract, it is possible after the price reaches the trend line. If we talk about an upward contract, then its opening is possible when the price fixes above the level of 1.0860, which is difficult to expect.

NZD/USD

Weekly trading in this currency pair led to the actual sideways movement. If we consider the last week, then the downward movement prevailed here, within which the price dropped to the level of moving averages and to the important level of 0.7025. At the same time, the indicators do not speak of a trend movement, since the histogram is in the negative area, while the oscillator is at neutral values. In this regard, we can expect that the sideways movement will continue for this currency pair.

EUR/RUB

The euro against the Russian ruble last week showed high volatility, alternating upward and downward movements. It is very important to note that the oscillator was in the overbought area for a long time, but after that there was a downward movement of sufficient strength, which allows us to speak about the elimination of the overbought area effect. Returning to the price chart, it is important to note that the downward movement led to the price reaching the moving average level and the 89.84 level. At the same time, a candlestick with a very short body and long shadows was formed. This is a harbinger of the end of the current downward trend movement, which means you can trade up.

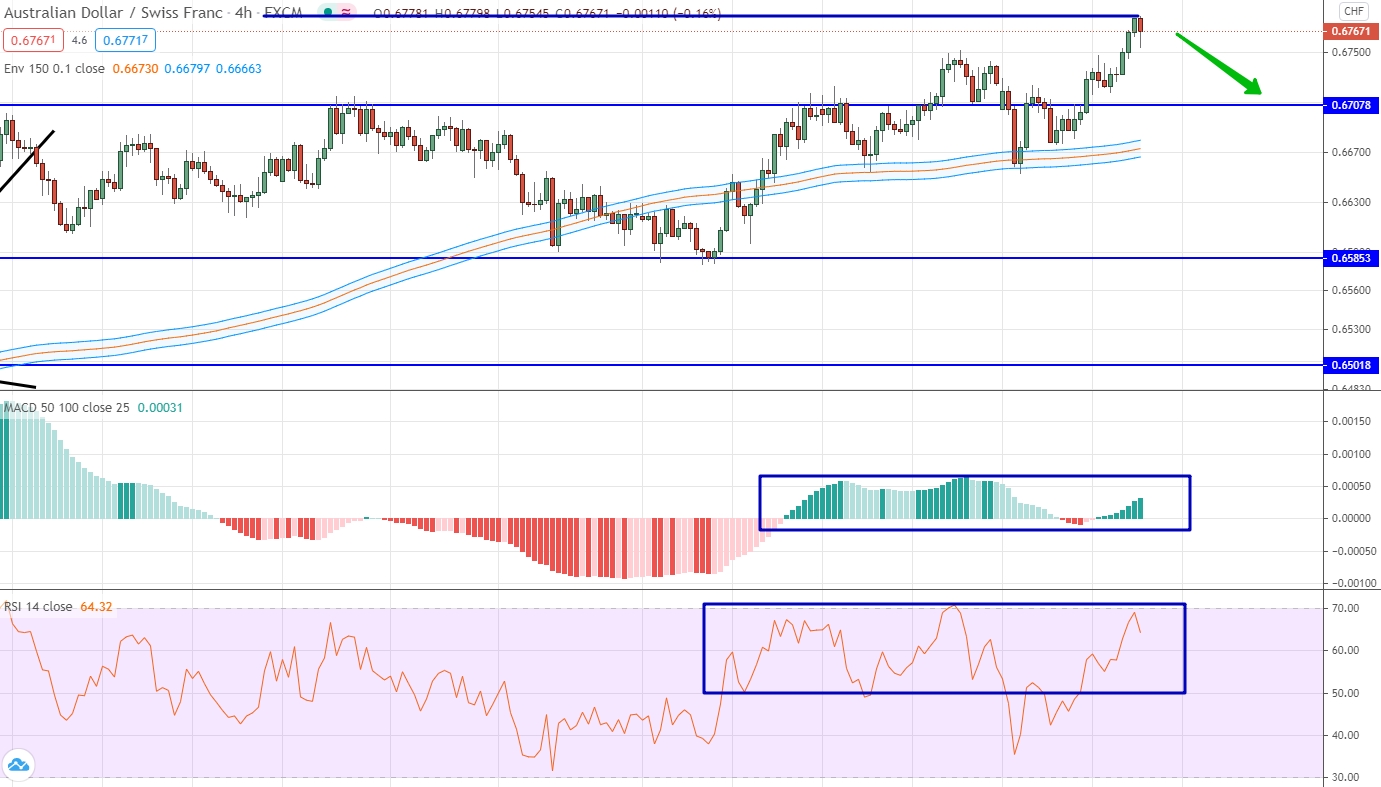

AUD/CHF

The Australian dollar is mostly positive against the Swiss franc, continuing to form an upward movement above the 0.6707 level. It is important to note that here and now the price is at a local maximum. At the same time, if you look at the indicators, they confirm the upward movement, but do not speak of a strong trend. This is especially evident in the histogram, which is close to zero and generally has a downward slope. Therefore, we can expect that the market will need a correction and will again pull to the important level of 0.6707. Therefore, you can open a local top-down contract.

GBP/CAD

This currency pair is trading with a clear uptrend that has a very steep upward slope. The upward dynamics is confirmed not only by the price chart, but also by indicators that have confidently come out of the negative area and continue to update their positive values. According to all the laws of technical analysis, we can only consider options for trading up, but the market has already grown very much, and we will be very late. Therefore, only options for trading down can be considered, but such a contract is possible only if the price is below the trend line indicated on the chart.

NZD/CHF

The New Zealand dollar versus the Swiss franc is mostly trading sideways, although the past week has led to attempts to form an uptrend. First of all, we note the fact that the price turned out to be above the moving averages and is trying to gain a foothold above the 0.6327 level. It is important that consolidation has not come at the moment, therefore, basically only options for trading for a fall can be considered. As for the upward contract, it is possible only if the price is above the level of 0.6350

USD/CNH

The dollar against the Chinese yuan is trading with low volatility and mainly in the sideways movement with the borders of 6.5069 and 6.5472. At the same time, the indicators either look up, or are clearly in the positive area. But since we are talking about a clear sideways movement, the indicator positions are not so important here. It is much more important to note that the level of moving averages gradually falls into the indicated price range and changes its slope to horizontal. Therefore, given that the price is close to the lower border of the channel, an upward movement can be expected.