Forex Weekly Forecast & FX Analysis September 14-18

EUR/CHF

This week we are returning to the side corridor, which we have been talking about for over a month. An upward trend and an attempt to gain a foothold above the designated corridor did not lead to success. As a result, both the price chart and all major indicators look down. Moreover, taking into account the slope of the indicators and the current market position, we can expect a slight downward movement from the price. Globally, we expect a new attempt by the market to consolidate above the 1.0800 level.

NZD/USD

The New Zealand dollar against the US dollar demonstrates an area with a fairly high volatility and a distinct upward trend. Particular attention should be paid to the last top that was formed on the price chart. This is a local minimum that coincides with the trend line and the level of the moving averages. If you look at the indicators, at the same point they showed their local minimums. The oscillator does not allow this situation to be interpreted somehow, while the histogram, on the contrary, indicates a fall for the current price stage. Therefore, we can expect an upward movement, but the trend line and the level of 0, 6717 form a triangle. You cannot trade while the price is inside. In the future, you can trade in the direction of the exit from the triangle.

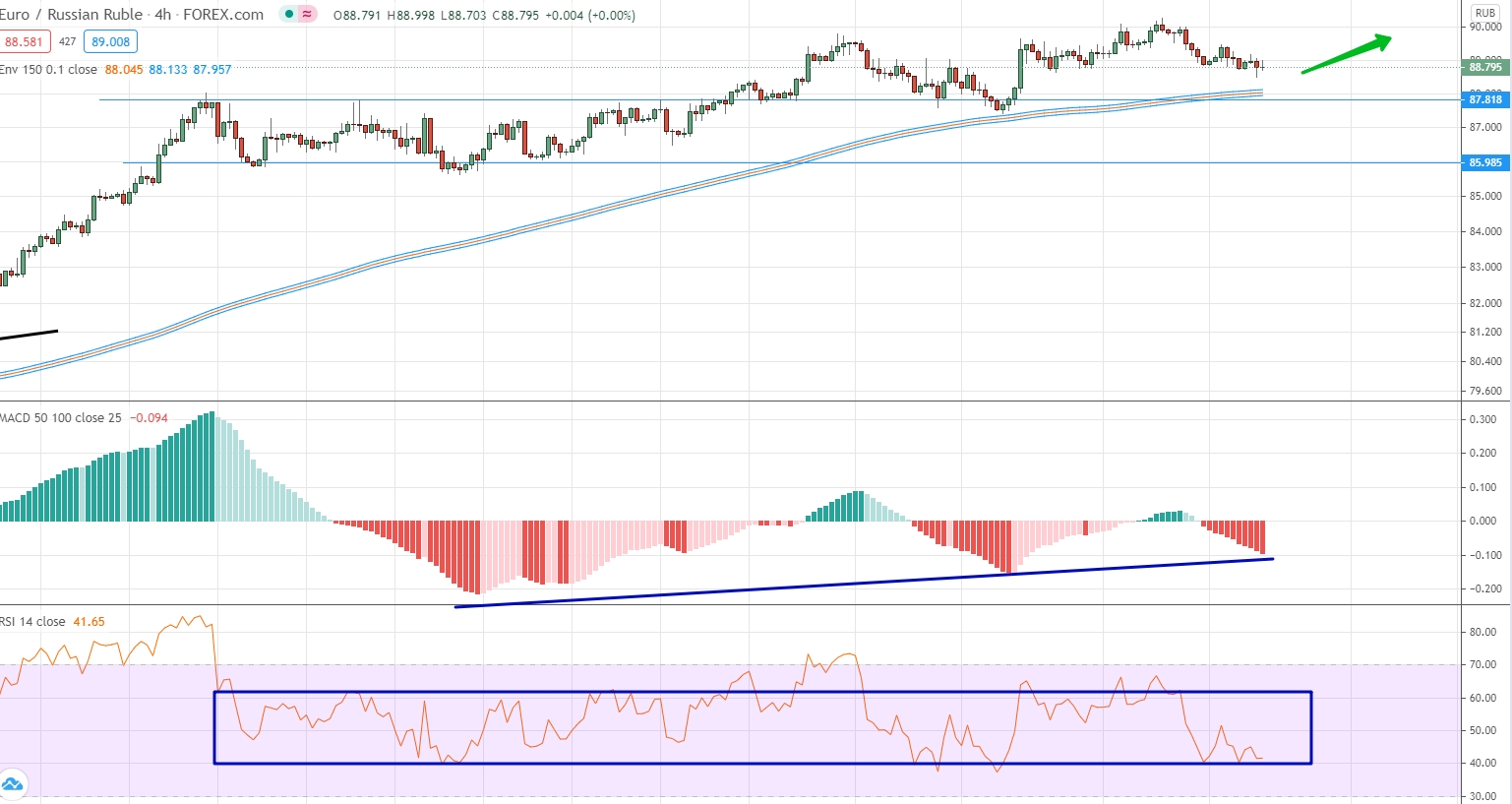

EUR/RUB

The euro against the dollar is still developing globally in an uptrend, locally we are dealing with a slight sideways correction. An uptrend can be traced both on the price chart and on indicators, primarily on the histogram. At the same time, if you look at the indicators, they are close to neutral values and do not show any tendency towards a trend. Nevertheless, given that the price is still above the level of the moving averages, but has approached this level as close as possible, an upward movement can be expected.

AUD/CHF

For this currency pair, after stages of very significant growth, a correction stage has begun, within which the price and all indicators look down. As a result, a downtrend line is formed, and the movement is framed from below by the 0.6585 level and moving averages. On the one hand, it is impossible to talk about specific signals for trading, but on the other hand, the last few candles give food for thought. The candles themselves are growing, and they do it quite confidently, and if you look at the histogram, it continues to fall and renew its lows. This is atypical, but still divergence. Therefore, we can say that there is an option to trade for a fall.

GBP/CAD

The past week has resulted in a rather strong fall of the British pound against the Canadian dollar. As a result of this fall, the price and the histogram were at a minimum of more than 3 months. If you look at the scintillators, they have been in the oversold area for a very long time. Therefore, we are talking about the fact that the current section of the market is definitely descending and you can trade only for a fall. On the other hand, there is a level of 1.6786 in the direction of movement. The level is strong enough and having approached it the price slowed down its fall. Therefore, we can expect that there will be a correction from this level. This collection is a short trade limited from the top by a trend line.

NZD/CHF

The current segment of the market for this currency pair is characterized by the presence of a local downtrend. This trend is confirmed by all indicators, but the histogram gives the basic idea for work. It is at a local minimum, which turned out to be critical last time, after which an upward reversal occurred. It is only on this basis that we can say that there is an option to consider upward trading as a priority, but an upward trade can be opened only when the price consolidates above the trend line. In this case, it will be possible to trade to the level of 0.6150.

USD/CNH

The dollar continues to fall against the Chinese yuan, however, for the first time in a long time, there are real preconditions for a trend change. To be more correct, the current section of the market is the place where either a reversal will occur or the downtrend will intensify. A similar situation is very well traced in the histogram, which for the first time in a long time fixed in the area above zero and reached a maximum. Around the same time, the oscillator turned out to be in the area of 60. If two trend lines are drawn on the price chart, they form a triangle or wedge between them. You cannot trade as long as the price is within the given chart pattern. As soon as an exit occurs, you can trade in its direction.