AUD Q2 2021 Technical Forecast

Technical Analysis: Aussie Risks Deeper Correction into Q2

Heading into 2021, our ‘bottom line’ on the Aussie technicals noted, “the Australian Dollar price rally has matured with an advance of more than 37% off the yearly lows risking topside exhaustion in the months ahead. From a trading standpoint look for signs of a high in the first quarter to give way to larger correction – ultimately a pullback may offer more favourable opportunities closer to uptrend support.” The rally registered a high at 8007 in late-February before reversing sharply lower with the decline approaching the 2021 yearly opening-range lows just days ahead of the March close. Was that the high we were looking for?

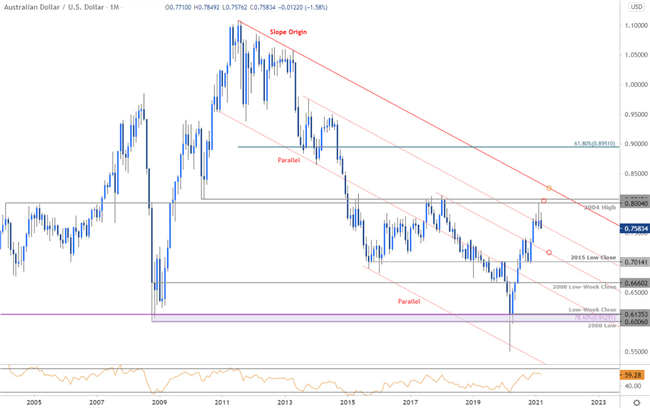

AUD/USD Price Chart– Monthly Timeframe

Source: TradingView; Prepared by Michael Boutros

A breakout of the 2018 slope-line noted last quarter kept the focus higher into the yearly open with the advance marking an intraweek high into technical resistance at 8004/65. The region is defined by the 2004 swing high, the 2010 low and the 2017/2018 close highs. Aussie posted a massive outside-week reversal off that high with the subsequent decline covering nearly the entire yearly range.

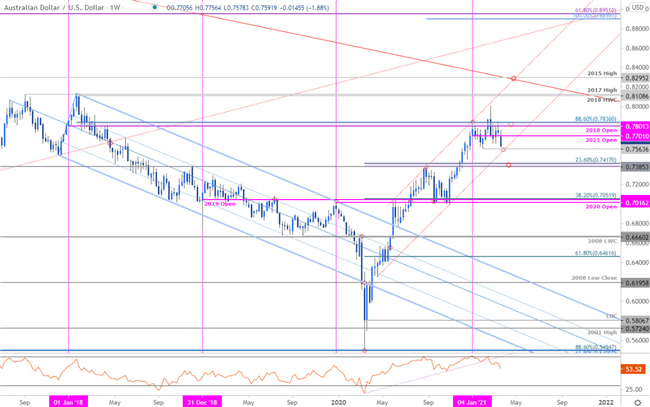

Gold Price Chart – Weekly Timeframe

Source: TradingView; Prepared by Michael Boutros

The weekly chart shows AUD/USD approaching confluence support at the yearly swing low / April channel line at 7563 -- look for inflection off this threshold into March’s close for guidance. A close below would threaten a break of the yearly opening range and suggest a more significant high may have occurred in February. Such a scenario would risk a larger correction towards the May 2017 low-week close / 23.6% retracement of the 2020 advance at 7385-7417. Yearly-open resistance at 7701 with a breach / close back above 7801/36 would be needed to mark resumption of the broader uptrend.

Bottom line: The broader Australian Dollar rally has turned off uptrend resistance on building momentum divergence with the pullback now eyeing the first major test of uptrend support since November. From a trading standpoint, look for topside exhaustion ahead of 7700 if price is heading lower with a break below this channel risking a larger Aussie correction in 2Q.

Follow Michael on Twitter @MBForex

Information source - DailyFX.com