High-Frequency Trading (HFT) Definition

Background

The modern high frequency trade was birthed after United States Security and Exchange Commission (SEC) authorization of electronic exchanges toward the close of the 20th century. The evolution of the high frequency trade is generally explored from a global perspective of the pre-crisis period to the post crisis period. Further, the time frame for the development of the high frequency trading strategies is congruent to the advancements in computer programming and corresponding technologies. High frequency trading is categorized as a type of automated trading (AT) within which computers make trading decisions based upon algorithms that reflect evidence-based trading theory and years of manual trading experience. Speed is the critical ingredient, which is acquired by sophisticated, high speed, quantitative programs that generate, route, and execute the orders. The alternative trading system (ATS) electronically matches buyers and sellers as opposed to traditional matching on the floor of the exchange. The high frequency trader is a proprietary, or own-account trader; as opposed to agency or for-client trading. (Durbin, 2010) presented that the high frequency trader historically evolved from the traditional market specialist who profited from spreads between prices that were purchased and then sold. Pioneering and leading high frequency trading firms include Automated Trading Desk; Getco; Citadel; Jump Trading; and Knight Capital. The downside of high frequency trades lies in error proned trading algorithms and high trading competition. Knight Capital lost $440 million due to errors in a high frequency trading algorithm. The loss created a significant negative impact on the market. Further, high market competition decreases the amount of inefficiency that is available for short run traders to exploit. Regulation of high frequency trading became of focus following the flash crash of 2010. On May 6, 2010, the Dow Jones Industrial Average dropped by 9%, or approximately 1,000 points and recovered from the losses to create the largest intraday, 1-day decline in points in the history of the index. Since then, regulators have debated over the degree of ethics that are integrated into high frequency trades; and to some degree, associated the strategies with insider trading.High Frequency Trading Theory

High frequency trading occurs in the stock market, stock options, and the equity index futures markets; and are based upon market microstructure environment trading rules, as opposed to the tenets of asset pricing models. The high frequency trade capitalizes upon low latency and inefficiencies in the form of event-driven and arbitrage opportunities. Traders are generally categorized as predictors; investors; market makers; and arbitrageurs. (Durbin, 2010) argued that in juxtaposition to the market maker, the high frequency trader is more selective of actively traded stocks. However, (Brogaard, 2010) argued that the high frequency trader “appears to be the new form of the market maker”. Durbin described high frequency trading as “the buying and selling of assets in a manner in which success is dependent upon the speed with which the trader acts and delays of a fraction of second could mean the difference between substantial profit or substantial loss”. Brogaard also described high frequency trading as a subset of algorithmic trading in which large quantities of small-in-size order are channeled through the market at high rates of speed and with total round trip execution times that are typically measured in milliseconds.

Profit using Annualized Sharpe Ratio (ASR)

William Sharpe (1966, 1994) developed a statistic that could be used to calculate the performance of an asset, which is referred to as the Sharpe ratio, or the Reward-to-Variability ratio. The ex-ante Sharpe ratio used to measure returns for daily, monthly, and annual trading periods is represented by: SRp= ( E[Rp] – Rf )/σp where Rf = the return on a fund in the period forth coming. A high Sharpe ratio and minimal risk produces substantial profit. Table 1 shows the potential of profitability of high frequency trading using the Sharpe ratio: The difference in maximum annualized ratio to the trading frequency is massive as it diminishes from a frequency of 1 day to 10 seconds; as well as the decrease in the standard deviation from 0.76% to 0.01%. The Sharpe ratio measures the excess returns that may be generated per a unit of risk based upon a zero investment strategy (Wagner, 2011; Sharpe, 1966).High Frequency Trading Strategies

The high frequency trading strategy is designed to capitalize on a diversity of market scenarios that encompass price movements, ceilings and floors; corporate actions; and bid-ask spread discrepancies. The strategies are software driven and programmed to post orders and cancel them at intense speeds. The short-run trader extract prices from the exchanges that operate at the fastest speeds to front run the regulators, or the slower exchanges. High frequency traders generally submit and cancel several limit orders; utilize computer power and co-location facilities; exercise brief holding periods; and close the trading day with 0 inventories. Positions that are held overnight translate to undesirable capital and clearing fees.Market Making, Liquidity and Arbitrage

Common high frequency trading strategies include passive market making; structural; arbitrage; liquidity detection; and directional strategies. Electronic market making, or Passive Rebate Arbitrage, is a liquidity providing high frequency trading strategy that is characterized by making 2 sided markets with the objective of profit through bid-ask spread earnings. Market making participants may classified by trading profiles that either engage in only proprietarytrading using computer algorithms; trade for clients; or participate in both client and proprietary trades. Statisticalarbitrage is a high frequency trading strategy that is characterized by searches for price correlations between securities and trading off the imbalances that are found in the correlations. The structural trading strategy is characterized by exploitations of the market or market participant structural vulnerabilities. In this light, high frequency traders may exploit access to low latency data and profit from participantson venues displaying asset prices that are stale. The high frequency trader may also use co-location proximity services near the exchanges in order to reduce latency and to acquire discounts for large volume. Liquidity detection is a high frequency trading strategy that is characterized by a deciphering of large orders by pinging to identify the location based upon the assumption that when a small order has been filled quickly, larger orders will follow. Pinging, or immediate-or-cancel (IOC) orders may be used in searches for undisplayed liquidity and access to those securities; to include dark pools, or private exchanges which do not provide asset data to the public. Directional, or momentum trading strategies create opportunities in the market as subdivisions into market making trading.Kors Quote Stuffing

All of the high frequency trading strategies focus upon the generation of modest profits from market inefficiencies that combine to create substantial profits in short periods of time; and ending the trading day flat. However, some methods of high frequency trading, such as quote stuffing, attract more scrutiny from regulators than others. Quote stuffing is an instance of thousands of trade quotes and cancellations in succession, and within seconds. In 2012, KORS was stuffed with quotes from a diversity of exchanges at rates over 18,000 per second.High Frequency Trading Regulation

Global and national financial market regulators identified the need for public policy as a central focus of highfrequency exchange trading monitoring and mitigation approaches. The Securities and Exchange Commission implemented the Regulation of Alternative Trading Systems regulatory framework in 1998, which some attribute to the increase in the emergence of dark pools. Others attribute it to the more aggressive high frequency trading strategies of momentum ignition and order anticipation; and illegal practices such as spoofing and front-running. Europe recently implemented revisions to the Markets in Financial Instruments Directive (MiFID) 2 in order to regulate the manner in which assets are traded by restricting the use of AT and high frequency trading strategies by market participants. In 2015, the Commodities and Futures Trading Commission (CFTC) proposed the Regulated Automated Trading (Reg AT) rule that fails to specifically address high frequency trading in its terminology; however, the rule makes reference to automated trading systems. Further, the Securities and Exchange Commission and the CFTC also announced future plans to implement similar regulations in order to promote anti-disruptive trading tools.Impact on Today’s Markets

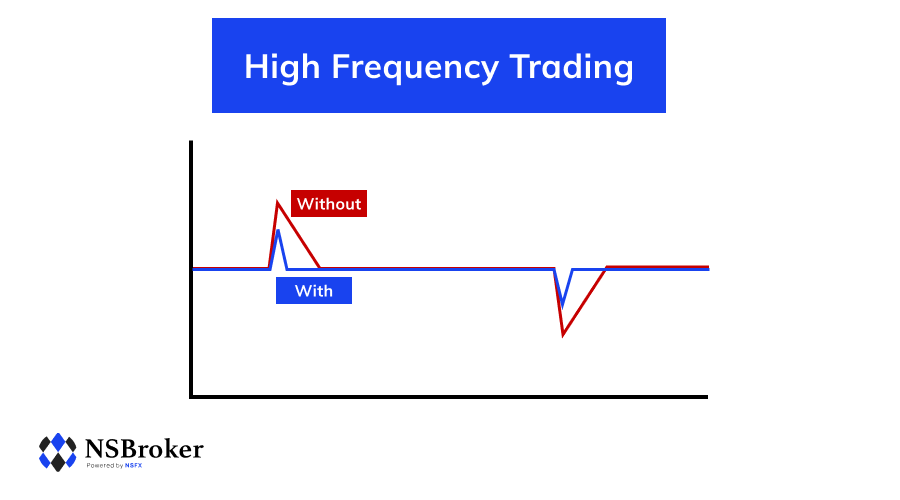

The use of computers to aid in asset trading has become embedded into the fabric of the equity markets. Even by trading for profits of less than 1 cent per share; high frequency traders can realize hundreds of millions in profits by trading hundreds of millions times per day. The volume of high frequency trades that are executed across the markets are of such great magnitude that the majority of daily trade liquidity is an outcome of the high frequency trades. Generally, all owners of equities are impacted in some manner by the strategies of high frequency trading. High frequency trading impacts the relative, intraday market volatility of the SPDR, S & P 500, and the ETF. (Wagner, 2011) contributed that high frequency trading provides socioeconomic benefits in the form of employment, liquidity, and market efficiency. Brogaard supported that high frequency trading improves the markets and enhances the market operations through increases in price efficiency and liquidity; and reductions in market volatility. However, the misuse of high frequency trading strategies and subsequent market manipulations have the potential to harm masses of market investors. Short-run speculation drives trader focus upon single sources of information, rather than a diversity of sources; which in turn, causes negative spillovers of information (Froot, Scharfstein, & Stein, 1992). Overall, the short run trade may impact social welfare through the deficient asset information quality; and also through short-sighted misinterpretations of asset information. Massive price volatility has also been a concern, as the United States Treasury volatility in 2014 and the Dow Jones crash in 2015 has been speculatively linked by many to high frequency trading.Challenges to Day Traders

The potential for extremely high profits in short periods of time has attracted many investors to partake in high frequency trading. However, market conditions, technology and the macroeconomy continue to evolve, producing variations that impact high frequency trades in different ways. High frequency traders are challenged, among other things, by aging high frequency trading technology upgrade requirements and by the advancement of the ATS dark pools. Dark pools limit the capacity of high frequency traders to utilize high frequency strategies on sizable block trades. (Phillips, 2013) supported that high frequency traders are trading in smaller increments and earning smaller percentages on each share as the stock market has become taxing. The cost-benefit analysis of high frequency trades has become less ambiguous as market reactions provide indicators of the true impact of such high volumes of trade. Market making has progressed to market taking; many traders are being crowded out through adverse selection; and the costs of high frequency trading, such as constant information technology infrastructure spending, consume massive amounts of social capital. High frequency traders have been plagued by market deficiencies in price volatility and trading volume. Pricevolatility has decreased tremendously since the financial crises between 2008 and 2010. In turn, the market price fluctuations cause market disparities. Phillips also pointed out that high frequency trading has repelled many of the large firm investors. Other high profile trading firms that have remained have taken a beating due to setbacks ranging from fees to algorithmic errors. Knight Capital and Getco have both experienced considerable challenges that have demanded millions in investments and the uncertainties in regard to the guarantee behind the returns. An unlucky Knight Capital responded to erroneous arithmic trading data by buying and selling a total of $7 billion in shares at a rate of $2.6 million trades per second. The faulty algorithm concurrently raised the price of the stock on the market, which cost Knight Capital approximately $440 million to mitigate the damage. The exchanges identified a profitable opportunity and increased the fees associated with co-location. In 2012, Getco publicized that the firm had become a victim of high frequency trading karma in an annual report that reflected millions in spending to update computer systems. The firm reported a 90% decrease in profits from $163 million in 2011 to $16 million in 2012.