How to Trade with Currency Strength Meter

.png)

What is a Currency Strength Meter?

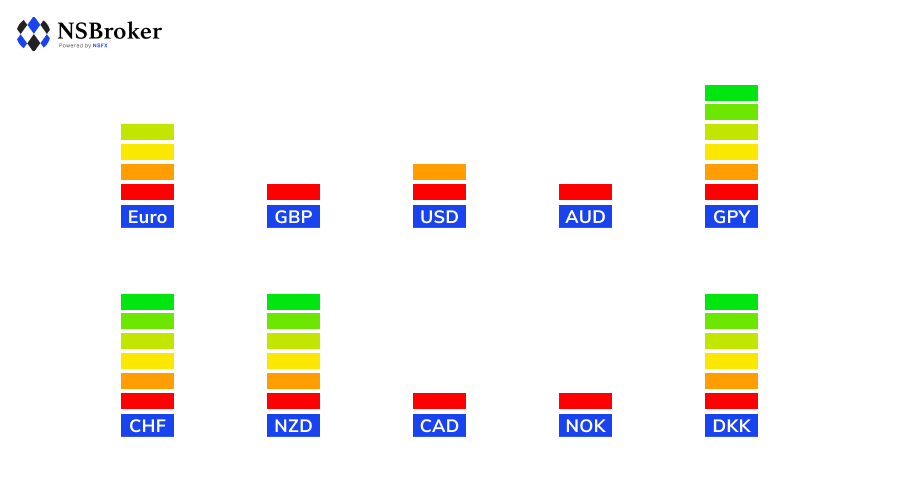

A currency strength meter is a way of displaying graphically the relative strength of each currency. They generally cover the last 24 hours. Sometimes they show each currency against each other currency that it trades against, essentially just showing you how each currency pair is doing. Others combine all the pairs associated with a currency to come up with an overall strength of a currency. The information is usually presented in a “heat map” format, or sometimes in the form of a line graph.

How to Use?

Say, for example, that you look and see that U.S. dollar (USD) is really strong today. To take advantage of this, you want to find another currency that the strong currency forms a pair with, since Forex trades in pairs. You take a look at the Euro (EUR) and it’s also strong today, but not quite as strong. Since Forex operates with currency pairs and works by pitting one currency against another, buying a strong currency in relation to another strong currency probably doesn’t offer much of an opportunity.

How to Trade with the Currency Strength Meter MT4

Looking at a currency strength meter gives you a sense of what currency pairs are good markets for trading.

Here’s a short set of steps for how a currency strength meter is typically used:

- Find a currency that has suddenly turned weak on the currency strength meter

- Find the strongest currency and look at the pair composed of the strong currency and the suddenly weak one. Check the chart for it to see if there is a trade you can justify there.

Another way is to:

- Look for the strongest currency and the weakest currency;

- Look at the chart for the pair composed of both these currencies and see if there is a trading opportunity there.

To pick up from our example above of a strong USD, you might look at Japanese Yen (JPY) and notice that it’s suddenly turned weak today. You could buy USD/JPY to take advantage of USD’s strength and JPY’s weakness. Another way of trading with the currency strength meter is to take the strongest currency paired with the weakest currency and look at that pair’s chart to see if there is a buying opportunity there. So, if USD is the strongest currency and NZD is the weakest, then you would look as USD/NZD and see if there is a strong trend or indicator signal that you can use to justify a trade there.

If you just look at one trading pair, a currency could be down due to its own weakness or due to the strength of the other currency in the pair. With a currency strength indicator that combines all the associated pairs of a currency into one reading, it suggests that the currency itself is trending a certain way overall, as opposed to looking at only one pair.

How to Know if I’m Using an Accurate Currency Strength Meter?

You can manually compare the performance of a currency through all the currency pairs used in the currency strength meter if you distrust its accuracy. For example, if JPY shows as strong but is down across the board, you may not feel comfortable using this particular currency meter. Choosing the right currency strength meter for you is really about whether you feel comfortable with its performance and if it fits into your particular strategies. There are several currency strength indicators available for MetaTrader 4 (MT4). Some of these utilize the typical heat map-style presentation of the data. Some others show a line graph of the relative strength of each currency.

Conclusion

Currency strength meters are a good way to eyeball what currencies are exhibiting strength or weakness across the board. Just seeking to explain such strength or weakness can alert you to changes in the fundamentals that you could otherwise miss. Currency strength indicators help you find markets where there is real imbalance that you can potentially exploit and make money.

In the currency market, as is with stocks and other commodity markets, trading is based on knowledge and understanding of different variables that influence the particular market. In the forex(FX) market traders are keen to understand forex currency strength , normally a result of changes in demand and supply of forex together with other local and international macroeconomic policies and factors that impact the foreign exchange market.

The concept of currency pairs in the FX market differentiates it from other financial markets and enables us to measure one currency’s strength against another hence the broader notion of forex currency strength. This interesting opportunity among others is gained when you receive exposure after taking what is technically termed an FX position on a pair of currencies, for instance, the EURO/US Dollar position. The use of currency pairs to evaluate the strength of foreign currencies in the FX market is based on the fact that it is far too complicated to judge the performance of a currency in isolation in a bid to make a trading or investment decision. In the aforementioned currency pair, it may be imperative after a strong gain on the trading day, to understand whether that gain in strength is a result of the Euro doing well or as a result of the US Dollar performing poorly.

If you like to measure the strength of the different currencies you’re trading in, you can download this app using the Meta Trader Plugin. This Forex indicator displays which currencies are weak and which are strong at any given moment, reflecting that movement in a matrix. Using an effective currency strength meter puts another tool to your disposal aiding to turn you into a more profitable currency trader.

In real-time currency strength meters/indicators function as visual guides demonstrating which currencies are strong and which ones are weak. These indicators use exchange rates of different currency pairs to produce an aggregate comparable strength of each currency. Currency strength meters are diverse and range from simple to advanced ones applying their own weighing parameters and combining other indicators in currency strength measurement ; to provide standard trading signals. In a more advanced system for instance, calculating the strength of the US Dollar would involve the currency strength meter calculating the strengths of all pairs containing the USD in trading, and then putting those calculations together to determine the overall (average) result for the US dollar.

A lesser-known but more comprehensive measure is the broad USD Index, using a wider selection of currencies but also calculating the strength of the dollar against various dollar containing pairs(EUR/USD, USD/JPY, AUD/USD, GBP/USD, USD/ZD, etc) by aggregating bilateral exchange rates into a single number. The broad index also applies a weighing derived from the share of merchandise imports in annual bilateral trade(trade data) with the USA. Source: Admiral Markets Meta Trader 4 Supreme Edition – Correlation Matrix.

It is critical at this juncture to observe that certain deficiencies over time arise in the use of currency strength meters making them not only outdated but of little trading use. By causing Meta Trader 4(MT4) freezes, PC freezes, stuffers, whipsaw signals, memory leakages and CPU working constantly at 100%, some products might even produce data that has even moved away from the original concept of what currency strength actually is. Some also applying smoothing filters such as moving averages and by adding fillers on top of demonstrating currency strengths, traders might find themselves getting false trading signals, entering poor trades and suffer a losing streak.

Such issues with currency strength meters have been the basis of evolution in the measurement of currency strength – to use currency correlation as the real best approach to the measurement of currency strength. Hence coming up with the forex correlation matrix or the real currency strength meter. Very important to observe that if a forex correlation matrix has been coded perfectly, using the latest technologies, it is unlikely to cause any of the aforementioned deficiencies while retaining all the benefits of a currency strength meter. Therefore currency strength meters have over time evolved naturally into currency correlation matrices delivering more complex and accurate information. Forex correlation is a statistic of possible of trading relation between two currency pairs.. This numerical measure of the relationship between the two variables forex pairs 0 has its coefficient ranging between -1 and +1.

A correlation of +1 indicates that the two currency pairs are perfectly related and will flow in the same direction 100% of the time. A correlation of _1 indicates that the two currencies have a perfectly negative correlation, will flow in opposite directions all the time. Whereas a zero correlation denotes a completely arbitrary relationship between the two currency pairs.

Since currencies are traded in pairs, for instance, EUR/GBP, the euro paired with the pound sterling, we can use correlation to measure the strength of individual currencies as well. For example if the EUR/GBP and GBP/USD have a negative correlation, the pairs are likely to move in opposite directions. So two long trades or two short trades on these pairs would likely cancel each other out. In the first pair, the GBP is the quote currency (meaning long trades expect the EUR to strengthen against the GBP). In the second pair, the GBP is the base currency(meaning that long trades expect the GBP to strengthen against the USD)b A high correlation between these two currency pairs leads us to deduce that the GBP(the common currency between the two pairs) is the one driving these movements and therefore the strongest currency in this example.

In a nutshell, there are numerous merits in using the real currency strength meter, ranging from their simplicity, usefulness as short term indicators/quick trading guides, availability online for free, correlation matrices eliminate double exposure (assets with high correlation move in one direction), eliminating unintentional hedging of funds (currencies and assets, to currency strength meters signaling high-risk trades to prevent losing streaks by traders.