Forex Weekly Forecast & FX Analysis March 01 - 05

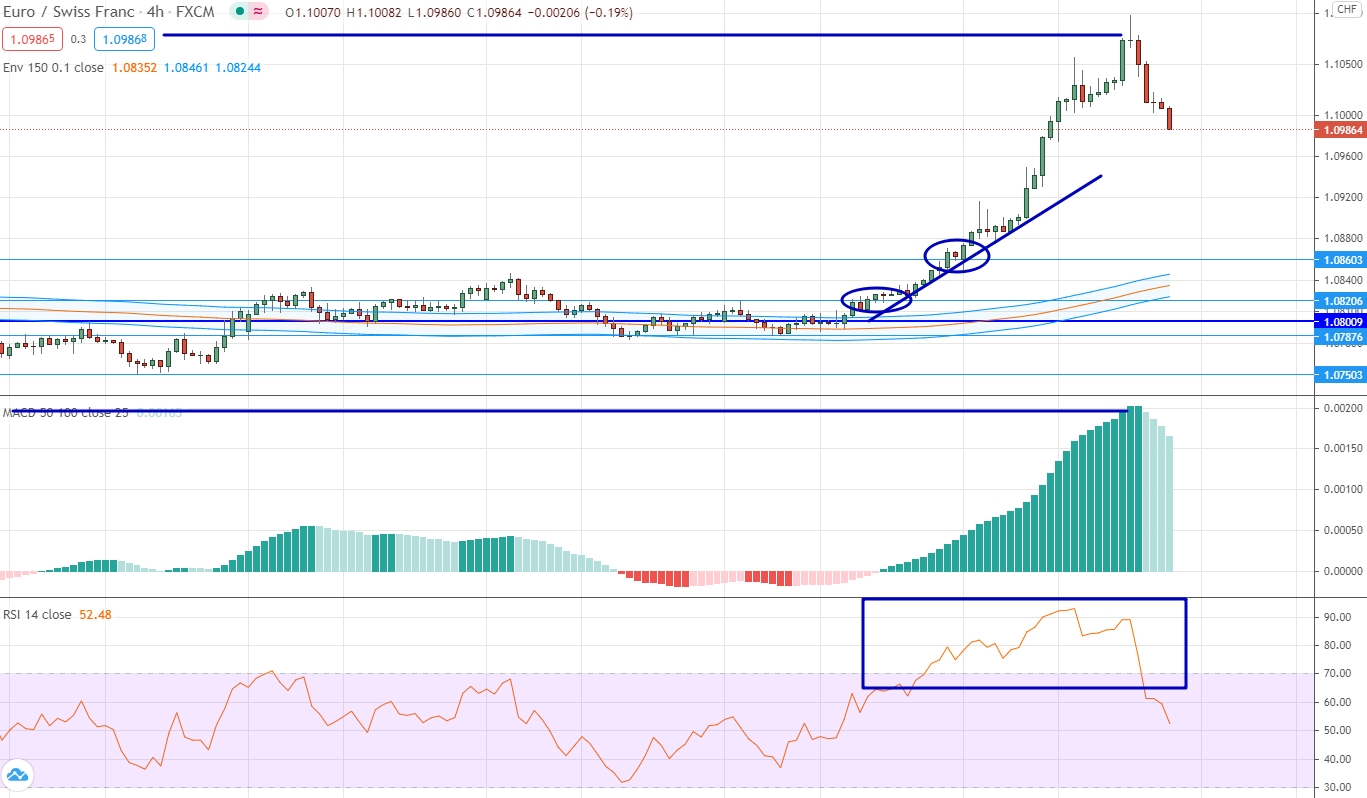

EUR/CHF

For the first time in more than a few months, the price of the euro against the Swiss franc made a very strong upward movement, breaking 2 strong levels, which we talked about in previous weekly reviews. In fact, what we talked about happened: all ranges were broken upwards and after that there was a strong movement. Thus, it was possible to make very good money on it. Now we are talking about the fact that the price is at a local maximum, the same mark is confirmed by the histogram, and the oscillator has been in the overbought area for a very long time, and it has risen even above 90. This is market volatility, and it is best to abandon trade.

NZD/USD

The value of the New Zealand dollar against the US dollar last week broke through the level of 0.72 2 and made a strong forward movement upward. Thus, what we said in the previous weekly review happened. Now we are stating the fact that the price has risen to the local maximum value and they are all confirmed by indicators. I would like to draw your attention to the fact that at the end of the week the price dropped quite strongly and practically beat off all the growth. Thus, the price can be expected to return to the growth stage and an upward contract can be opened.

EUR/RUB

The value of the euro against the Russian ruble has already turned out to be above 89.84 and is now making attempts to consolidate above the level of moving averages. Please note that the indicators do not show any trend movement and speak of neutral positions. Nevertheless, the price is looking up and attempts to fix it above the moving averages are distinct. Therefore, we can expect that this movement will be successful, which means that we can open an up contract.

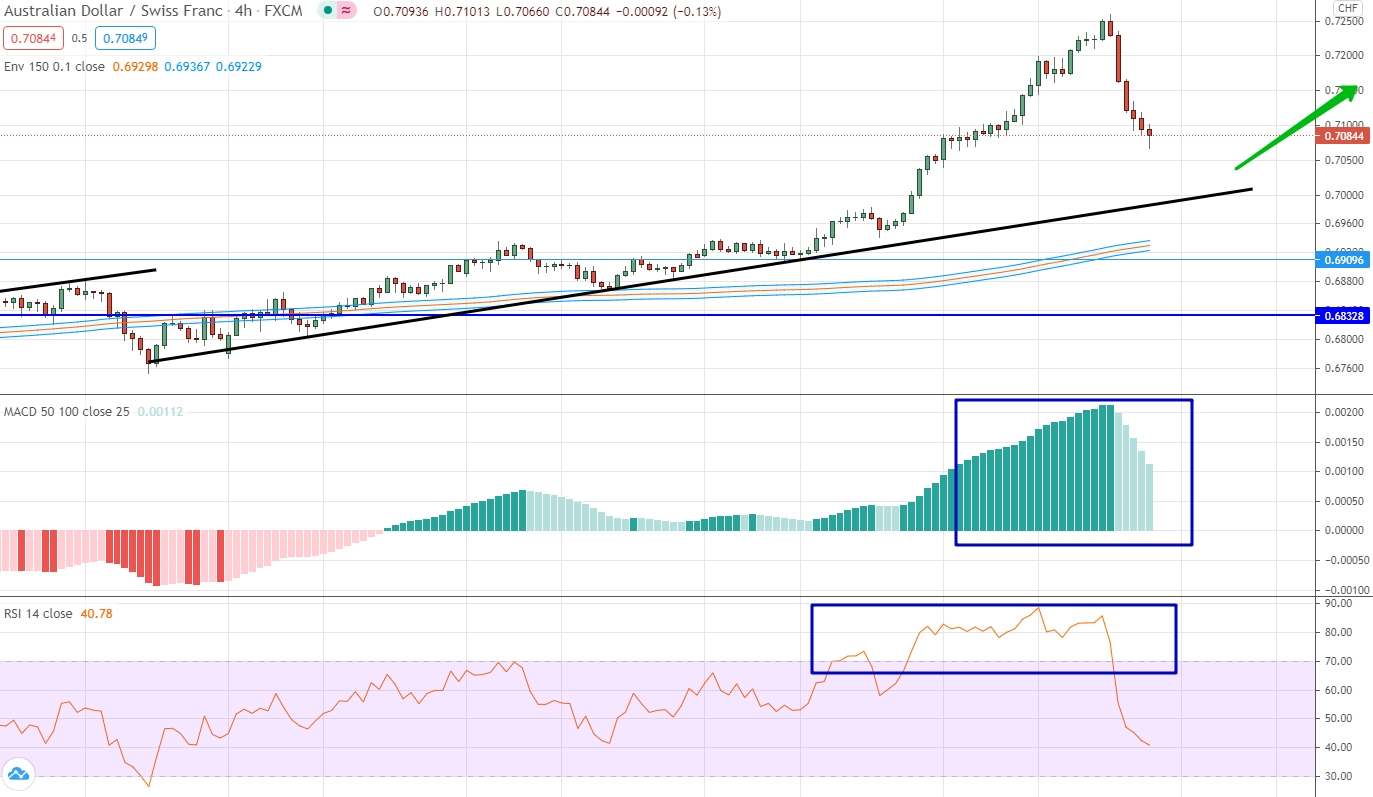

AUD/CHF

The Australian dollar continues to develop an upward movement against the Swiss franc, within which an uptrend is clearly visible. We pay attention to the indicators that have risen to very high rates for themselves, and this can be seen especially clearly in the oscillator, which has been in the overbought area for a very long time. Nevertheless, at the end of the week there was a downward market movement and the indicators actually normalized their position. Therefore, taking into account a combination of factors, we can expect that the upward dynamics have not lost their strength and after the correction the price will again lead to growth.

GBP/CAD

The British pound versus the Canadian dollar is one of the few currency pairs in this weekly survey for which there is no clear trend. Yes, formally we are talking about the presence of upward dynamics, but it is not obvious. Pay attention, for example, to the histogram, which mostly develops near the zero line. Nevertheless, it is very important to note that the last candlestick formed at the level of 1.7571 and this level coincides with the levels of the moving averages, while the oscillator was in the negative area for the first time in a very long time. Thus, we are waiting for a correction at the designated point, which means we can open an upward contract.

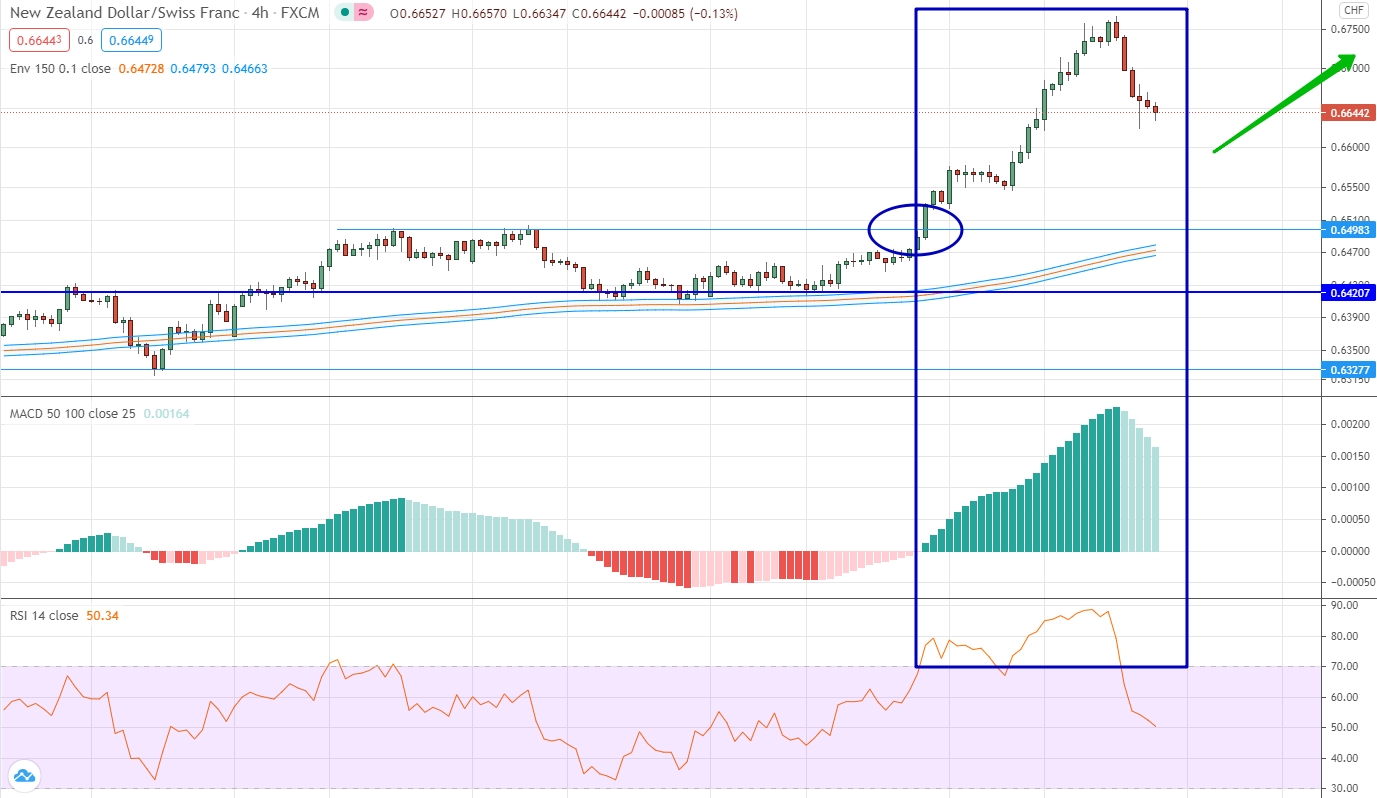

NZD/CHF

The past week has resulted in a strong upward movement of the New Zealand dollar against the Swiss franc. Thus, the range was broken upwards, and an upward movement occurred. Thus, what we talked about in the previous weekly review was fully justified. Now we are talking about the fact that the upward dynamics continues to form and after a slight correction the market should return to the growth stage. Therefore, you can open an upward contract, but only after the downward correction has been worked out.

USD/CNH

For the first time in a very long time, the value of the dollar against the Chinese yuan shows clear signs of consolidation above the moving averages. Please note that almost all trades in recent weeks have been developing in the area of the moving averages, but on Friday there was a fairly strong upward movement, after which several candles with long shadows in different directions were formed at once. These are the first signs of movement change. Thus, we can talk about the formation of an uptrend if the situation does not change during the next candles. If the market makes a strong downward movement and again falls below the level of the moving averages, then it will be possible to open a downtrend contract.