5 Day Trading Strategy

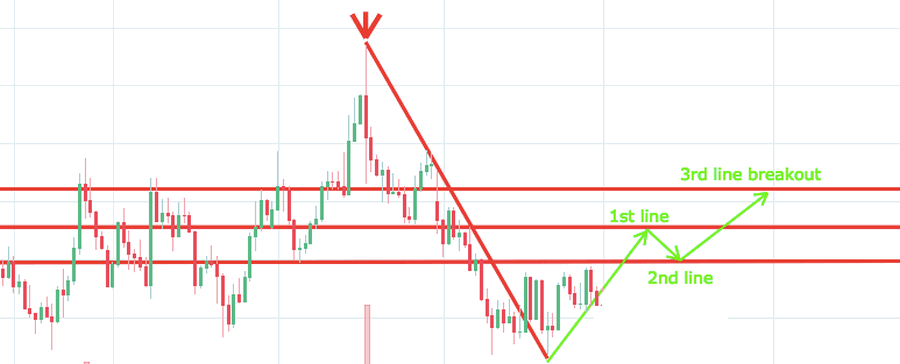

Breakout strategies focus on when the price exceeds a certain level on your chart with increased volume. The breakout trader goes into a long position after the asset or security exceeds the resistance. Alternatively, you can enter a short position as soon as the stock falls below the support.

Once an asset or security has traded beyond the price limit you enter, volatility usually increases and prices often tend to move towards the breakout.

You must find the right instrument to trade. When doing so, take into account the support and resistance values of the asset. The more often the price has reached these points, the more valid and important they become.

Entry Points

This part is nice and uncomplicated. Prices that are near and above the resistance levels require a bearish position. Prices that are set to close and go below a support level require a bullish position.

Plan your exit

Use the current performance of the asset to set an appropriate price target. Using chart patterns makes this process even more accurate. You can calculate the average current price fluctuations to create a target. If the average price fluctuation was 3 points above the last several price fluctuations, this would be a reasonable target. Once you have reached this target, you can stop trading and enjoy the profit.

Popular Breakout Trading Strategy

Scalping

One of the most popular strategies is scalping. It is particularly popular in the forex market, and it seems to benefit from tiny price changes. The driving force is quantity. You will try to sell as soon as the trade becomes profitable. This is a fast and exciting way to trade, but it can be risky. You need a high trading probability to balance the low risk/reward ratio.

Be on the lookout for volatile instruments, attractive liquidity and timely. You can't wait for the market, you need to close the lost trades as soon as possible.

Popular scalping trading strategy

Momentum

This strategy, which is popular among beginner trading strategies, focuses on trading on news sources and identifying major trend movements with high volume support. There is always at least one stock that moves 20-30% every day, so there are plenty of opportunities. You simply hold your position until you see signs of reversal and then exit.

Alternatively, you can also hide the price decline. This way, your price target is bypassed as soon as the volume decreases.

This strategy is simple and effective when used correctly. However, you need to make sure that you are aware of upcoming news and profit announcements. Just a few seconds of each trade will make the difference to your daily profits.

Momentum Day Trading Strategies on the Chart

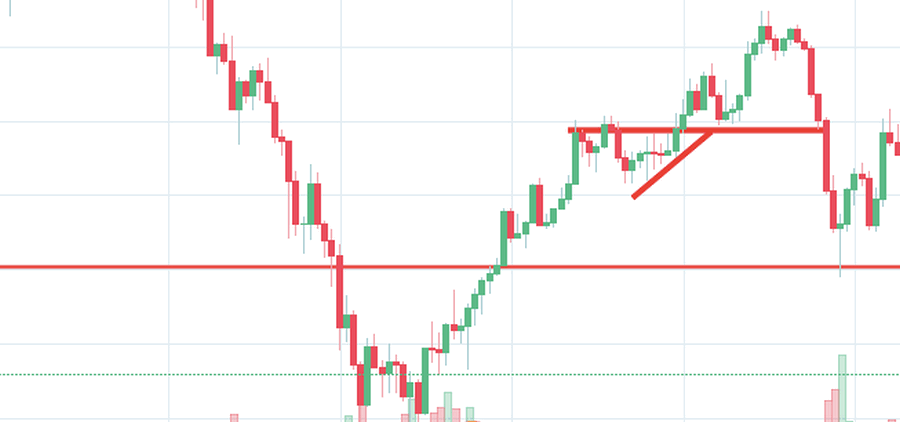

Reversal

Although hotly debated and potentially dangerous if used by beginners, reverse trading is used worldwide. It is also known as trend trading, pull-back trending and an average reverse strategy.

This strategy defies basic logic because you want to trade against the trend. You must be able to accurately identify potential setbacks and predict their strength. To do this effectively, you need in-depth market knowledge and experience.

The "Daily Pivot" strategy is considered a unique case of reverse trading, as it focuses on buying and selling the daily low and high pullbacks or reverses.

Reverse Trading on the Chart

How to Use Pivot Points

A day trading pivot point strategy can be fantastic for identifying and responding to critical support and/or resistance levels. It is especially useful in the forex market. In addition, it can be used by rangebound traders to identify entry points, while trend and breakout traders can use Pivot Points to locate key levels that need to be broken through for a movement to count as a breakout.

Calculating Pivot Points

A pivot point is defined as a point of rotation. To calculate the pivot point, you use the prices of the previous day's high and low, and the closing price of a security.Note that if you calculate a pivot point from price information from a relatively short time frame, the accuracy is often limited.

So how do you calculate a pivot point?

- Central pivot point (P) = (high + low + close) / 3

You can then use the pivot point to calculate support and resistance values. You must use the following formulas to do this:

- First resistance (R1) = (2*P) - Low

- First support (S1) = (2*P) - High

The second level of support and resistance is then calculated as follows

- Second resistance (R2) = P + (R1-S1)

- econd support (S2) = P - (R1- S1)

How to Use 5 Day Strategy

If you apply it to the forex market, for example, you will find that the trading range for the session is often between the pivot point and the first support and resistance levels. This is because a large number of traders play this range.

It is also worth noting that this is one of the systems and methods that can also be applied to indices. For example, it can help to develop an effective S&P day trading strategy.

Limit Your Losses

This is particularly important if you use a margin. Requirements that are usually high for day traders. When you trade on margin, you are increasingly vulnerable to large price movements. Yes, this means the potential for higher profits, but also the possibility of significant losses. Fortunately, you can use stop losses.

Stop Losses control your risk to you. In a short position you can place a stop loss above a current high, and in a long position you can place it below a current low. You can also make it dependent on volatility.

For example, a stock price moves £0.05 per minute, so you place a stop loss £0.15 away from your entry order so that it can swing (hopefully in the expected direction).

A popular strategy is to place two stop losses. First you place a physical stop loss order at a specific price level. This will be the most capital you can afford to lose. Second, you create a mental stop loss. Place these in the place where your entry criteria were violated. So if the trade takes an unexpected turn, you will find a quick exit.