Pronóstico semanal de Forex y análisis de FX 29 De Marzo - 02 De Abril

EUR/USD

The past week turned out to be negative for the euro against the US dollar. The single European currency dropped to the level of 1.1757, and the oscillator sank into the oversold area, and practically repeating its minimum values of a month ago. As a result, we can say that the price turned out to be squeezed within the sideways range with the boundaries of 1.1757 and 1.1863. In the current market situation, it is important to note that we are at the lower border of the price channel, which means there is every reason to open an upward trade. This trade will be local and short-lived. Globally, we wait in which direction this trading range will be broken and open a contract in the direction of the breakdown. The downward movement is most likely, since a downtrend prevails in the currency pair. An upward movement is possible, but it will be accompanied by a trend change.

GBP/USD

The British pound made a strong forward movement down against the US dollar, as a result of which the price was below the strong level of 1.3850 and reached another strong level of 1.3688. As part of this downward movement, the oscillator sank into the oversold area, which it had not been in for several months. It is very important to note here that within the framework of more than monthly trading, the market showed a tendency to test the level of moving averages. On the price chart, we see at least 7 such situations. Consequently, we can expect that this market trend has not yet been lost and that it will again want to test the moving averages, which means that an upward contract can be opened.

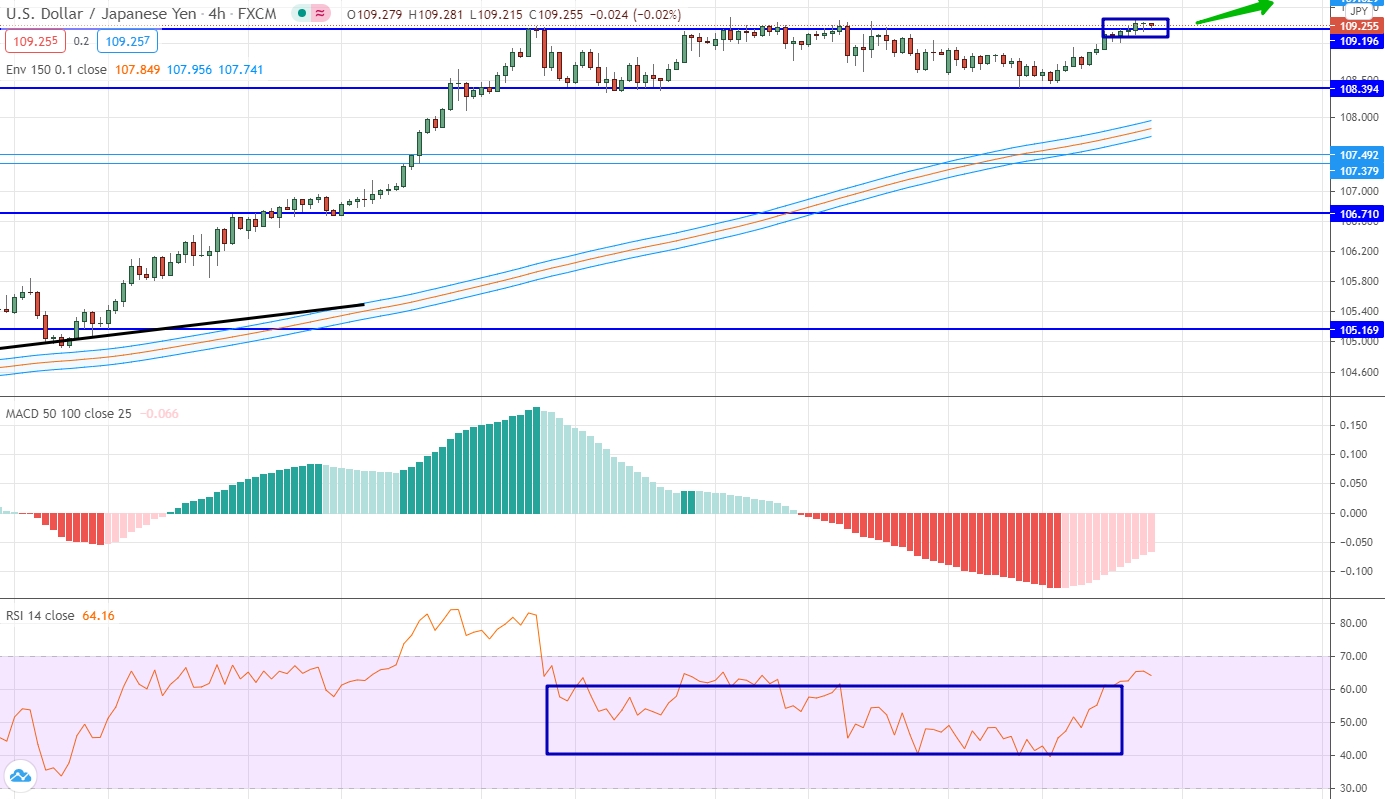

USD/JPY

The US dollar continues to develop an upward trend against the Japanese yen. The side corridor, which we talked about in the previous weekly review, with the boundaries of 185.395 and 109.196, is still relevant. The corridor is confirmed by all indicators that show no volatility and no directional movement. Nevertheless, the last candles demonstrate an attempt to fix the price above the designated range, which means that the option of opening an up contract can be considered.

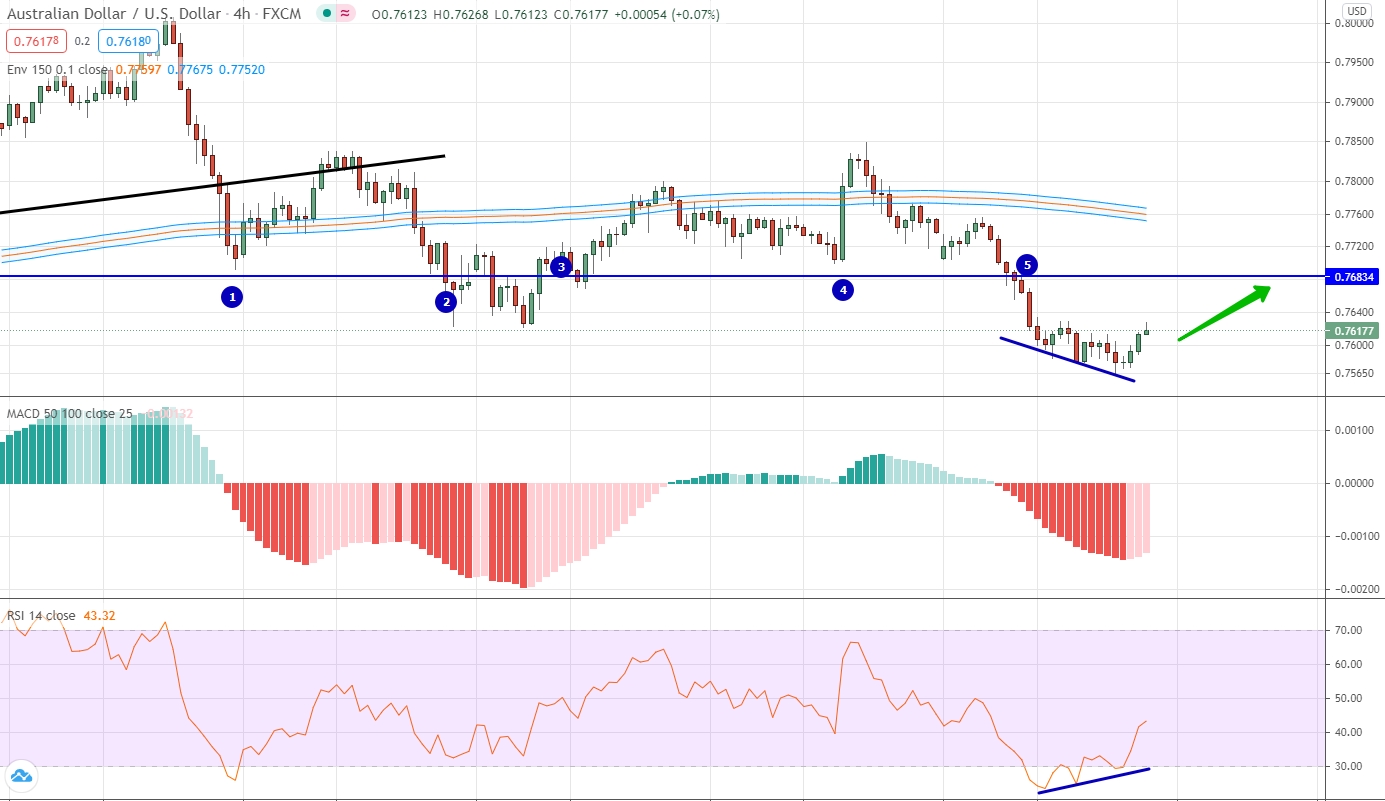

AUD/USD

Locally, the Australian dollar against the US dollar is developing in a downtrend. This can be judged by the fact that the price is below the moving averages, and the moving averages themselves have changed their slope to a downward one, and the price has dropped below the level of 0.7683. Nevertheless, it is still premature to speak globally that a downtrend is dominating and therefore only a downtrend can be traded. Globally, an upward trend is still dominating the currency pair and the market is only trying to change it. As for the current situation, it is very important to note the presence of divergence between the price and the oscillator. Therefore, we have every reason to open an upward contract in the area of a strong level.

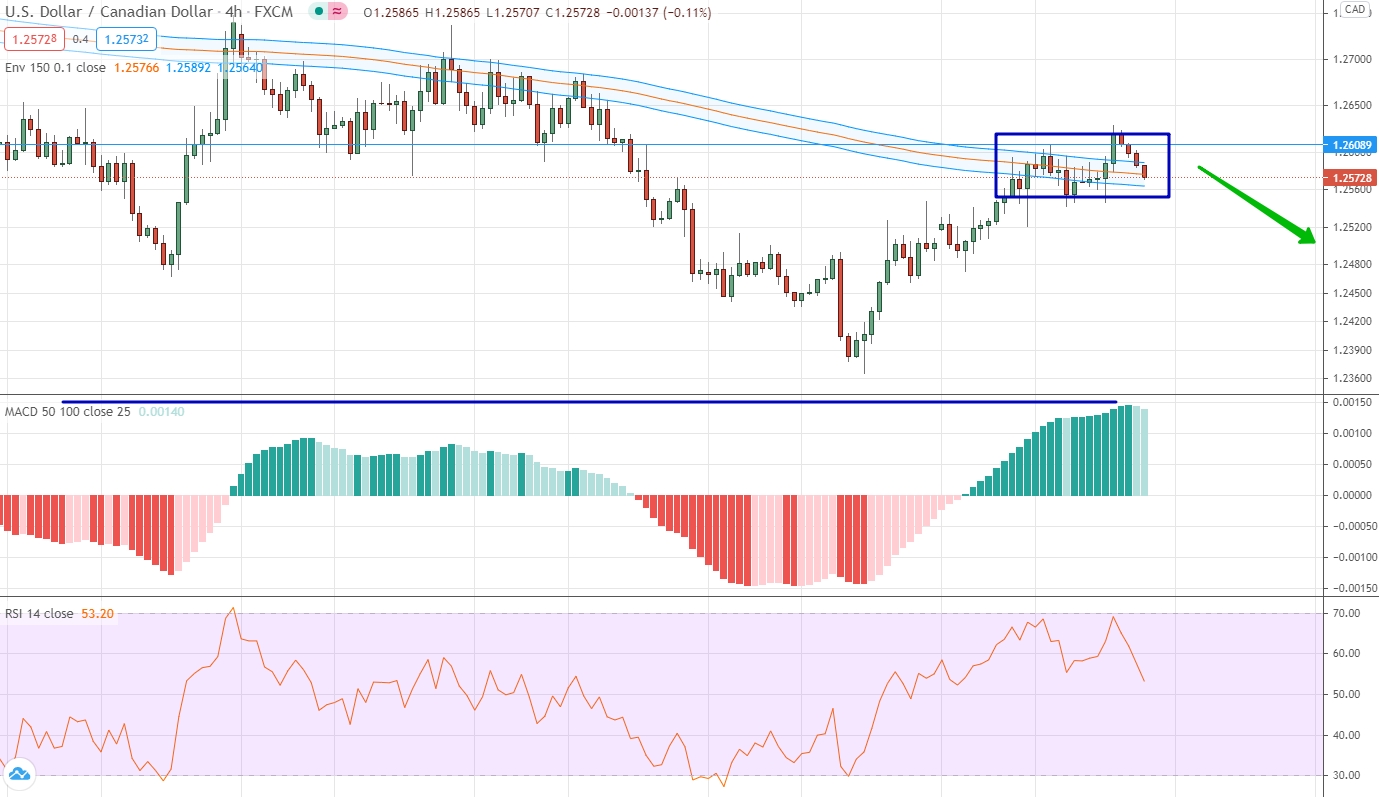

USD/CAD

The past week led to an active upward movement of the US dollar against the Canadian dollar. This movement is notable primarily for the behavior of the price chart, which shows how the market reached the important level 1.2609, which at its current stage practically coincides with the levels of the moving averages. At this point, there was a slowdown in movement. The histogram confirms the upward trend and has already reached its local maximum value. In part, the same can be said about the oscillator. Thus, we can expect that the market will make a correction in the area of the moving average level, which means that we can open a downtrend contract.

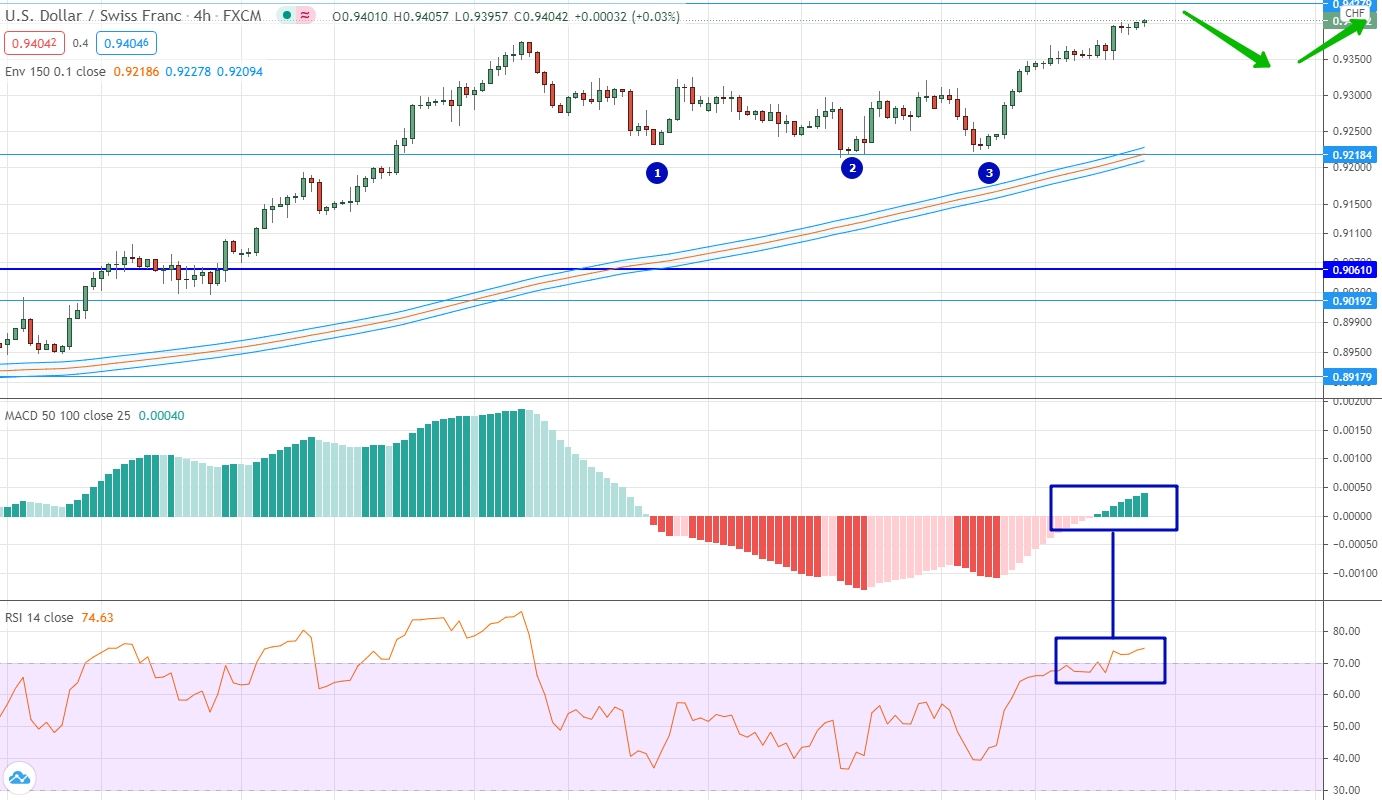

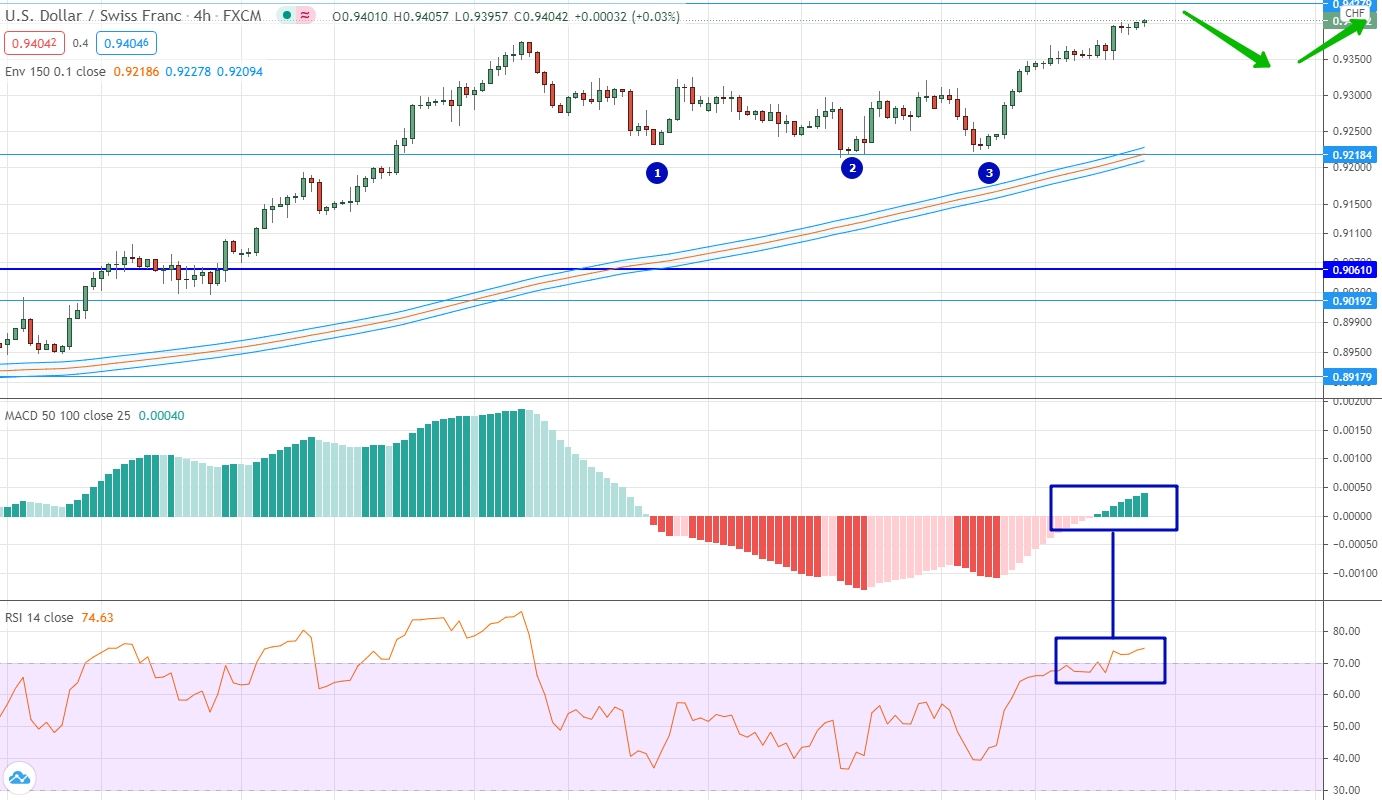

USD/CHF

The US dollar continues to develop an upward trend against the Swiss franc, which has somewhat slowed down in recent weeks, as it developed close to the level of 0.9218. The last week resulted in a strong upward movement, as a result of which the price moved away from the price level and from the level of moving averages, in fact, reached another important psychological level at around 0.9428. If you look at the indicators, you can see that the oscillator has entered the overbought area, but the histogram has just entered the area above zero. Thus, we can expect that a downward correction will be made in the area of a strong level, after which the price of the currency pair will return to growth again.

USD/RUB

The dollar against the Russian ruble last week made a strong volatile upward movement, being above the level of 76.20. It is characteristic that the movement turned out to be so strong, but by the end of the week both the price chart and all indicators are already looking down to normalize their position. Nevertheless, it is important to note that the upward dynamics continues to dominate in the currency pair, and it is being formed, among other things, according to the indications of the moving averages, which have already changed their slope. Thus, we can consider options for trading up, and the optimal entry point will be located in the area of the level of 75.48.

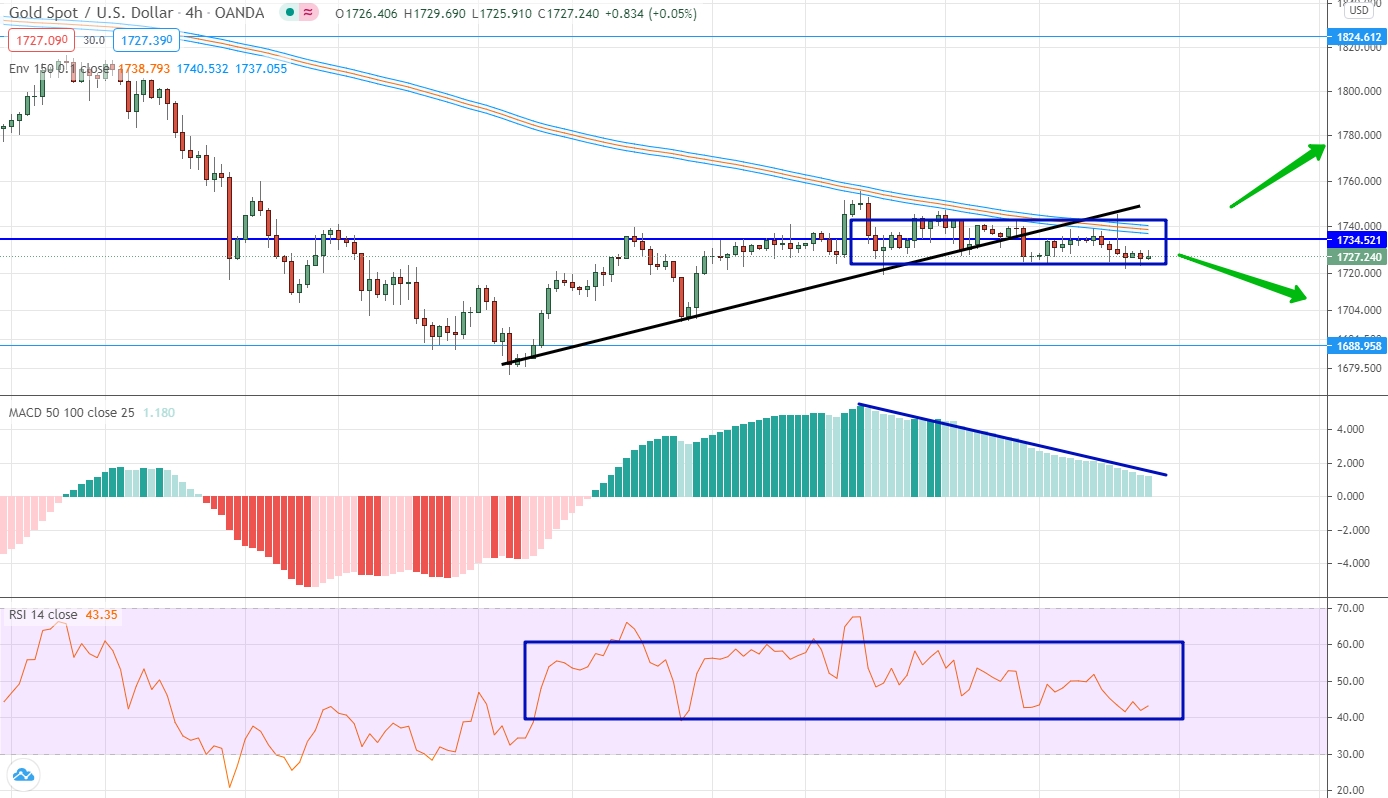

Gold

Gold last week reduced its volatility as much as possible around the level of 1734.520 For the current market stage, this level is super significant, since it actually coincides with the level of moving averages. The indicators confirm the absence of volatile movement, since all are in neutral values and do not show an obvious trend. As a result, we can say that since the price is below the designated level and below the moving average level, as well as below the correction trend line, it is possible to open a downtrend contract in the direction of the main trend for this asset. Trading upward will be possible only if the price turns out to be above the level of 1834.521 and above the level of the moving averages.