What Is The Most Profitable Forex Trading Strategy?

Having a profitable trading strategy is an important part of being a successful Forex trader. It’s amazing how many people continue using the same trading strategy over and over again even though there is no sign that it works. When you make trading your business, you will want to put in the reflection necessary to be sure what you are doing is going to lead to success. You will need good management not only of your trades and your money, but also your strategies. Here are some strategies that are known to be successful.

Pin Bar Strategy

A pin bar is a single candle with a small body and one long tail and a short tail. For a bullish pin bar, the long tail appears on the bottom of the candle while for a bearish pin bar the long tail is at the top. These candles represent either a reversal pattern or a continuation pattern. The long tail indicates that a price level is being rejected. Depending upon your trading style, you will want to place your entry order at either:

- As a market order, at the close of the pin bar

- As a stop order at the high for bullish candles or at the low for bearish ones

- As a limit order at a level halfway along the long tail

Moving Average Crossover Strategy

Moving averages are very good because they are easy to see. It’s very simple to notice that the 50-period SMA is crossing the 200-period SMA. These indicators are available on practically every platform. The SMA is simply the average of all the closing prices from the specified period while the EMA puts more weight on more recent prices. When the 50-period MA crosses the 200-period MA, it is a sign that a significant trend has been established. Traders then wait for a pullback and enter in the direction of the trend at this point. This strategy works on all timeframes, but intraday traders like to use EMAs because it reduces the lag, which is much more significant with such a short trading window. A good point of exit would be when a trend termination signal occurs like a pin bar, free candles above Bollinger Bands or Keltner Channels, or simply when the MA200 crosses back across the MA50 – signaling a weakening in the trend.

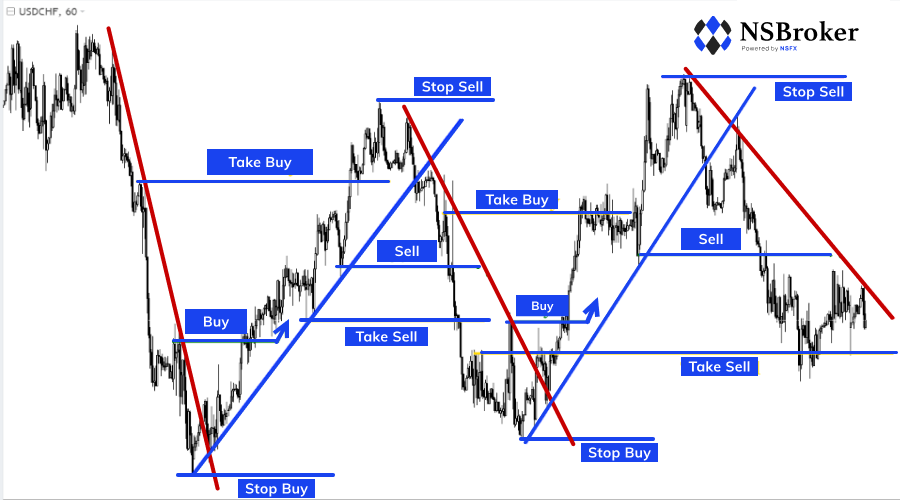

Another profitable forex strategy will require you to draw trendlines representing support and resistance levels in the market. Drawing trendlines on price charts, be they horizontal or diagonal lines, show you zones in the market that have a significance in the price action. The more times a support or resistance is tested and holds, the more significant it is. You can use these trendlines to identify uptrends, downtrends and even ranges. When you identify a resistance zone and the price rallies beyond this point, you can easily position yourself to trade the false breakout.

Setting a stop order at the support level to sell the pair short on the way down will maximize your opportunity to take advantage of the move. If the breakout turns out to be rejected and the price never falls back to your stop, no harm is done. But be aware that support becomes resistance and when it does come back you may want to trade it long the next time it comes around. Support and resistance properly understood and executed represents one of the most profitable trading strategies in the Forex market, stock market or any other market.

Conclusion

Each trading strategy will succeed differently when matched with a trader’s particular style and temperament, making it hard to identify the most profitable trading strategy. A profitable forex strategy that works for you is practically like printing money. Each of these systems stands alone to provide a good chance for profit. However, there are also cases where they can be used in tandem. If they conflict with each other, you have reason to stay out of a trade, while if they agree that would give you all the more reason to believe that the trade is a good one.