Forex Weekly Forecast & FX Analysis August 17 - 21

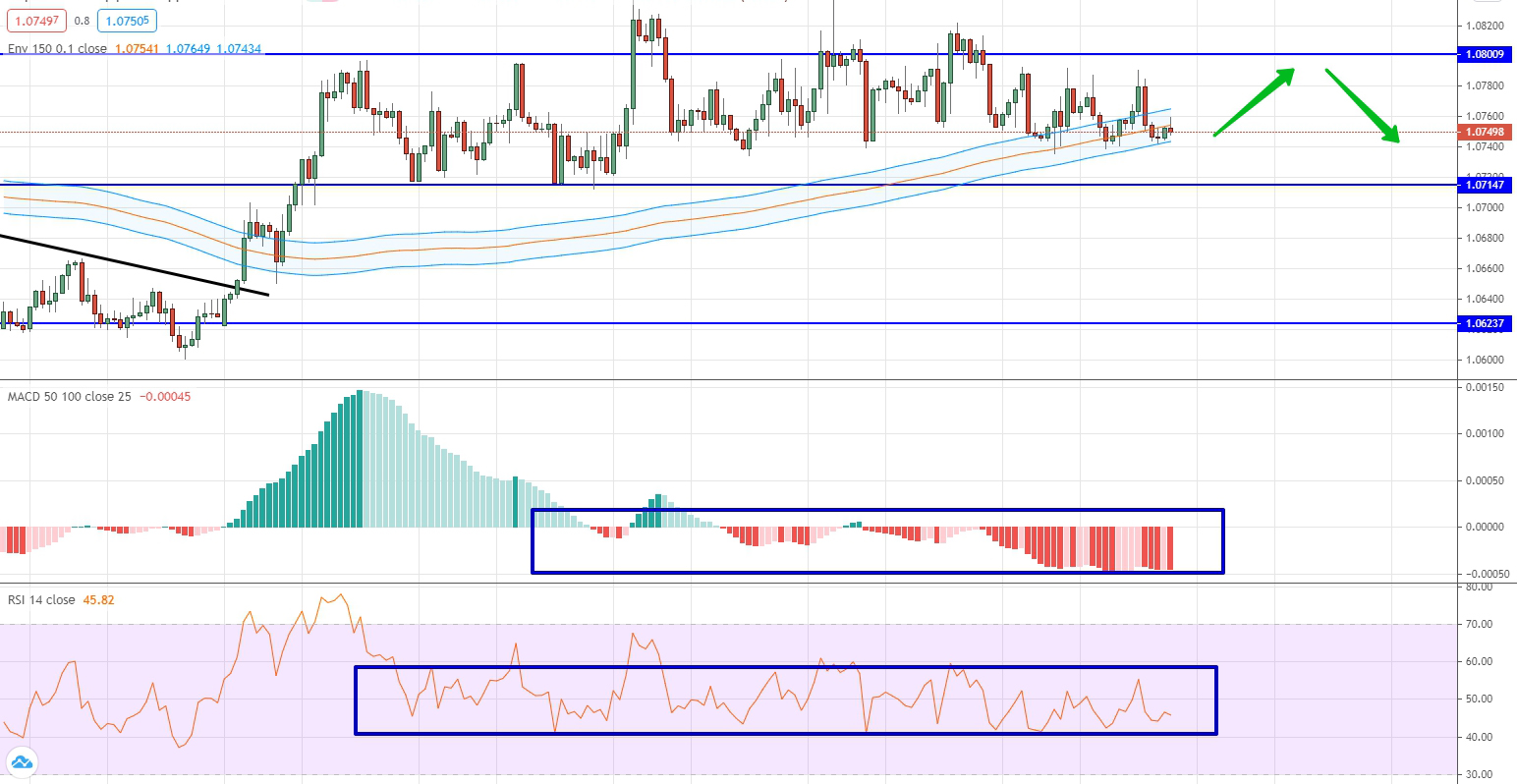

EUR/CHF

For several weeks now we have been talking about the same things for this currency pair. Globally, there is a side corridor of 1.0714 and 1.0800. The corridor is very strong and the price cannot go beyond it. The last weeks allow us to speak about the presence of the level 1.0740. The indicators do not give any signals for trading and are close to neutral positions. Given that the level of moving averages is looking up, and the price is close to 1.0740, you can expect to move up and further correction from the level of 1.0800.

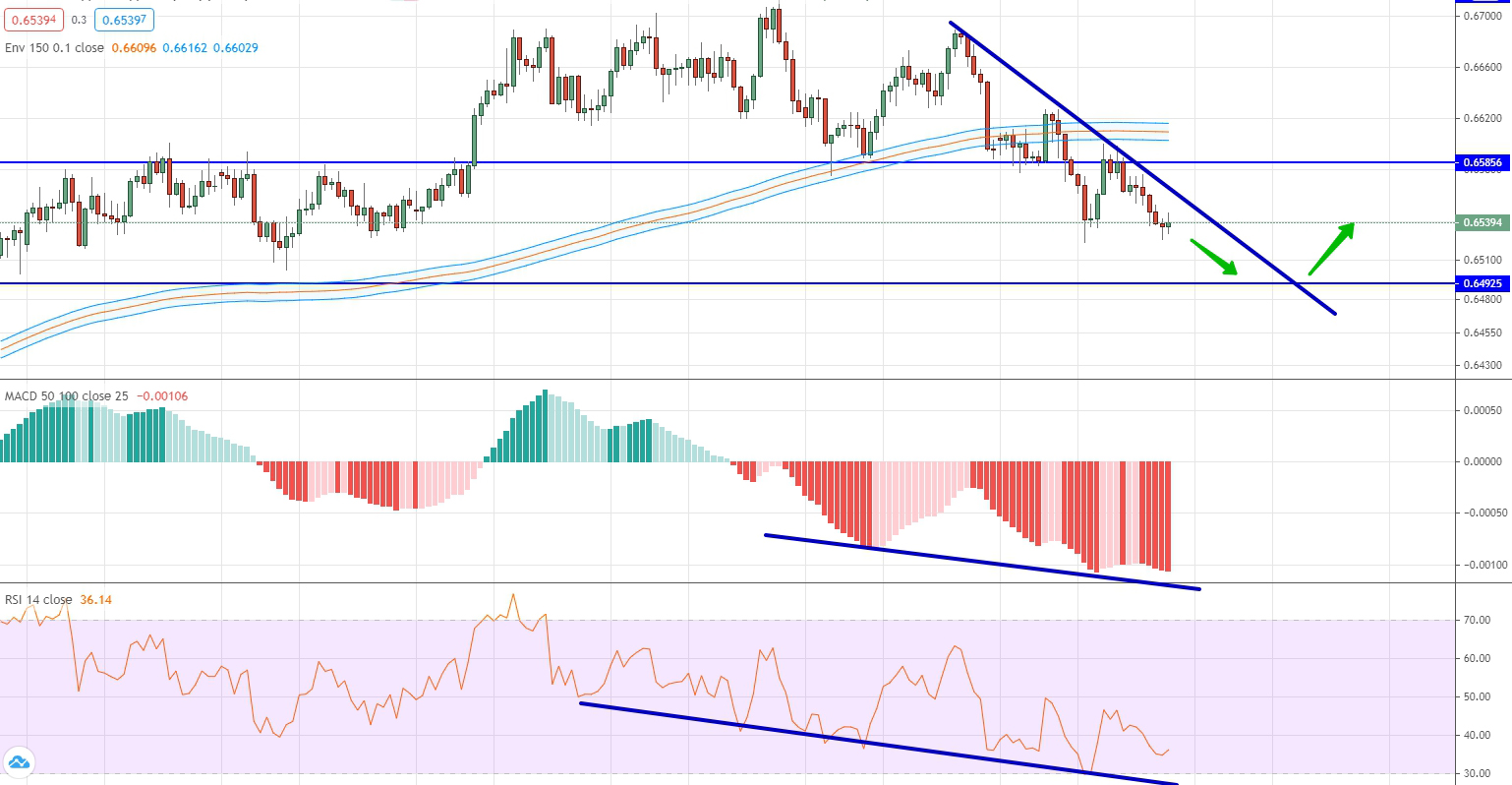

NZD/USD

The New Zealand dollar is losing its positions against the American dollar, and within the descending dynamics it managed to consolidate below 0.6585. The movement turned out to be quite strong and the downtrend line has a rather steep slope. On the one hand, it indicates that the drop is excessive and the need for correction, but on the other hand, the downward trend is confirmed by all the indicators that keep looking down. Therefore, we will work on the main postulate of technical analysis and follow the trend. Therefore, we are trading downwards, as 0.6492 is quite an important level from below. With a certain probability, we can expect a reversal at this very level.

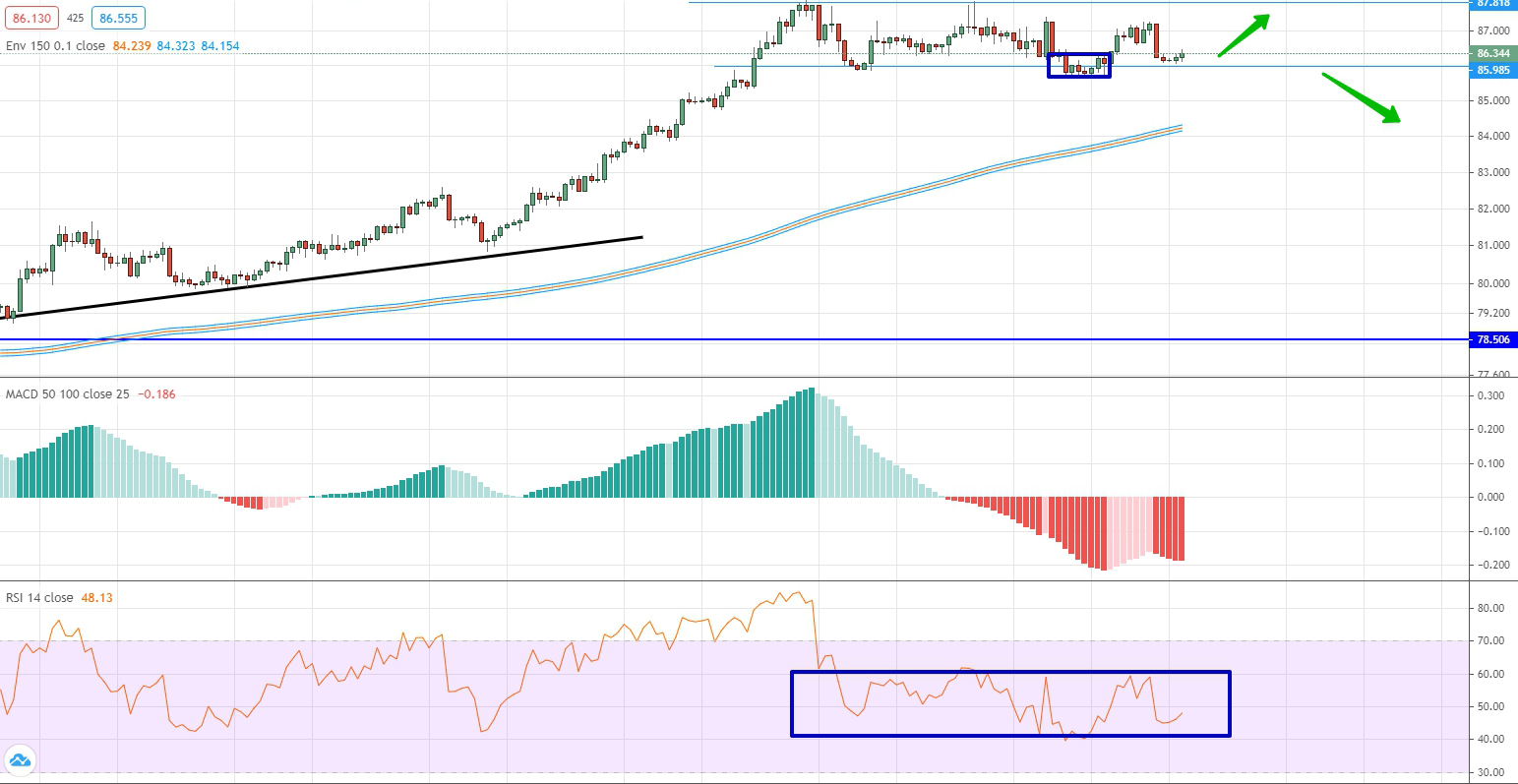

EUR/RUB

For the last week, there were no changes for this currency pair. We still talk about the strength of the corridor 85.98 and 87.81. The only exception from the last week is that the price is very close to the lower boundary of the corridor, which means that we can expect upward movement. But it is a local and short position. Globally, we are waiting in which direction the sideways corridor will be broken through. It will be possible to trade in the direction of the breakthrough.

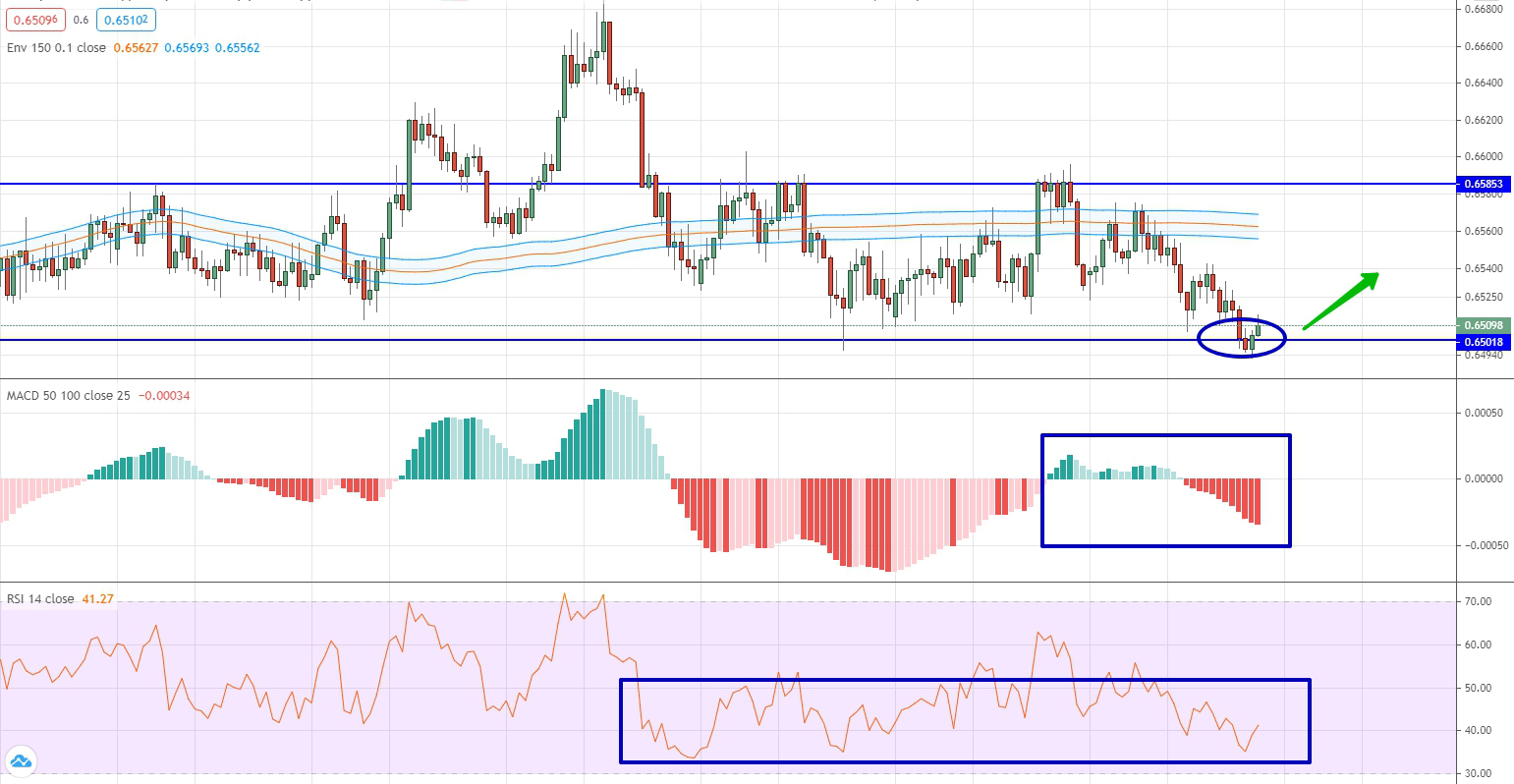

AUD/CHF

For this currency pair, we still speak about the strength of the sideways corridor 0.6310 and 0.6585. Interestingly, last week the price tested the lower boundary of the channel, after which a pullback upward occurred. If you look at the indicators, the oscillator generally shows a tendency for downward movement, but does not show a global trend. The histogram also tries to form a downward dynamic, but there are no global prerequisites for this. Therefore, you can try to play ahead and open an upward position.

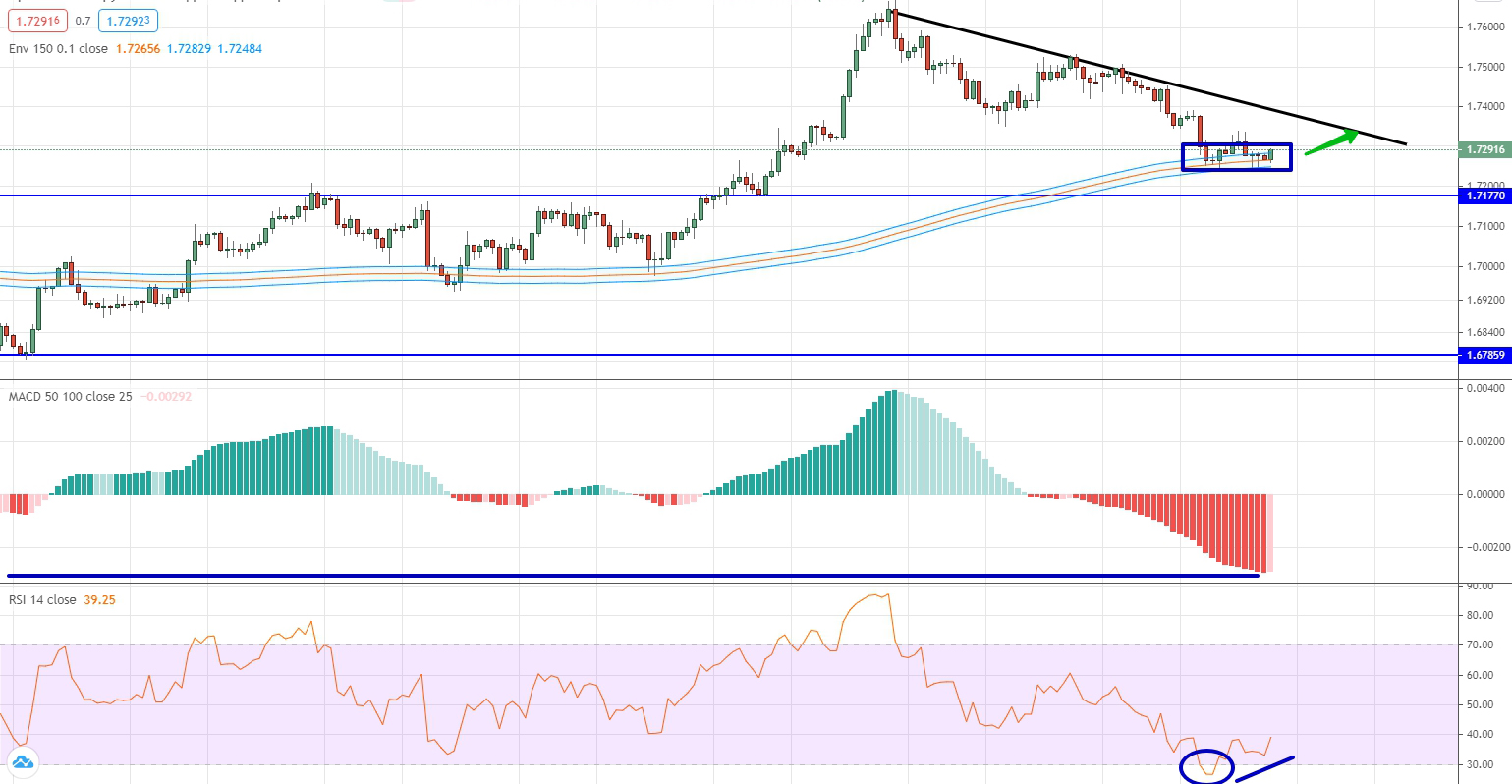

GBP/CAD

The British pound is correcting against the Canadian dollar, as a result of which a downward trend is seen. This trend led to the price reaching the level of moving averages, where it reduced its volatility and actually stopped completely. Interestingly, all the indicators have tested the minimum values for themselves, and oscillators even managed to enter the oversold area and return to normal values. Taking into account the fact that all indicators are close to negative values, we can expect that the market will need a correction, which means that we can trade upwards. Trading here is risky and short.

NZD/CHF

The New Zealand dollar keeps falling hard against the Swiss franc. Characteristically, this fall has already resulted in the price being at its local minimum in more than 3 months. Moreover, the last movement is formed in such a way that the market has almost no retreat. If we compare the price position and the histogram, we can see the divergence. To this we should add that the oscillator has reached the oversold area. Taking into account all these factors, you can open a position to rise, waiting for the market to correct towards growth. But it is a very risky option.

USD/CNH

The American dollar against the Chinese yuan is still looking down. Once again, we are talking about the dominance of the downtrend, which can be traced both by indicators and by the price position relative to the level of moving averages. However, if you look at the 2 local lows of the price of the last 2 local lows of the indicators, they form a divergence. Therefore, there is an option to trade up and it will be the main hypothesis for the next week. In this case, we take into account that the trend line and moving average levels are higher. Limit level trade is at 6.98.