Forex Weekly Forecast & FX Analysis November 30 - December 04

EUR/CHF

The euro against the Swiss franc still cannot form a clear trend in either direction. In the previous review, we talked about the range level with the borders of 1.0787 and 1.0820. Last week we managed to achieve success in reaching the specified range. Therefore, everything that we talked about in the last weekly review continues to be relevant. It is not possible to trade a currency pair here and now. We are waiting in which direction the market will work out the channel, and in the direction of the breakdown it will be possible to open a contract.

NZD/USD

The New Zealand dollar continues to update its local maximum values against the US dollar, while the price continues its upward trend. It is typical that the market is at a local maximum for itself, but the same cannot be said about indicators that are increasingly striving for neutral indicators. It turns out an atypical divergence, as the market is growing and the indicators are mostly falling. Therefore, we can expect that this currency pair may need a correction, which means that we can consider trading options downward. However, we take into account that we are trading against the trend.

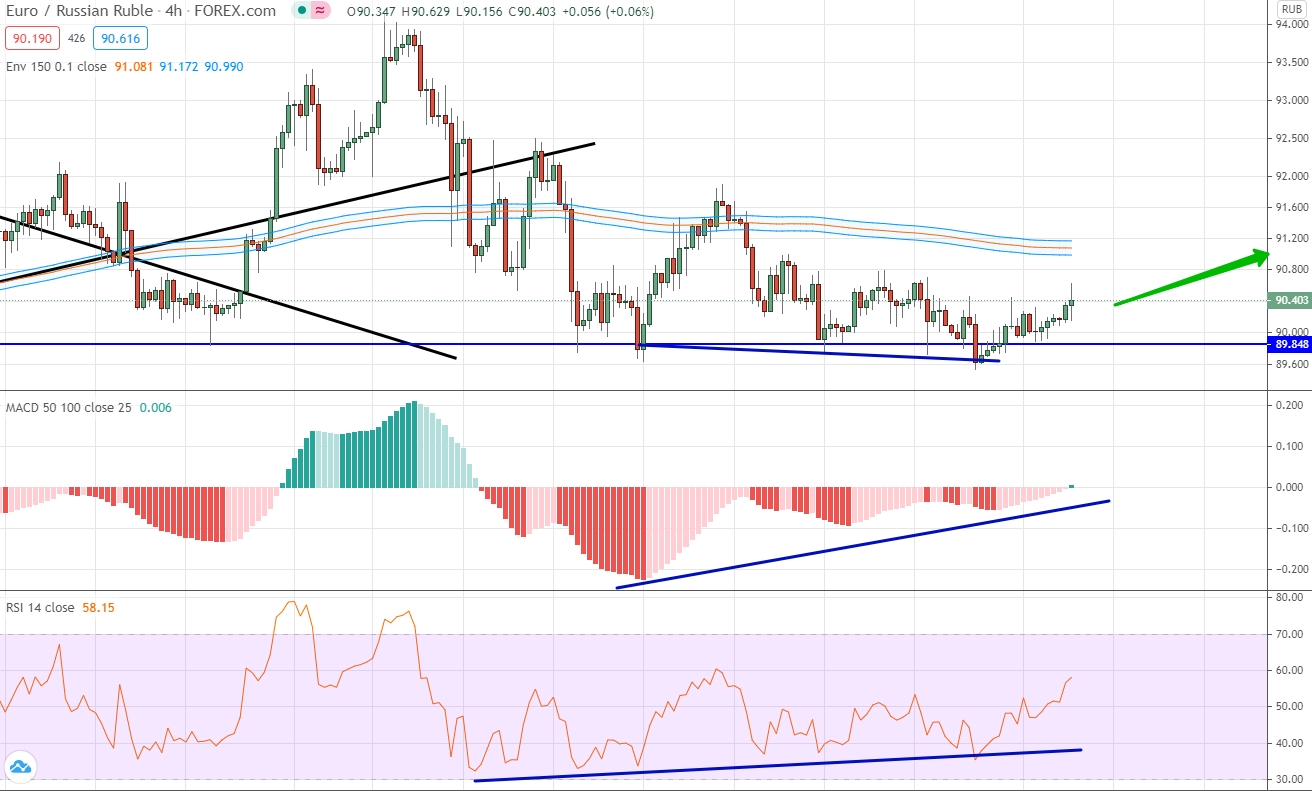

EUR/RUB

Divergence is also observed for the euro currency pair against the Russian ruble, since the price is mainly moving down, and the indicators look noticeably up. For the current market situation, it is important to note the significance of the level 89.84. The price is close to the indicated level, and taking into account the positions of the indicators, as well as the recently formed divergence, we can expect that the market will need an upward movement. You can open an upward contract with a target at the level of moving averages.

AUD/CHF

For this currency pair, the uptrend is still the main driving force, however, last week the upward trend has significantly slowed down and allows you to draw an additional trend line, with a much less obvious slope. Please note that despite the dominance of upward dynamics, the main indicators are close to zero values and do not speak of any trend. Theoretically, only the options for trading up can be considered, but taking into account the fact that we are already at the top of the market, we were late with this movement and the contract cannot be opened. Therefore, only options for trading down can be considered, but such a deal can be opened only when the price is below the trend line.

GBP/CAD

The British pound versus the Canadian dollar is one of the most difficult to predict currency pairs for the coming week, since neither graphical nor technical analysis provides specific recommendations for opening a trade. Here and now, we can only say that the main indicator is looking down, and the histogram is below zero for the first time in a long time. Theoretically, the downward movement of the charts can be opposed to the upward movement on the chart, which means that we can consider options for trading down, taking into account a combination of factors.

NZD/CHF

This currency pair is still forming an upward trend and last week the price managed to gain a foothold above the strong level of 0.6327. Indicators are close to neutral. This applies primarily to the histogram. If we look at the oscillator, it also demonstrates the absence of volatility, but for several months it has been building exclusively in the area above zero, confirming the upward trend. Therefore, we can only consider trading options in the direction of the main trend, which means an increase. A downtrend contract can only be opened when the price is below the trend line.

USD/CNH

The main development in the price of the US dollar against the Chinese yuan occurs near the level of 6.5473. At the same time, the indicators look up, and the price cannot significantly move away from the specified level. Therefore, we can only rely on the indicators of indicators that look up, and which allow us to consider options for upward trading. This trade is acceptable because the price has moved away from the moving averages, and the levels themselves gradually change their slope to horizontal.