Oil Price Outlook Hinges on US Output as OPEC Upgrades Demand Forecast

Oil Price Talking Points

The price of oil attempts to retrace the decline from earlier this month as US crude output contracts in April, but lack of momentum to push back above the 50-Day SMA ($60.69) may generate range bound conditions even as the Organization of the Petroleum Exporting Countries (OPEC) upgrade the outlook for global demand.

Oil Price Outlook Hinges on US Output as OPEC Upgrades Demand Forecast

The price of oil appears to be stuck within the opening range for April even though OPEC+ plans to gradually restore production over the coming months as US production remains at pre-pandemic levels.

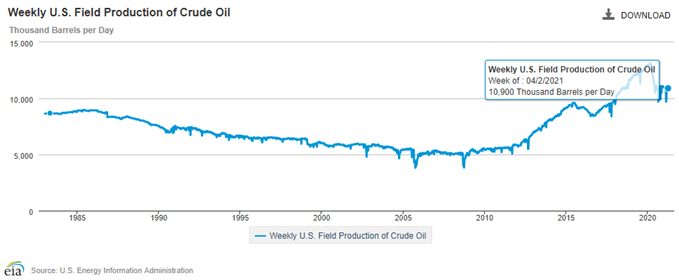

Recent figures from the Energy Information Administration (EIA) showed weekly field production narrowing to 10,900K from 11,100K in the week ending March 26, and a further slowdown in US output may keep oil prices afloat as OPEC Secretary GeneralMohammad Barkindo reiterates the group’s “commitment to supporting oil market stability” while speaking at an event held by the International Monetary Fund (IMF).

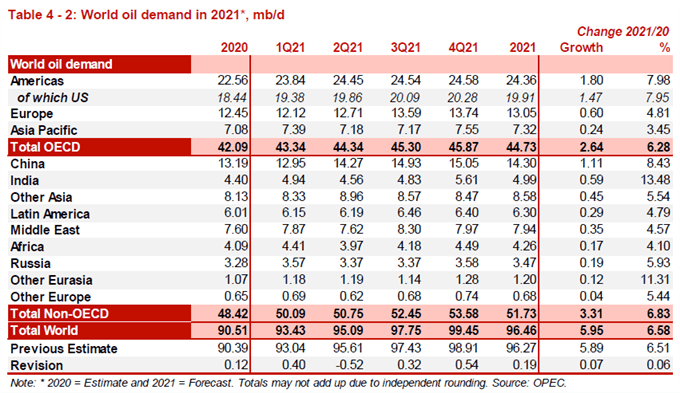

It remains to be seen if OPEC and its allies will continue to regulate in 2021 as the updated Month Oil Market Report (MOMR) reveals that “in 2021, world oil demand growth is expected to increase by about 6.0 mb/d y-o-y, representing an upward revision of about 0.1 mb/d from last month’s report.”

Source: OPEC

The April 2021 MOMR emphasizes that “oil demand in the 2H21 is projected to be positively impacted by a stronger economic rebound than assumed last month,” and the pickup in global activity may encourage OPEC and its allies to make further changes at the next Joint Ministerial Monitoring Committee (JMMC) meeting on April 28 as the group plans to “assess market conditions and decide on production level adjustments for the following month, with every adjustment being no more than 0.5 mb/d.”

Until then, the price of oil continue to face range bound conditions as it struggles to push back above the 50-Day SMA ($60.69), but the ongoing weakness in US crude output may keep oil prices afloat as OPEC and its allies upgrade the outlook for global demand.

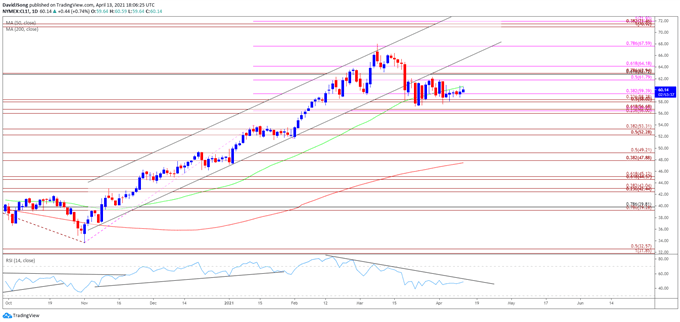

With that said, the decline from the March high ($67.98) may turn out to be a correction in the broader trend rather than a change in market behavior, and the Relative Strength Index (RSI) may show the bearish momentum abating if it breaks out of the downward trend from earlier this year.

Oil Price Daily Chart

Source: Trading View

- Keep in mind, crude broke out of the range bound price action from the third quarter of 2020 following the failed attempt to close below the Fibonacci overlap around $34.80 (61.8% expansion) to $35.90 (50% retracement), with the price of oil taking out the 2019 high ($66.60)as both the 50-Day SMA ($59.88) and 200-Day SMA($46.89) still reflect a positive slope.

- However, the price of oil has slipped below the 50-Day SMA ($59.87) as it snapped the upward trend from November, with the Relative Strength Index (RSI) indicating a further correction in crude as it tracks the downward trend established in March.

- The price of oil appears to be stuck in a narrow range following the failed attempt to trade back above the $61.80 (50% expansion) region, but need a move below the $58.00 (50% expansion) to $58.40 (23.6% expansion) to bring the Fibonacci overlap around $56.00 (23.6% expansion) to $56.70 (61.8% expansion) on the radar.

- Next area of interest comes in around $52.30 (50% expansion) to $53.30 (38.2% expansion), which sits just above the February low ($51.64), followed by the $49.20 (50% expansion) area.

- At the same time, a close above $61.80 (50% expansion) opens up the $62.80 (61.8% retracement) to $62.90 (78.6% expansion) area, with the next region of interest coming in around $64.20 (61.8% expansion).

Information source - DailyFX.com