Simple Forex Scalping Trading Strategy - The Best Scalping System

The forex scalping strategy focuses on executing a large number of trades, with the objective of obtaining small profits on quick transactions. The extreme liquidity and high volume on the forex exchange allows investors to capitalize on the price fluctuations of currency pairs.

Under the scalping umbrella, three core strategies that exist: shorting the position, limited profit margins (what we will focus on in the below examples), and heavily leveraged positions. There are many variations of this particular trading strategy, and choosing the best will vary depending on the investors’ available capital and ability to react quickly to a fast moving market.

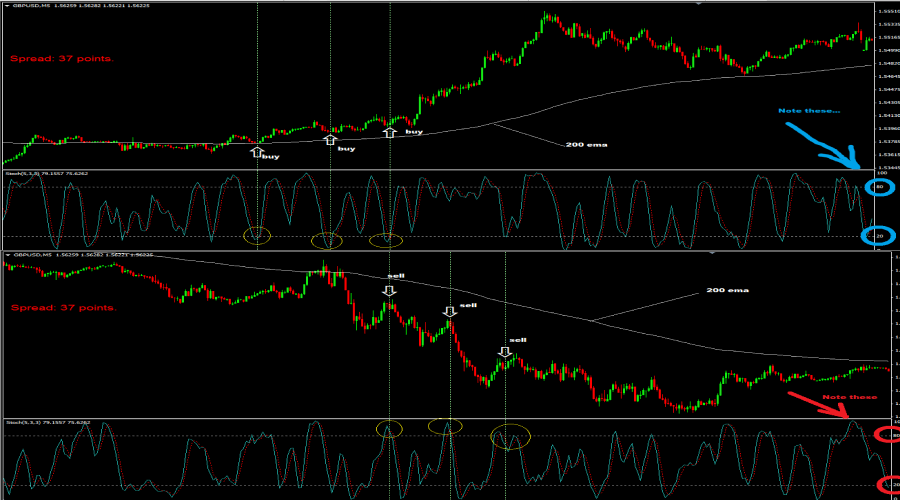

In addition, scalp traders will utilize additional indicators to help execute successful trades. Indicators like Price Action,EMA trading indicator, or the Stochastic Indicator are just a couple of common tools used by traders to give their scalping gaming an advantage.

The Benefits of scalping?

- Reduced risk because of quick trades

- Market liquidity and volume allows for high volume of trades.

- Focus on fast small gains helps avoid large losses

- Historical reliability of scalping has proven to help generate returns

*“This type of strategy despite requiring a lot of speed and intelligence, is perfect to speed up your mind and become a much humbler in regards to the gains that are normally expected from fore. It serves as an administrator of the money that is produced through this strategy. It also gives me various options to use, which is how I best work” **(Mindy Hashem; comment on Quora)***

Scalping Strategies

The goal behind any trade is to generate a profit, and traders are always in search of the best indicators. Every investor will have their own “best scalping trading strategy” that utilizes various time frames and indicators. However, as a trader, what is important is having a rule book that will guide your trading. Knowing when to enter the trade and when to place stops is important. Having an exit plan for your scalping strategy is key to success. Below we detail out a few of the common forex scalping strategies that traders are using today.

5 minute scalping strategy

This strategy has become a well-known and widely used in today’s fast moving marker. The trader will to need to execute a minimum of 10 trades in a single day, with the goal of capitalizing on any minor price changes that may occur in the various currency pairs.

With the 5-minute forex scalping strategy, it is necessary to implement a strict exit strategy, which has the capability to minimizing any potential loss. In this particular strategy, the length of the trade will be approximately 5-minutes.

Below we have a 5-minute chart with our channel indicator. As a trader, each will use their own indicators in tandem with their scalping strategy. Our strategy would consist of buying when the price dips below the moving average into the lower channel. And we would sell or short our position once we entered into the upper channel.

In the instance where the price does not trade into a channel we would simply wait for our price to move into our strategy and then begin trending again. We see an indication of this after the price enters the upper channel the first time.

The goal here is to make quick trades in and out of the market within 5-minutes, while the profit may be small, many small wins equates to large profits. The most important thing as an investor is capital preservation, and avoiding large losses helps with that.

Forex price action scalping

The objective of forex price action scalping is to exploit the reduced price on the trend, whether bullish or bearish. The idea behind price action is to allow for the smaller trader to identify and plan for the trends, this is because the markets tend to be moved by your big banks or financial institutions. In the below example you will see the price failing to close above the resistance level indicating further decline. A trader would utilize the basic indicators of price action with our scalping strategy to provide active signals that help direct or trading. The forex price action scalping strategy has places a dependency on additional price action indicators.

Summary

To execute the forex scalping strategy successfully, a trader will need to demonstrate they have a clear set of rules and guidelines, dictating how they plan to open and close their positions. A scalp trader may place hundreds of trades a day, and it’s important to ensure you do not falter your plan, otherwise you run the risk generating losses and not gains.