How To Trade The Bollinger Band Squeeze

- What are The Bollinger Bands?

- How to Use Bollinger Bands?

- How to Analyze the Bollinger Bands Charts?

- Bollinger Band Formula

- Most Convenient Charts to Display Bollinger Bands

- Calculation of Bollinger Bands

- Bollinger Band Strategies

- Forex Scalping System – Trading with BB Indicators

- Requirements of the Forex Scalping System

- Default Setting of BB for Forex Scalping System

In this post, we present a thorough explanation of Bollinger Bands, which are highly beneficial for all professional traders. Hopefully, you will get answers to your questions once you go through the entire article.

Moreover, in this article, you will get to know the best Bollinger Bands strategies that every trader worth their salt must know. Once we’re through with the basics, we also have some advanced knowledge and strategies of Bollinger Bands. Let’s get started!

What are The Bollinger Bands?

Bollinger Bands are one the best technical analysis tools that are defined by a set of lines plotted 2 deviations (positively and negatively) away from the SMA (Simple Moving Average) of the security’s price. Still, their bands or envelope can be adjusted as per user preference. The standard deviation depicts where a band of support or resistance level may lie. Bollinger Bands are the best usage of the volatility channel concept.

There is nothing wrong with the saying that Bollinger Bands are used to find out the volatility of the market and provide loads of useful information.

For instance:

- Reversal or continuation of the trend;

- Consolidation of market periods;

- Duration of upcoming large volatility breakouts;

- Market tops, bottoms, and possible price targets.

“Summary”

Bollinger Bands are a technical analysis tool that has been created by the famous trader John Bollinger.

Three lines together compose the famous Bollinger Bands:

- Upper band;

- Middle band (SMA);

- Lower band.

The upper and lower bands are 2 standard deviations from 20-day SMA, but these can be modified.

How to Use Bollinger Bands?

Bollinger Bands are entirely based on the 20-days SMA. This period of 20 days actually forms the basis of the Bollinger Outer Bands, i.e., the upper and lower band. And as mentioned in the definition, these bands are derived from 2 standard deviations.

The generic setting for the Bollinger Bands is 2%, which means the outer bands show a 2% deviation from the 20 days SMA line. However, prices sometimes tend to deviate more than 2%.

However, Bollinger Bands are capable of adjusting to this new deviation. The 20, 2 Bollinger Band setting is normally used by traders, and they tend to experiment with these values.

Don’t fool yourself by expecting the same level of deviation between forex and currency or between gold and oil. Let’s have a look at an example of Bollinger Bands indicators that have been applied to forex.

The default settings of Bollinger Bands are:

- 20-day SMA;

- 2 applied on the daily timeframe.

As you can see, when the price is either bearish or bullish, the bands tend to expand. Whereas, when the price moves in the range, the outer Bollinger bands contract. When looking at the 20-day SMA, you can easily see that it is signaling the uptrend of the stock price.

From the combined information, you can say that the ideal point to enter the market is when the price breaks out of the range. With the increment in market volatility, traders will be able to find out much better entry points.

How to Analyze the Bollinger Bands Charts?

The screenshot below clearly depicts the information that traders can easily get from the chart by using Bollinger Bands. There, you can see the points from 1 to 5. Let’s go through each point one by one.

Point 1 – depicts clearly the strong downward trend of the price. You can see that the price lies close to the outer band all the time. This is what we call the bearish signals.

Point 2 – shows that the price fails to reach the outer band and suddenly starts shooting up. This kind of signal is known as the fading momentum.

Point 3 – shows the swings: the first swing of the trend tries to reach the high outer band, but as you can see, it is followed by 2 failed tries. A bearish signal.

Point 4 – similar to Point 1, where the prince falls down and stays close to the low outer band. A bearish signal.

Point 5 – depicts the consolidation of the price not reaching the low outer band anymore. Here, it rejects the pin bar and ends the downtrend.

Thus, we can say that Bollinger Bands alone can easily provide useful information about forex trends. Traders usually experiment with Bollinger Bands to find out the right trends between the bull and bear markets.

Bollinger Band Formula

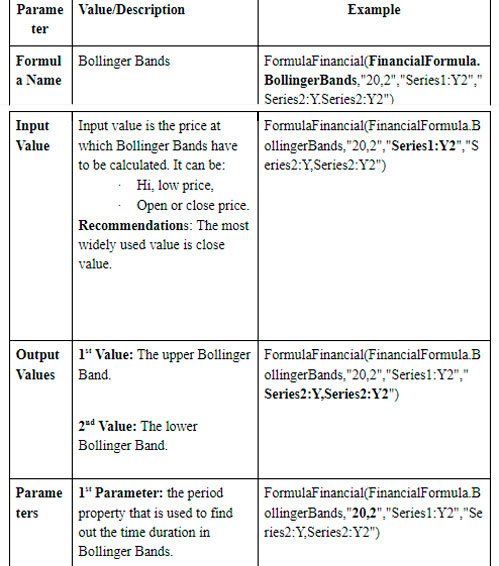

Bollinger Band Formula is calculated by using the method of FormulaFinancial that accepts the arguments like:

- Formula name;

- Input values;

- Output values;

- Parameters.

Before applying this method, you must ensure that you have all the data points having their X-value property set, and their series X-value indexed property is set to false.

Here’s a table that enlists the use of the FormulaFinancial method to calculate Bollinger Bands. Here, we’ve also mentioned a bit of information about these parameters to enrich the understanding of Bollinger Band Formula.

Most Convenient Charts to Display Bollinger Bands

The Range Chart is considered one of the most convenient charts used to display Bollinger Bands. It is completely independent of the time metric compared to other conventional charts and candlesticks.

Calculation of Bollinger Bands

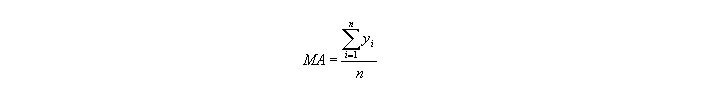

The first step of calculating Bollinger Bands is to find out SMA (Simple Moving Average). The formula for finding SMA is shown below.

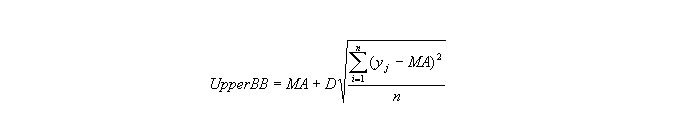

After finding the SMA, the next step is to find out the Upper and Lower Bollinger Bands. Upper Bollinger Band can be determined by adding SMA to a specified number of standard deviation from SMA. The formula used to find out the Upper Bollinger Band is given below.

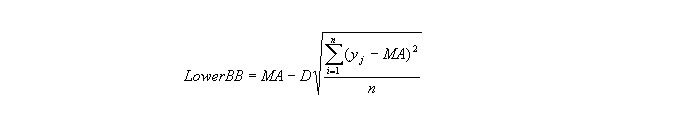

The Lower Bollinger Band can be determined by subtracting a specified number of Standard deviation from SMA. The formula used to find out the Lower Bollinger Band is shown below.

In both of the above formulas, you can see “D”. D here represents the number of standard deviations that have been applied to the Bollinger Bands.

Bollinger Band Strategies

Most traders are well familiar with the technical analysis patterns of Bollinger Bands like:

- Double tops;

- Double bottoms;

- Ascending triangles;

- Symmetrical triangles.

But today, we are going to showcase some of the best Bollinger Bands strategies. Once you go through all of them, you should zero in on the one that suits your most and will work best for you as per your own trading style.

Strategy 1 – Double Bottoms

Most traders are well familiar with the technical analysis patterns of Bollinger Bands like:

- Double tops;

- Double bottoms;

- Ascending triangles;

- Symmetrical triangles;

- Others.

But today, we are going to showcase some of the best Bollinger Bands strategies. Once you go through all of them, you should zero in on the one that suits your most and will work best for you as per your own trading style.

Strategy 1 – Double Bottoms

One of the best Bollinger Bands strategies is involving the setup of a double bottom. According to John himself, Bollinger Bands can be used in the identification of different price patterns such as “M Tops,” “W Bottoms,” and “Momentum Shift.”

In the Double Bottoms strategy, the primary bottom, in general, has significant volume and a sharp pullback of the price that usually closes outside of the lower Bollinger Band. These kinds of movements normally lead to the "Automatic Rally.” Here, the peak price of the rally serves as 1st-level resistance.

Once the automatic rally begins, the price attempts to retest the recent lowest price of the stock that has been set. Thus, it will challenge the force of purchasing that usually jumps in at the double bottoms. The screenshot shown below is an example of a double bottom strategy that generates the automatic rally.

Strategy 2 – Reversals

Here comes another simple and effective Bollinger Bands strategy called the Reversals. In this strategy, the stock volume starts fading when it begins to appear outside the bands.

Let’s move a step ahead by applying the candlestick analysis to this strategy.

For instance, rather than having stock shorting as the upper gap goes up through the upper Bollinger Band limit, you need to wait and try to predict the overall behavior of the stock.

If you find the lower gap going up and closing somewhere at the lower limit of the Bollinger Bands, but it still lies outside the band, then it is definitely a good indicator.

Let’s have a look at the chart below. You can see clearly that the candlesticks are looking terrible, but the stock rolled up quickly and took an almost 2% dive in just 30 minutes.

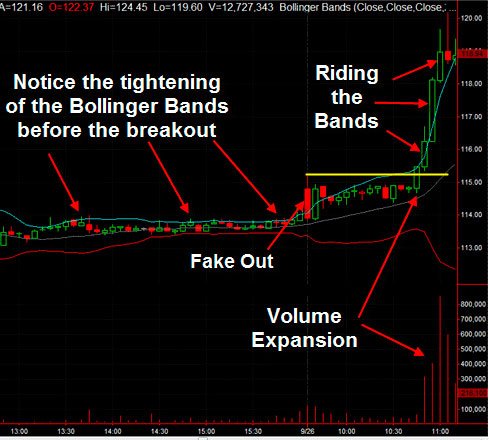

Strategy 3 – Riding the Bands

One of the biggest mistakes most Bollinger Bands professionals make is that they sell the stock when the price reaches the peaks of the upper band or buy when it touches the lowest part of the lower band. According to Bollinger himself, touching the upper or lower band doesn’t mean a sell or buy signal. Let’s have a closer look at the image below and try to check out the tightening of the BB (Bollinger Bands) just before the trend breakout. That’s why Bollinger said that price penetration can’t alone decide whether to buy or sell the stock.

Notice how the volume exploded at the trend breakout, and then the price began to trend outside of the bands. Such kinds of setups could be profitable if you allow them to fly.

Strategy 4 – Bollinger Band Squeeze

Here is another Bollinger Bands trading strategy in which traders have to gauge the initiation of the next upcoming squeeze. Bollinger Band width is an indicator created by John himself, and it’s super easy to calculate it.

First of all, you need to subtract the lower Bollinger Band value from the upper Bollinger Band value and then divide it by the middle Bollinger Band value.

The formula of Bollinger Band Width = (Upper BB – Lower BB)/Middle BB (SMA)

The main idea behind the usage of charts is that when you see the indicator reaching its lower level in 6 months, start expecting great volatility. This again starts off the tightening of Bollinger Bands, as we have mentioned before in Strategy 3. This squeezing action of BB actually indicates an upcoming great move. With this squeezing, you can use other indicators like the expansion of stock volume and more. These indicators combined can add up as evidence of a great Bollinger Band Squeeze.

It is the time to find out how we can use the BB Squeeze to get maximum advantage. Here, we have depicted a chart of 5 minutes.

At that moment, some professional traders may think about shorting the stock at the time of stock opening, assuming that the energy developed during the tightness of the bands can lead the market stock much lower. Alternatively, you can wait to confirm this belief.

So, what do you think? What could be the best ways to handle such a type of setups?

Here are some of them:

- Wait for the time the candlestick comes back inside the BB;

- You must ensure that some of the bars actually couldn’t break the low of the first bar;

- Stock shorting on the break of low by the first candlestick.

Strategy 5 – Trade Inside the BB

Trading Inside the BB is a favorite strategy of many traders. Most traders make money from the market by minimizing the risk. The lesser the risk, the higher the potential of gaining. Surely, you can make a great amount of money by playing big, but such type of traders don’t stay in the game for long.

In this strategy, first of all, you have to find any stock that is stuck in the trading range. The bigger the range, the better it is for you.

As seen on the chart, you should buy the stock at the time when it reaches the lower end of the range or is at the lower band. On the other hand, sell the stock when it reaches the higher range or upper band. The key feature of this trading strategy is that the stock must have a clear and defined range of trading. In this strategy, you are not trading blindly between the BB but using a gauge when the market stock has gone beyond.

Where do we need Bollinger Bands to execute this type of trading strategy? By using BB, you can verify that the security is in the low volatility phase simply by having a look at the bands.

“Bollinger Bands can help you verify that stock is stuck in a defined range.”

So, by using the Trade Inside the Bands strategy, you can play in the range and profit on each swing instead of trying to win big.

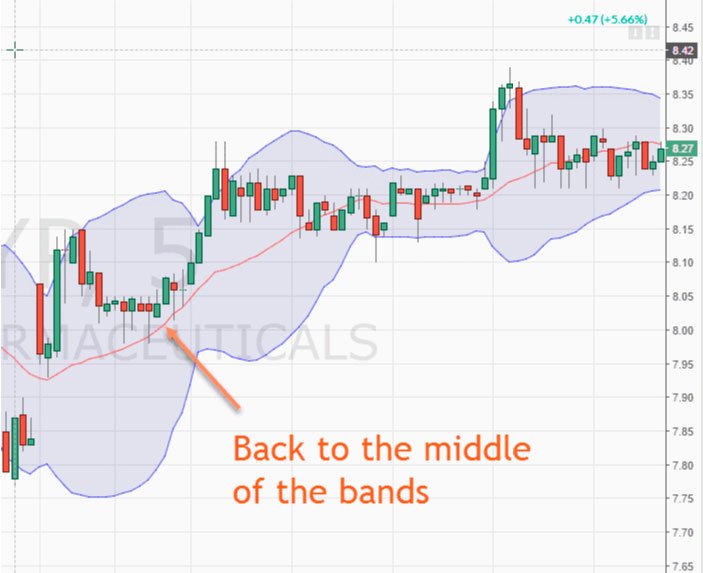

Strategy 6 – Snap Back to the Middle of the Bands

Snap Back to the Middle of the Bands is the best strategy for those who like to ask about the market very often. They usually wait for the market to get back to the middle line and bounce off the upper or lower Bollinger bands.

The most interesting fact about this strategy is that with time, you will definitely get a high winning percentage.

By asking about the market more often, you can safely pull money out of the market on reasonable grounds and lower the risk of potential losses that most beginners experience when forex trading. Always think about the mitigation of risk.

The key element of this type of strategy is to wait for the middle band before it enters the right position. You can easily increase your rate of having winning trades if you go in the direction of trade and there is a sizeable amount of volatility available in the market.

It can be clearly seen in the chart how the stock experienced a sharp up only to get back to the middle BB. You definitely want to enter the market just after the failed attempt to break the trend of the downside. You can purchase at the lower end and sell at the position of the upper band. If you still think that you can take the risk, then start riding the bands to get maximum profit.

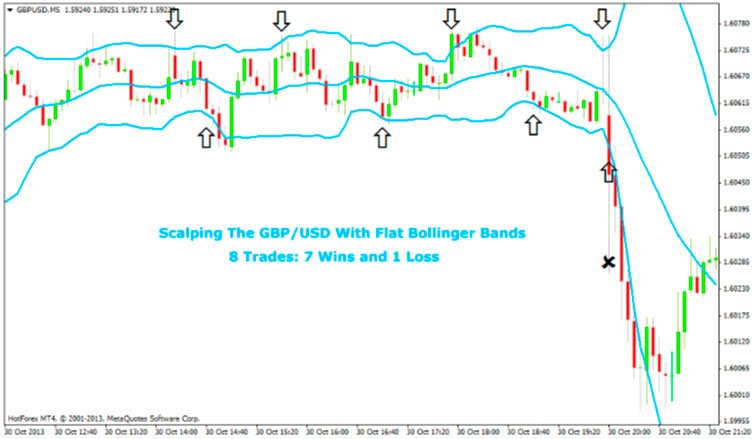

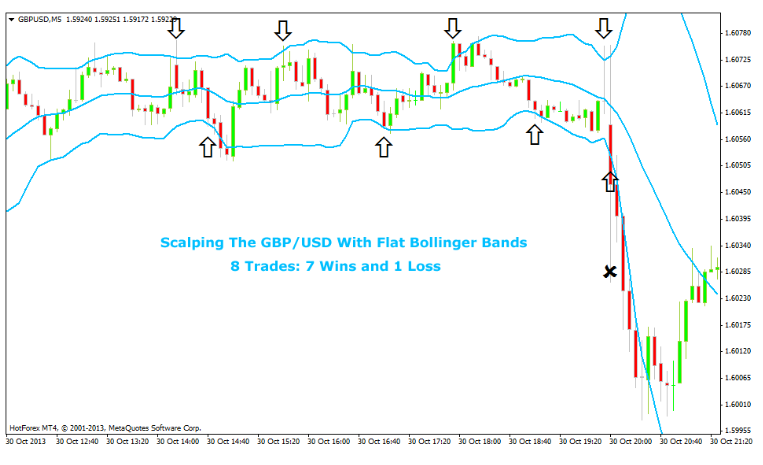

Forex Scalping System – Trading with BB Indicators

If you are looking for a BB indicator for scalping, then you will fall in love with this strategy. If you like to be in a range-bound market, then this forex trading scalping system is the best for you to carry on the trading. It is commonly known as the 5 Minutes Forex Scalping Strategy.

Requirements of the Forex Scalping System

Default Setting of BB for Forex Scalping System

The default setting of Bollinger Band Formula consists of:

- An N period Simple Moving Average (SMA).

- The default value is a 20-day period.

- An upper Bollinger band at K times and an N period of standard deviation above the SMA.

- A lower Bollinger band at K times and an N period of standard deviation below the SMA.

- The default value of K for the upper and lower Bollinger band is 2.

Example of 5 Min Forex Scalping System

Rules of Buying

- BB must be flat or almost flat. You will observe this when the market is in the trading range;

- Check if the stock price went down and touches the lower BB;

- Always set the stop loss 10 pips below the entry price;

- Always take the profit when the stock price reaches the upper BB.

Rules of Selling

- BB must be flat or almost flat;

- Check if the stock price goes up and it touches the upper BB;

- If it touches the upper BB, open the sell position;

- Always set the stop loss 10 pips above the entry price;

- Always take the profit when the stock price reaches the lower BB.