Euro Forecast: EUR/USD Outlook Tilted to the Downside in Week Ahead

Fundamental Euro Forecast: Bearish

- Renewed optimism about the EU economy and its Covid-19 vaccination program has lifted EUR/USD in recent days.

- However, the EU economy is still underperforming and doubts about the AstraZeneca vaccine may reduce the number of people agreeing to have the jab.

- That suggests that once the current bout of profit-taking and short-covering has ended, EUR/USD may well head lower again.

Euro price at risk of further falls

Growing optimism about an EU economic recovery has lifted EUR/USD in recent days, reducing the losses suffered since the start of this year. For some analysts, the advance suggests that a new trend higher is now in place. There are, however, grounds for caution.

First, the economic recovery is based on optimism that the EU’s Covid-19 vaccination program has now picked up after a slow start. Note, though, that many EU citizens are still wary of the AstraZeneca/Oxford vaccine even though the European Medicines Agency said last week that “the overall benefits of the vaccine in preventing COVID-19 outweigh the risks of side effects”.

There have also been reports of delays to supplies of the Moderna vaccine to Germany, although that has been denied by the company.

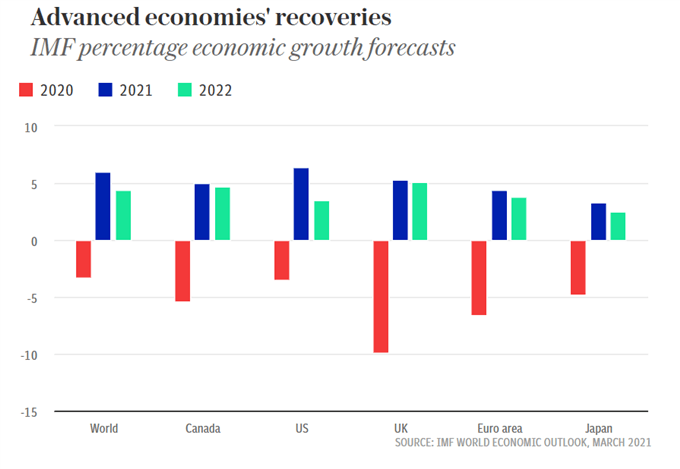

If take-up is indeed low, that would hinder an economic recovery that is anyway expected to be relatively weak. The International Monetary Fund forecast last week that growth in the Eurozone would be lower this year than in either the US or the UK, and that is bound to have an impact on both EUR/USD and EUR/GBP.

Against this background, it is possible that EUR/USD has run ahead of itself, with the advance representing just profit-taking and short-covering after the previous slide, and that once the position-squaring is over EUR/USD will resume its path downwards.

EUR/USD Price Chart, Four-Hour Timeframe (January 4 – April 8, 2021)

Source: IG (You can click on it for a larger image)

ZEW Highlight in Week Ahead

Turning to the economic data in the week ahead, the only release of note is the ZEW indicator of German economic sentiment, which is expected to rise to 79.1 from 76.6. Otherwise, Eurozone retail sales, industrial production and final inflation figures are unlikely to interest the markets.

Check out one of our top trading opportunities for Q2: short EUR/JPY

Feel free to contact me on Twitter @MartinSEssex

Information source - DailyFX.com