Forex Weekly Forecast & FX Analysis November 11 - 15

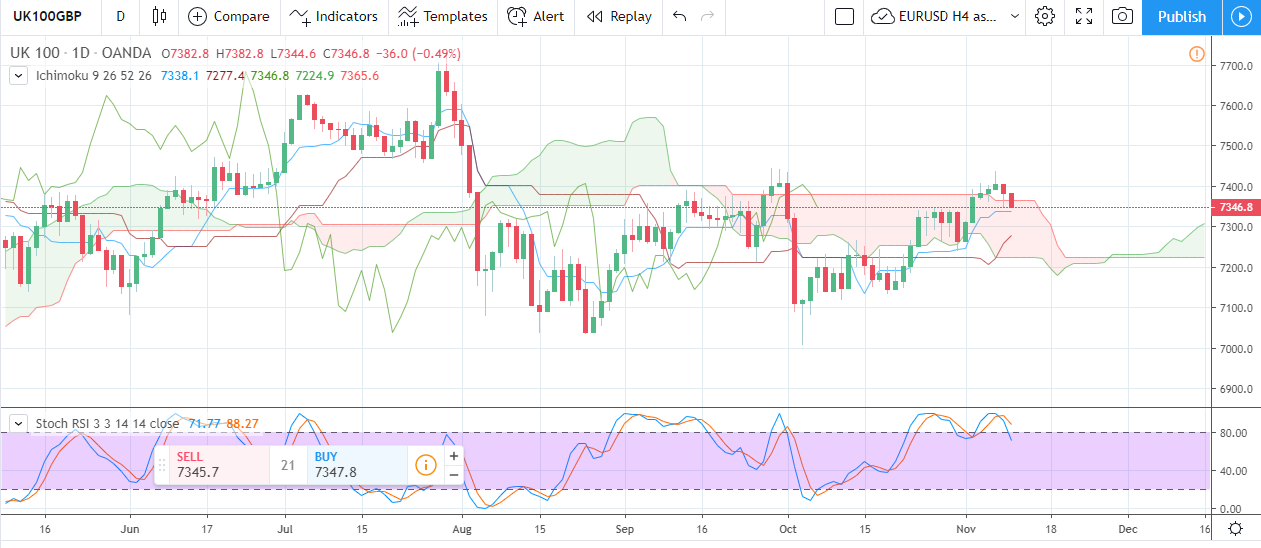

FTSE 100: Bullish

British stock index made a bullish breakthrough this past week. Although gains were limited and the benchmark erased some of them on Friday, the overall technical sentiment remained in favour of the bulls. Ichimoku Cloud trend indicator is bullish as the leading span has a positive surplus. The rate went off the cloud on Thursday but the price action on the London open suggests a bearish retracement as the index dropped back inside the cloud. The indicator points to a support range at 7338/7224 points with several crucial levels to monitor. First, the Ichimoku Conversion Line comes at 7338.1 points, and if it held the bears from further selling pressure, then another upswing would be noticed. Second, the Ichimoku Base Line is placed at 7277.4 points, but it is a rising support curve. Third, the bottom band of the cloud is coming at 7224.2 points. Stochastic RSI had a crossover in the overbought zone and both lines are headed south, pointing to a deeper bearish rebound. If the bears breached the second Ichimoku support curve, the technical analysis would raise a question about the sustainability of the recent uptrend with the last defensive barrier at the bottom band. Nevertheless, the buy-lows trading strategy looks attractive as the mid-term sentiment is still bullish.

DXY: Bullish

The U.S. dollar index measuring the greenback’s strength versus the volume-weighted basket of six major currencies changed the technical sentiment for the third time this Autumn. After charting a double-bottom formation on the daily chart below, the index reversed the price action and breached several technical resistance levels. One of the most important resistances, now support, comes together with 34-days exponential moving average slightly above 98.00 handles. A bearish retracement towards this support curve is possible at the beginning of this week, and it should be used for fresh long positions in case of a bullish bounce.MACD trend indicator turned bullish last Wednesday when lines performed the bullish crossover and headed north. The histogram also turned positive, printing growing bars, which underlines the bullish power. 13-days fast Relative Strength Index confirmed the buy-signal from MACD when the line crossed the 50% level from below. The bullish momentum is quite strong, so we expect further strengthening of the greenback in the upcoming week.

GBP/USD: Bullish

Although the British Pound failed to sustain gains above 1.2900 handle and slipped back to 1.2775 support, we still believe in Sterling’s ability to continue the uptrend. The Double-Bolli chart setup below shows that the bearish retracement is coming to an end as borders of the channel had narrowed the surplus, confirming that the bearish momentum is getting exhausted. What’s more, the daily exchange rate is hovering above the support line of the second Bollinger Band indicator with deviation 1 (yellow background on the chart below). Even though whipsaws towards the last support are possible, we’d rather open long positions than short GBP/USD. The overall formation looks like a flag pattern, which should point to a bullish continuation, according to the technical analysis. Resistance levels are as follows: 1.28588 (BB middle line), 1.29378 (BB upper line) and 1.30168 (BB top resistance). If the bulls managed to lift GBP/USD above the first threshold with daily close rates, then the overall formation would turn bullish as the price would appear in the upper channel. Traders should also monitor the spread between top and bottom borders of the Bollinger Band, if it widened, a buy-signal would occur.

USD/JPY: Bullish

The pair made a bullish breakthrough of strong psychological resistance at 109.00 yen per dollar this past week. The bulls were expecting for this event since the plunge on May 31. Although USD/JPY bounced back below 109.00 on Monday Asian trading session, the technical analysis still points to upside risk. Ichimoku Cloud trend indicator is bullish, the leading span is positive and both lines are placed above the cloud in the right order to proceed with the uptrend. The nearest support curve - Ichimoku’s Conversion Line - should be considered for additional longs in case if the bears failed to breach it with a daily close rate. Similar price action was noticed last Thursday when the pair bounced back up after testing the support line. Talking about possible targets, we should mention the level of 110.50, which held the rate from further appreciating on May 21. That was also the beginning of the three-months downtrend, so the bulls would eye that handle in terms of taking profits. On the other hand, if the bears were able to breach the support at 108.688, then the next barrier would come at around 108.073. Thus, stop-loss orders have to be hidden below the 108.00 round-figure marks.

USD/CHF: Bullish

The daily chart of USD/CHF reminds the same formation of the U.S. dollar index as the pair was always reflecting the greenback’s demand/supply relation rather than the Swiss Franc itself. What’s interesting, the bulls lifted the exchange rate back to the parity with a range of 40 pips to go at the time of writing. That should be the fifth attempt to reach the parity this autumn, while all previous attempts were followed by retracements of 150 pips approximately. If the bulls had enough power to break the threshold through, then we’d see an acceleration of the uptrend with 1.0200 targets in the market’s focus. Otherwise, another leg of bearish action is possible. Nevertheless, the overall formation looks like an asymmetric triangle, while the bullish momentum jumps every time USD/CHF is heading to the parity. A breakthrough trading strategy might be lucrative with buy-limit postponed orders above 1.0000.USD/CAD: Neutral

The Canadian dollar underperformed the rest of the commodity currencies as USD/CAD did not have such a sharp action as AUD/USD or NZD/USD. Two reasons for that have to be highlighted. First, the price of oil supported the Loonie, while the overall fundamental environment and risk appetite remained in favour of the currency. Second, the technical sentiment is mixed on the daily chart below.Although Parabolic SAR changed the outlook to bullish on October 30 and remained positive so far, several technical factors limit possible upside action. BullBearTrend indicator had a lagging buy-signal and the positive surplus is too low to proceed with the uptrend. What’s more, Average Directional Index points to a weak bullish momentum as the mainline is heading south and is nearing the threshold. Thus, USD/CAD is mostly driven by the overall demand for the greenback rather than supply for the Loonie. We’d stay away of the pair unless a strong intraday signal occurred.

NZD/USD: Bearish

The New Zealand dollar was the weakest currency among majors versus the U.S. dollar this past week. NZD/USD dropped -1.55% or 100 pips after failing to breach crucial technical resistance. Fibonacci Retracement levels of the downtrend started in mid-July and bottomed out in mid-September showed that the downtrend is renewed. The main concern was that the bulls failed to breach 61.8% Fibo resistance at 0.64519 last week. What’s more, the bearish plunge led to the weekly close rate below 78.6% Fibo support at 0.63675, which should lead to another test of the lowest weekly close rate this year. The sell-highs trading strategy is applicable for NZD/USD.