Forex Weekly Forecast & FX Analysis December 07 - 11

EUR/CHF

The euro against the Swiss franc fails to form a strong and sustained move in either direction. For several weeks in a row we have been saying that the price of this currency pair is prone to sideways movement. This time, such a movement turned out to be limited by the price range of 1.0820 and 1.0860. Taking into account that the indicators are close to neutral values and do not give any clear signals for trading, we can say that while the price is within the indicated range, trade it is impossible. In the future, we are waiting in which direction this range will be broken and in the direction of this movement it will be possible to open a contract.

NZD/USD

The past week led to a strong upward movement of the New Zealand dollar against the US dollar. Nevertheless, we draw your attention to the fact that the price growth was accompanied by a downward movement primarily along the histogram. Thus, we are talking about the presence of divergence. Moreover, this divergence is along the set of peaks. The oscillator, on the other hand, is in the area above 50 and speaks of the strength of the upward movement, but the last candles attempt to consolidate in the area below 50. At the same time, the price chart forms an attempt to consolidate below the trend line. Thus, the combination of all factors allows us to consider options for trading down.

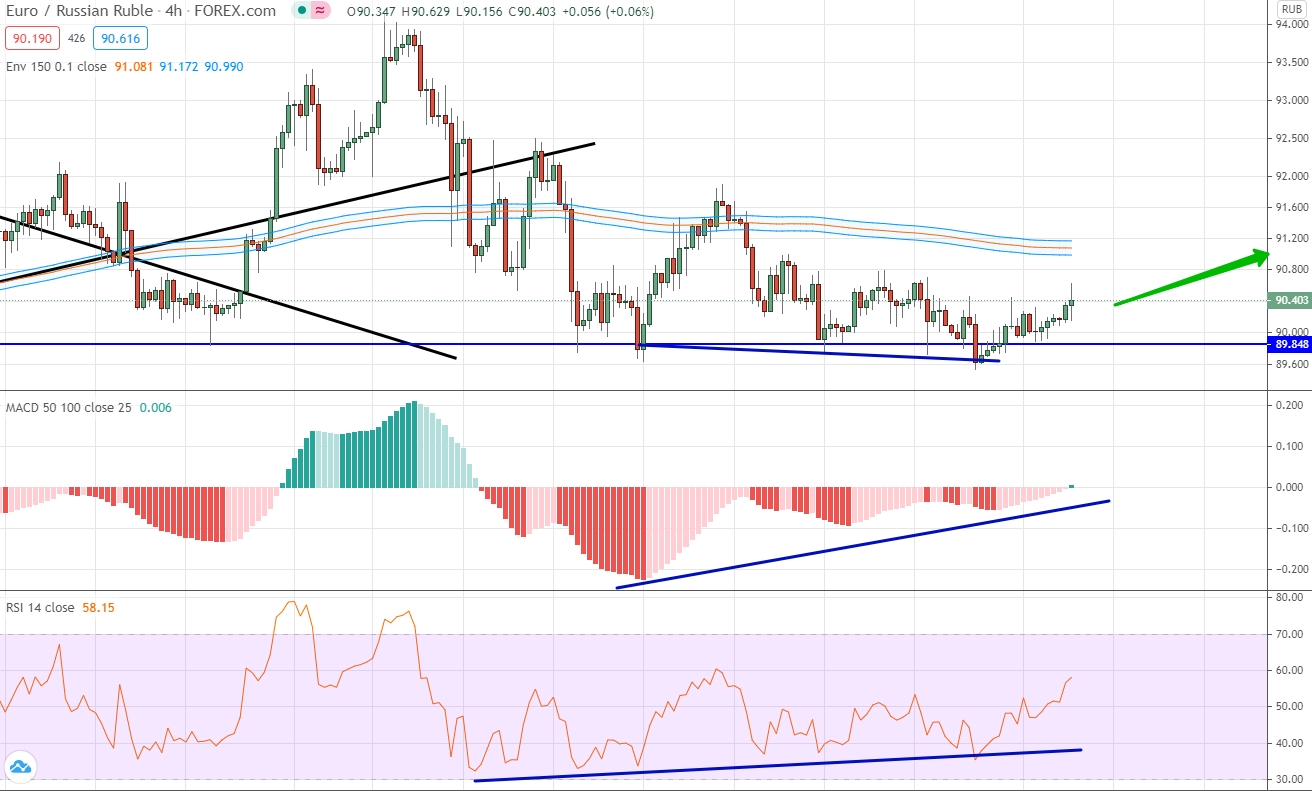

EUR/RUB

Euro against the Russian ruble alternates upward and downward movement. The last movement turned out to be downward, as a result of which the price was below the level of the moving averages. The indicators are in neutral positions and do not give any specific signals for trading. Now we can state the fact that the price of this currency pair is developing above the level of 89.84. Thus, we are talking about the dominance of the upward trend, since the price generally develops above this line. Therefore, we can consider options for trading up, but the optimal entry point will be close to the designated level.

AUD/CHF

The past week for this currency pair led to a downward movement, during which all indicators fell into the negative area, and the price reached the level of moving averages and is testing it. Please note that testing of the level of moving averages occurs near the level of 0.6585. At the same time, pay attention to the fact that the moving averages do not change their slope and continue to look up. This is one of the strongest signs of an upward movement. Thus, a downward movement can be viewed as a correctional movement, which allows you to open an upward contract.

GBP/CAD

The analyzed currency pair allows drawing 2 trend lines on the price chart: global ascending and local descending. These levels look in different directions and approach each other. It is characteristic that the level of moving averages is actually in the middle between these trend lines. The price and moving average levels are approaching the top of the triangle, which is formed along the trend lines. Therefore, we are talking about the fact that while the price is inside the formed pattern, you cannot trade. Then we wait in which direction the market will break through this figure and in the direction of the breakdown it will be possible to trade. The downward movement is most likely, and then it will be possible to open a contract with the target at 1.7177.

NZD/CHF

This currency pair is still forming an upward trend and last week the price managed to gain a foothold above the strong level of 0.6327. Indicators are close to neutral. This applies primarily to the histogram. If we look at the oscillator, it also demonstrates the absence of volatility, but for several months it has been building exclusively in the area above zero, confirming the upward trend. Therefore, we can only consider trading options in the direction of the main trend, which means an increase. A downtrend contract can only be opened when the price is below the trend line.

USD/CNH

The dollar continues to lose ground against the Chinese yuan. Last week the American currency against the Chinese one dropped below the level of 6.5473. At the same time, the oscillator was in the area below 50, and the histogram for the first time in several weeks was in the area below 0. Thus, there are all the prerequisites that indicate the strength of the downward movement. In this situation, only a descending contract can be opened.