Previsão e Análise Forex Weekly Forecast 19 - 23 De Julho

EUR/USD

Euro against the dollar continues to develop the stage of the downward movement. At the same time, a contradiction arises between the price movement and indicators, since the market moves down, and indicators are built in the positive area or have a clear upward slope. In this regard, we can only say that the price is below the important level of 1.1863, as well as the presence of divergence. Therefore, we have every reason to consider the possibility of trading up to the level of the moving averages. However, we take into account that we are trading against the trend.

GBP/USD

The British pound against the US dollar last week attempted an upward movement, which settled at the level of moving averages. You can find 2 stages of an upward movement, and each time the market reached the moving averages, after which there was a bounce down. The second case happened quite recently, after which the price was below the important level of 1.3850. Therefore, we can expect that the downward movement will continue, especially since it corresponds to the main trend movement, and will reach the level of 1.3751

USD/JPY

This currency pair continues to oscillate in different directions. In the current market situation, the price went down from 111.480 to 109.630. After that, a reversal occurred, which led to a fairly strong upward movement, which ended at the level of the moving averages, after which the price made a downward movement again. As a result, the current price is framed by a sideways range with the borders of 110,200 and 109,630. You cannot trade as long as the price is within this range. We are waiting for the exit from the range and trade in the direction of the breakout.

AUD/USD

The Australian dollar continues to develop a downward movement against the US dollar. The most important characteristic of the price movement is that the market has consolidated below the important 0.7500 level. At the same time, it is characteristic that the histogram demonstrates the absence of volatility, since the bars are very close to the zero level and do not move away. The oscillator has been looking up for a long time. Therefore, we can expect that since the market is at its lowest point for itself, there will be a corrective upward movement.

USD/CAD

The most important characteristic of the US dollar against the Canadian dollar is the absence of volatility and the market's desire to gain a foothold above the level of 1.2540. Attention is drawn to indicators that are very close to neutral values and do not demonstrate an obvious trend movement. This indicates a situation of uncertainty, when the market is trying to either continue the previous uptrend or form a new one - a downtrend. Therefore, it is impossible to open long-term contracts now and we work only on short-term contracts in the direction of growth, that is, in the direction of the main trend.

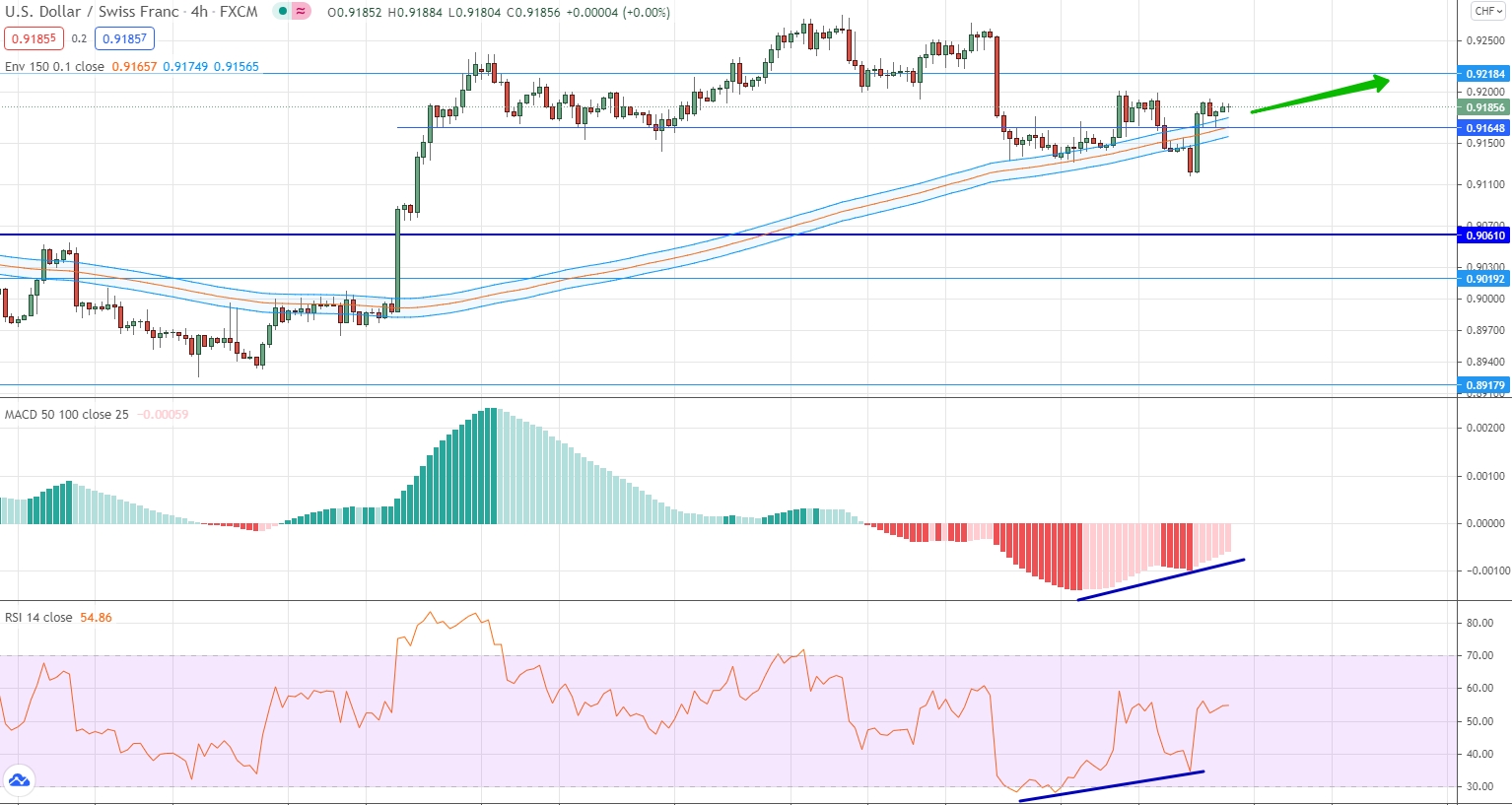

USD/CHF

The dollar continues to trade mostly horizontally against the Swiss franc and does not show a clear trend movement. The upward dynamics has practically exhausted itself, since on the price chart for several days in a row, the market has been building in the area of the moving averages level. Moreover, the previous sideways range, which we talked about about a month ago, with the boundaries of 0.9218 and 0.9165, turned out to be relevant again and again frames the price. Taking into account the fact that the moving averages are looking up, all indicators are looking up, the market has failed to break the moving averages down, we can consider trading options for an increase from the lower level to the upper level.

USD/RUB

The US dollar continues to reverse the trend against the Russian ruble, forming an upward movement. The current movement can be clearly traced both on indicators and on the price chart. Now the price chart clearly shows an uptrend line, which at first was a resistance level, but now it is already a support level. Taking into account the fact that the price has come very close to this level, we can consider trading options for an increase in the area of the level of 74.80. If the market manages to gain a foothold below this trend line, when it will be possible to trade down with the target at the level of the moving averages.

Gold

The price of gold continues to grow and the trading of recent weeks has led to the fact that the price has finally consolidated above the level of the moving averages and broke through several important levels upwards at once. Please note that the upward movement is confirmed by all indicators, but the oscillator is practically devoid of volatility. Consequently, the market has the potential to move clearly in one direction or the other. Taking into account that the upward dynamics is trying to become dominant again, we can consider options for trading up. If the trend line is broken downwards, then it will be possible to open a contract for a fall.