Wöchentliche Forex-Prognose und FX-Analyse 04 - 08 Januar

EUR/CHF

The euro is still showing sideways tendency against the Swiss franc. Formally, we can talk about the dominance of upward dynamics, since it can be clearly traced in the price chart and coincides with the position of the histogram. However, if you look at the oscillator, then it is close to the neutral value, which means that the trend is not strong. Nevertheless, given that the price is now testing the level of moving averages and the level of 1.0820, we can expect a price reversal and upward movement. An upward contract can be opened with a target at 1.0860.

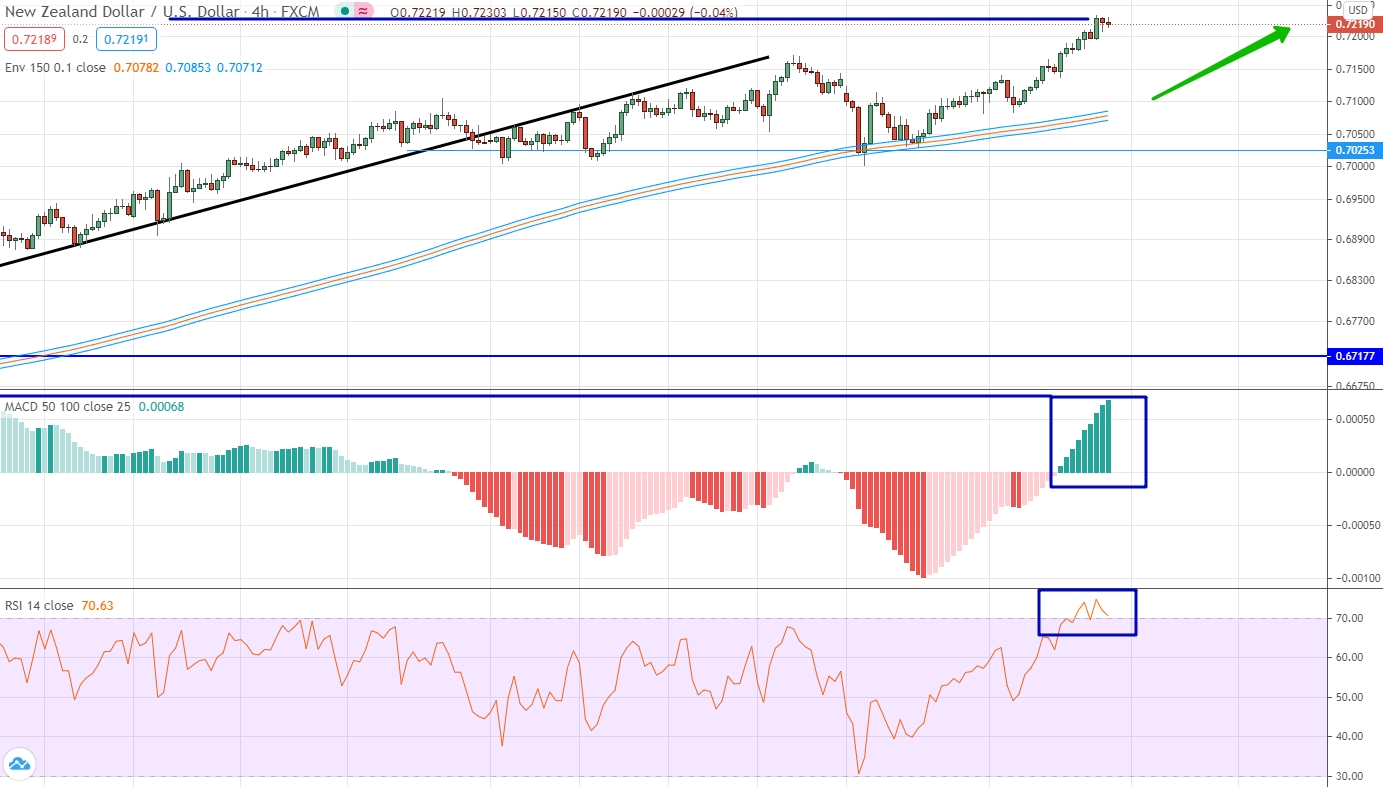

NZD/USD

The New Zealand dollar continues to strengthen its position against the US dollar. As a result of this movement, the current price stage indicates that the price is at a local maximum for itself, and the histogram confirms this maximum value. The oscillator is also growing and has been in the overbought area for some time. Thus, there are all the prerequisites to say that the current upward movement, even if it is at its maximum, has definitely already formed its strength. In these conditions, it is possible to trade only for an increase, but we are already late for the market, so the contract can be opened only after a downward correction.

EUR/RUB

The euro against the Russian ruble is growing. The trades of the last week allow for an additional level of 92.45. This level is very important and will be used in trading. It is important to note here that the indicators do not give specific signals for work, since they are either at neutral values or close to them. Therefore, we pay attention only to the price chart and say that the levels 91.70 and 92.45 form a range in which you cannot trade. When the price leaves the range, open a contract in the direction of movement.

AUD/CHF

The Australian dollar continues to rise against the Swiss franc, however, the last week's trading allows us to think about opening a downward contract. We mainly talk about such a possibility due to the presence of contradictions between the price movement and the movement of indicators. If the price looks up and updates the maximum values, then the indicators look down and the maximum values are not updated. This is a divergence, which indicates the weakness of the current movement, therefore, we trade down to the trend line.

GBP/CAD

This currency pair is still developing within the uptrend, although the past week led to the fact that the trend line had to be slightly corrected. Nevertheless, we draw your attention to the fact that the oscillators are close to neutral indicators, which means that the trend component of the current movement is close to completion. If we consider the trades of the last two weeks, then we can say that there is practically no upward movement. Therefore, we can expect that such dynamics will continue, which means that a downtrend contract can be opened as soon as the price is to the right of the trend line.

NZD/CHF

The New Zealand dollar continues to rally against the Swiss franc and has even managed to gain a foothold above 0.6327. The upward movement coincides with the indicators of all indicators, which also look in the direction of growth. Thus, we have all the prerequisites for upward trading and opening a contract upward. However, we take into account that the first weeks of the new year are rarely highly volatile, which means that the upward movement is unlikely to be strong.

USD/CNH

The dollar continues to fall against the Chinese yuan, which means the downward trend is only gaining momentum. A downward movement is traced along the price chart, the histogram and oscillators. Nevertheless, we can expect that at the beginning of the year there will be a slight upward correction towards the level of moving averages, and only after that the market will return to its main trend part.