Tip on trading the Swiss Franc to the US Dollar

Nowadays in forex, the currency pair USD/CHF is to be a major pair, as both these currencies are very popular all around the world. Throughout this article, we will be explaining some tips on how to trade more profitably on this particular currency pair.

The reality of the Swiss Franc

Throughout history and due to its stability, today the franc is the most popular offshore currency. It is not subject to inflation, has not changed for many years. According to the principle of the gold standard introduced in 1920, at least 40% of banknotes and currencies are supported by the gold and foreign exchange reserves of the state. It operated until 2000, but then it was canceled.

Only two times has the Swiss franc experienced a serious decline:

- the first time - during the First World War, when Switzerland abandoned the gold standard for the sake of military needs. But until 1920, the franc recovered and even rose slightly;

- the second time was during the Great Depression of 1936. Then several currencies immediately fell, the rate of the GBP, USD, and the French franc fell seriously. Following them, the Swiss currency also lost its value, having lost 30% of the price. Today, the franc continues to be quite stable.

General information about the USD/CHF pair

As we have mentioned above, this currency pair is one of the most popular pairs on the market, #4 in the list to be exact, as it is almost five percent of the entire forex trading volume worldwide. It may be sold and bought throughout the entire day, except weekends, so we can say it is traded 24/5. The biggest volume of trades of this currency pair happens on American and European markets. In general, the price is quite stable, it fluctuates by 50-80 points during the day, mostly when some financial news is released.

Mainly, the price of this currency pair demonstrates comparative states of the economies of both countries. When the US economy strengthens, the price of USD/CHF goes up, and vice versa if the economy of Switzerland grows, and not only economical news can influence the price, social events and political decisions do have an impact as well. The USD / CHF foreign exchange market is open 24 hours a day. However, trading in the UK is most active from 8:00 to 17:00. In the United States, the Swiss franc provides trading opportunities from Sunday evening to Friday afternoon.

This opportunity gives great chances of making a good profit. The downside is that volatility and volume can change dramatically with each daily cycle. This leads to widening spreads in less popular pairs and narrowing during periods of activity. Case increases dense spread throughout the entire 24-hour cycle. Moreover, many intraday catalysts are constantly driving trends in all directions. Short-term and long-term swings fit well with classic range strategies such as channel and swing trading.

Most of the economic data for Switzerland and the Eurozone in the US is released between 2:00 am and 5:00 am ET. Before publication, 30 to 60 minutes and one to three hours is a good time to trade CHF crosses. The times quoted coincide with trading activity in the United States, which contributes to the ideal trading volume in both parts of the Atlantic.

How to trade USD/CHF?

The first feature, which usually scares those who are just starting to get acquainted with our pair, is the complex calculation of the pip value. This is a disadvantage inherent in all reverse quotes, however, the algorithm exists, and over time it is not difficult to “fill your hand”. The formula for the calculation is as follows:

1 pip USD / CHF = (lot size * minimum value)/price at the current time.

For example, if you make a deal for 0.5 of a lot at a price equal to 0.8877, then a pip will be worth 5.64. Thus, if we make a profit of, say, 10 points, then it will be 56.4 US dollars. Another feature of trading this pair is its easy susceptibility to the influence of fundamental factors, so any strategy for USD / CHF is built taking into account fundamental analysis. The most important are changes and publication of interest rates, GDP data, and changes in the unemployment rate. These are data that are published in the United States of America.

The next thing that must be taken into account is the relationship between USD / CHF and other pairs, the main of which is the relationship with EUR / USD, since the two instruments are a direct reflection of each other. This allows you to better analyze the behavior of quotes and make the most successful predictions. A little trick for traders is that tracking EUR / CHF and EUR / USD allows you to spot further changes in USD / CHF ahead of time.

The easiest strategy to trade the USD / CHF pair

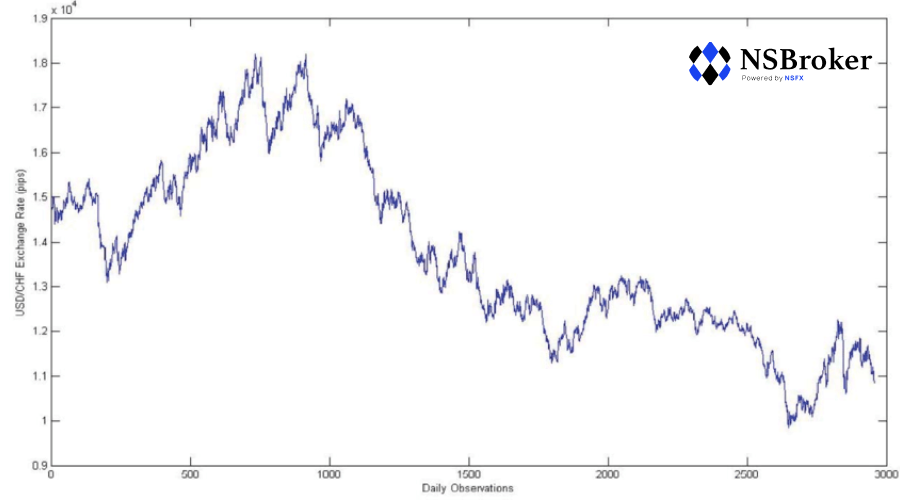

The simplest strategy for working with the USD / CHF currency pair is based on data on the dynamics of the pair's development over the past couple of years. Analysts note that for several years the pair has been demonstrating confident sideways movement, in which a corridor of one thousand points is observed. Knowing this, traders mark the upper limit at one thousand, and the lower one at .9000, and then follow the following algorithm:

if the price bounces off the lower level, after which it tends upward and passes one or two candles, buy positions are opened. Stop-loss in this case is set at a level below the support line. Profits are usually locked at 0.9500, or when the upper bound just touches. If the price bounces off the upper level, then sell deals are opened. Stop-loss in this case is set at a level above the resistance line. Profits are usually fixed at the target level.

Summary

Summing up, I would like to note that despite the specific characteristics and behavior of the USD / CHF pair and the difficulty of studying it, if properly “tamed” it can be easily predicted and can bring a very good profit. The main thing is to choose short-term and even ultra-short-term trading, as well as follow the release of economic news.