Trading Patterns & Volume Spread Analysis

Introduction

The study of trends associated with volume helps analysts pin point price tops and bottoms. Volume analysis was introduced to the trading platform by some of the icon traders in history, most known of them are Tom Williams, Richard Wyckoff, and Jesse Livermore. Pioneer traders hypothesized that the footprints of big volume data could be used by individual investors in order to understand the movements of institutional investors. The investment management “natural economies of scale” and the increasing pool of investment capital creates an environment of massive trading of large stocks. When stock price movements are observed based on price only, the investor is limited within the scope of emerging signals. Therefore, methods of reading trend line patterns for heavy volume became common practice, with the exception that trend line patterns with light volume may be false indicators; as low volume indicates an overall lack of conviction from the buyers.

Common Trading Patterns

Trading patterns manifest itself naturally in the market, they are a representation of the constant tug of war between buyers and sellers. As the demand on a particular stock increase, its prices will also increase, this in return attracts more sellers to step into the market and supply it, which in return shifts the price lower. These shifts in price sometimes create well known shapes or "patterns" that have very predictable outcomes. Some of these well known patterns include the Head and Shoulders; Cup and Handle; Simple and Complex Pullbacks; Triple Bottom and Triangles. There are trading patterns not discussed in this paper, also note that trading patterns are considered one of the main areas of technical analysis. (Thomsett, 2003) differentiated between fundamental market analysis and technical analysis in that fundamental approaches provide insight as to why the stock price moves; while the technical analysis provides insight into the timing of the movements. Further, the uptrend and downtrend trading pattern lines represent support and resistance, respectively; while the channels between the trend lines are referred to as consolidation lines and stabilization lines. The objective of trading pattern information is to support market entry and exit decisions that will yield eventual gains. (Gervais, Kaniel & Mingelgrin, 2001) supported that when an individual stock is trading in a significantly small price range within daily and weekly periods relative to the trading volume; the subsequent month is characterized by significantly large returns.The Head and Shoulders Pattern

The Head and Shoulders trading pattern is an indicator of a reversal in the main trend. The “head” of the patter is the highest peak, the two lower peaks are labeled as the “shoulders”. The “neckline” depicts resistance and is connector between the lowest trough points, or shoulders. Breaks beneath the neckline are interpreted as bearish signals that typically produce outcomes of a continued fall in the stock price. The head and Shoulders pattern may be used to predict how far down the stock price will fall by finding the head measurement and applying it to the break in the neckline and continuing the measurement downward. The formation of a head and shoulders trading pattern is an indicator that the stock movement is progressing against the trend. The pattern is confirmed when the neckline of the pattern is broken; at which time short term traders are likely to take positions. The downward trend is a signal of decreased stock visibility. The head and shoulders pattern could also be bullish, the inverse of the prior is true for that, The head will have the lowest peak while the shoulders will have two higher lows. Volume should be analyzed with the head and shoulders pattern, and traders should look for large spikes of volume at the break of the neck line.The Cup and Handle Pattern

The Cup and Handle trading pattern is categorized as a bullish continuation that forms during uptrends. The pattern is an outcome of stock consolidation periods; which indicates a time to buy when the stock breaks out above the handle to the upside. Figure 2 shows the cup and handle pattern, which is completed at the handle: The cup and handle has a high chance of success if its traders are cautious enough to analyse the volume behind the breakout, if the breakout was associated with relatively high volume than the pattern might have a very predictable outcome, however if there was any lack of interest which is seen in low volume levels, traders should be warned and avoid the pattern all together. Remember, if a trader is not shooting from a point of strength, he shouldn't be shooting at all. The lack of volume doesn't guarantee pattern failure, but the probability of success is reduced significantly.Volume Spread Analysis

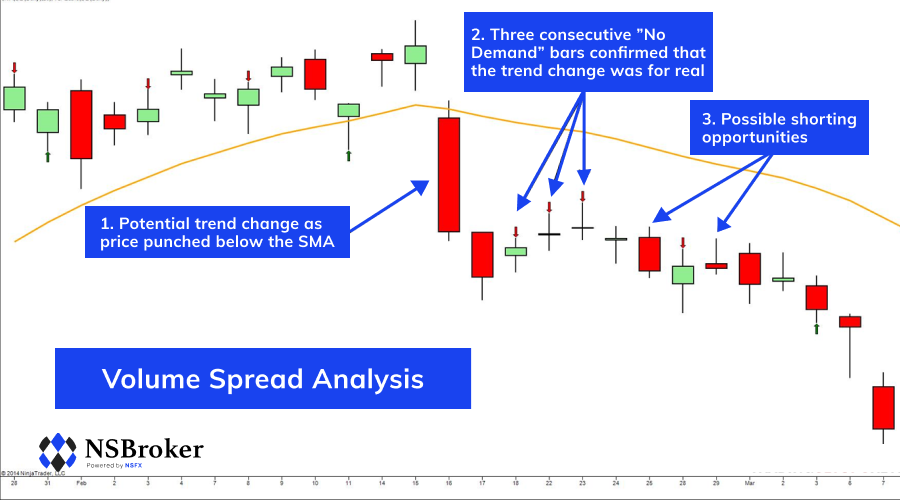

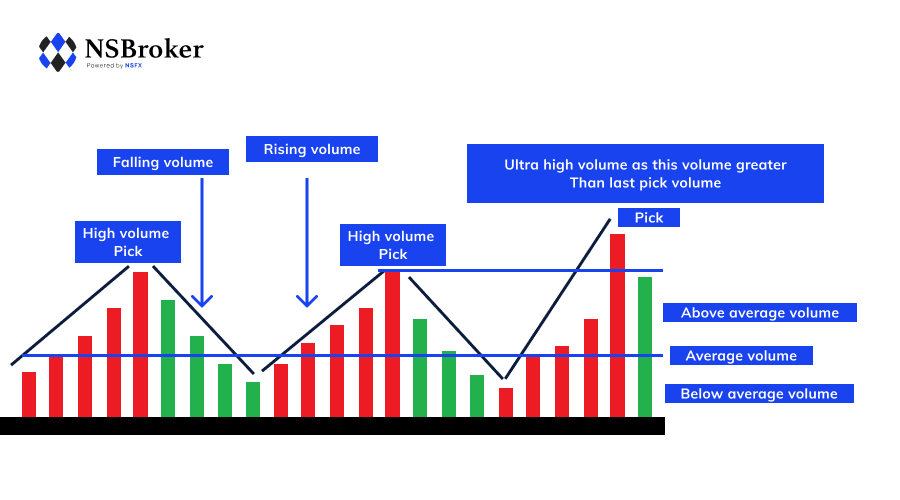

The primary concepts of volume spread analysis are (1) no buying demand; and (2) no selling pressure. This paper only covers the basic concept of volume spread analysis, there are a lot of details that goes into it that are not discussed in this paper, please read our book review on !!!!volume price analysis complete guide!!!! for more details on this approach. The volume analysis approach may be used in the stock markets, futures and forex. Forex market trade volume is replaced by tick volume which is still a viable resource to conduct this type of analysis with. The no demand bars confirm that the market shows little interest in the bullish run. Box number 1 shows a potential change in trend at a price that is below the simple moving average.Box number 2 pin points the bars where no buying interest is observed, Box number 3 shows potential opportunities for shorting. The VSA approach adhere’s to Wyckoff’s 3 trading tenets of Volume and Price; Effort and Result; and Cause and Effect. Other common VSA approaches include anchor bars; low volume pullback; and on-balance volume.