Harmonic Patterns Trading Strategy Explained

Harmonic patterns are used in Forex and other markets to identify geometric patterns that can be found again and again in markets and even in nature. Here, we discuss several harmonic patterns and how they are identified and used to predict future price. You can use this article as a harmonic patterns cheat sheet to aid you in your trading of harmonic patterns.

Harmonic Trading Patterns

Harmonic trading patterns are composed of turning points that define the shape of the geometric pattern. The way we identify certain harmonic chart patterns is with Fibonacci numbers. You may be familiar with these as they are often used in markets to define pivot points. The mathematical significance of the Fibonacci numbers also extends to patterns themselves. After the first leg of a potential harmonic pattern, the subsequent legs of the pattern are measured by their length in relation to the first leg. Harmonic patterns give us a way of predicting when price reversals will happen and to be able to predict the magnitude of a price move.

With harmonic patterns Forex can feel like magic. But they really are simply cycles that are identifiable in all markets that, when properly understood, offer great opportunities for successful trading.

Market Harmonics

Based on common geometric patterns that have been identified, we have a statistical advantage whereby we know with a high degree of probability where the price is likely to go. These patterns are never perfect in live trading, but we can identify their basic form within certain intervals, defined by the Fibonacci numbers. Harmonics is the term used to describe the identification of these rhythmic patterns in the market and using them for a trading advantage. Bear in mind that these patterns do not always work to perfection, just like any other strategy. But they do provide us a significant advantage, which is enough to be able to trade profitably with them. Identifying these patterns is not an exact science. As very few real-world markets present perfect patterns that match the theoretical ideals, some flexibility is required to qualify patterns as matching these forms.

These harmonic patterns are structured according to Fibonacci calculations. These Fibonacci retracements and projections are used to quantify the depth of price movements in relation to other nearby swings in the price action. They identify zones where the structure of these harmonic chart patterns form turning points in the price action of a given market. These patterns do not only apply to the Forex market but other markets like the stock and commodities markets as well. These turning points where the price tends to turn were identified by Scott Carney and called PRZs—Potential Reversal Zones.

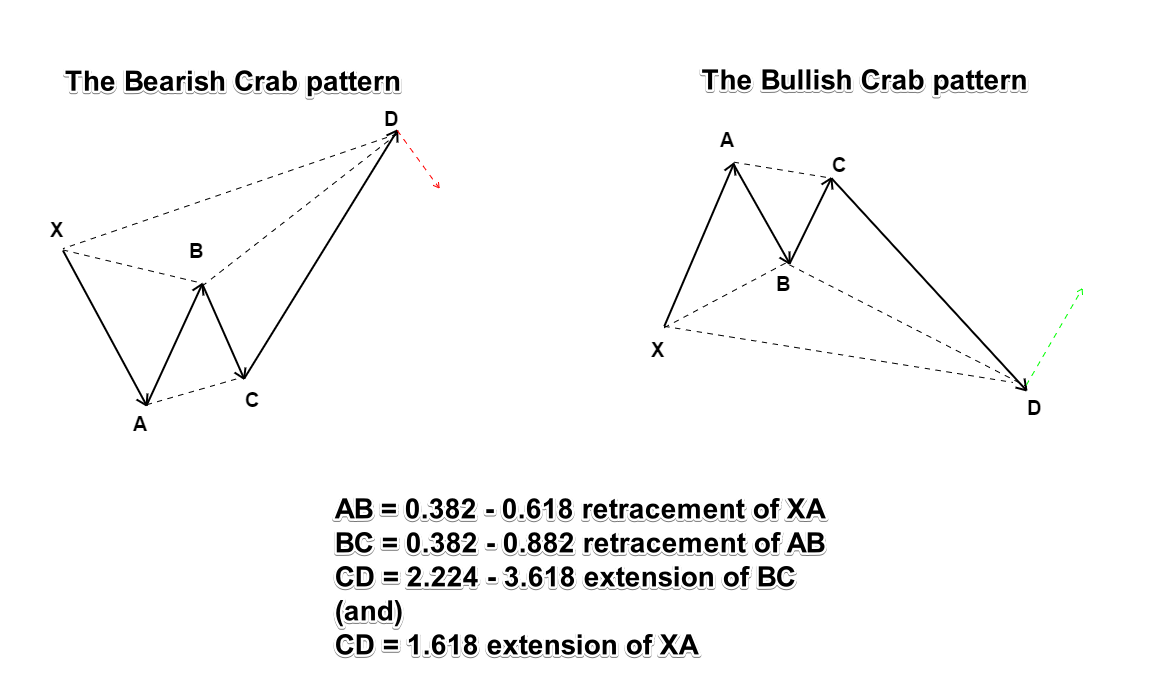

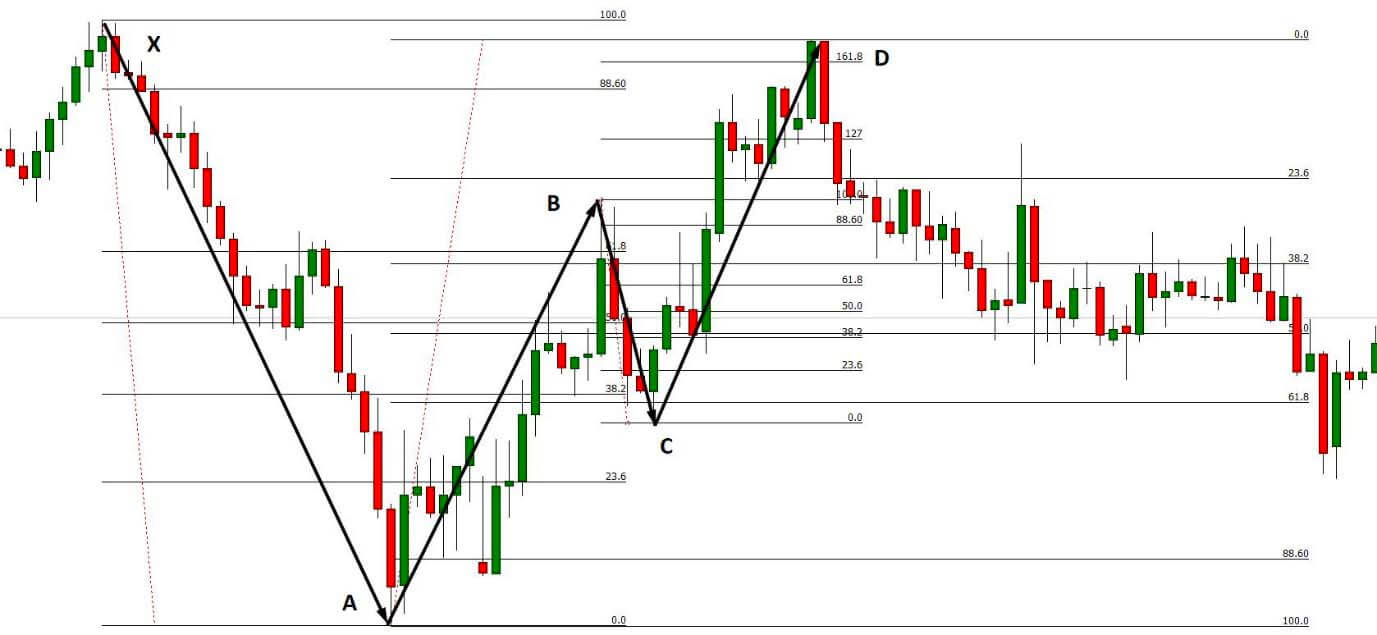

Deep Crab Harmonic Pattern

The Deep Crab pattern is a special case of the Crab pattern, in which the point B swings deeper

- XA is the initial leg of the pattern;

- The AB move should lie between a 38.2% and 61.8% retracement of the XA leg;

- The BC leg should be an 88.2% retracement of the AB leg;

- The CD leg should be between a 261.8% and 361.8% extension of the BC leg and a 161.8% extension of the XA move.

The trade should be entered once the CD leg has formed and a reversal of it has been confirmed. A stop loss should be set below point D for the bullish pattern and above D for the bearish pattern. Take profits can be set at point A for the more conservative trader or point B for the more aggressive.

Cypher Harmonic Pattern

The Cypher pattern is a four-leg reversal pattern.

The points that define the Cypher harmonic pattern are typically labeled X, A, B, C, and D

- XA is the first leg of the pattern;

- The AB move must be a retracement of the XA leg of between 38.2% and 61.8%;

- The BC leg must be an extension of the XA move between 127.2% and 141.4%;

- The CD move should be a 78.6% retracement of the XC leg.

Once the CD leg has reached the 78.6% Fibonacci level of the XC swing, you can enter a trade. This will be a buy when encountering a bullish Cypher pattern, indicated by a rising XA leg. It will be a sell order when dealing with a bearish Cypher pattern, indicated by a falling XA leg.

For the stop loss, you will place it below point X for the bullish Cypher harmonic pattern and above point X for the bearish Cypher pattern. The take profit should be placed at point A.

Gartley Harmonic Pattern

A Gartley pattern is a reversal pattern that looks like a bullish W, or its upside-down counterpart the bearish M. The Gartley pattern is one of the more popular harmonic trading patterns and was named after harmonic chat pattern pioneer H.M. Gartley in this 1932 book, Profits in the Stock Market.

Gartley patterns are defined by their resemblance to the following

- The AB move should be a 61.8% retracement of the XA move;

- The BC move should be a 38.2% or an 88.6% retracement of the AB move;

- If the BC move is a 38.2% retracement of the AB move, CD should be a 127.2% retracement of the BC move;

- If the BC move is an 88.6% retracement of the AB move, CD should be a 161.8% retracement of the BC move;

- The CD move should be a 78.6% retracement of the XA move.

It is at point D where the trader identifies the pattern as valid and decides whether to buy or sell. The price action is expected to follow the same direction and magnitude of the XA move. A downward direction of the XA move constitutes a bearish Gartley pattern, while an upward direction of the XA move signifies a bearish Gartley pattern.

Once point D reaches a 78.6% retracement of the XA move, there is a high probability that the price will reverse in the short-term and resume the long-term trend that the pattern interrupted. Enter the trade here, placing stop losses below the X point for the bullish version of the pattern and above the X point for the bearish version. Take-profits are generally placed at the 61.8% retracement of the AD leg.

Butterfly Harmonic Pattern

The Butterfly harmonic pattern is similar to the Gartley harmonic pattern, except that the Butterfly pattern has a point D that extends beyond the X point. Traders tend to like Butterfly patterns more than Gartley patterns because Butterfly patterns suggest sharper reversals and consequently higher profits.

The points of interest in the Butterfly harmonic pattern are X, A, B, C, and D.

- XA is the first leg of the pattern;

- AB forms a 78.6% retracement of XA;

- BC is a retracement of AB of between 38.2% to 88.6%;

- CD forms a 161.8% to 224% extension of AB;

- The D point should reach between 127% and 161.8% of XA.

If XA is an upward move, the Butterfly pattern is a bullish Butterfly pattern. If XA is a downward move, the pattern is a bearish pattern. The D point is where you should begin to look at entering a trade.

In the case of a bullish Butterfly pattern.

- If BC retraces 38.2% of AB, you will want to enter a buy when CD sets a bottom at 161.8% of BC;

- If BC traces 88.6% of AB, you will want to enter a buy when CD bottoms out at 88.6% of AB.

In the case of a bearish Butterfly pattern.

- If BC retraces 38.2% of AB, you want to sell when CB sets a top at 161.8%;

- If BC retraces 88.6% of AB, you want to sell when CB tops out at 224% of BC.

For a bullish pattern, you should put a stop loss below the bottom formed by the D point. For a bearish pattern, you want to set the stop loss above the top formed by D. The take profit should be set at the 161.8% extension of the CD leg. Another idea on how to handle the take profit with the Butterfly pattern is to set multiple take profits, one at point A and the other as a trailing stop below the last swing low in the case of the bearish Butterfly pattern or above the last swing high in the case of a bullish Butterfly pattern.

Shark Harmonic Pattern

The Shark pattern is one of the newer harmonic patterns, being discovered in 2011 by Scott Carney.

It is a reversal pattern and uses 0, X, A, B and C for its swing points

- The initial leg is labeled 0X;

- This 0X leg is partially retraced by XA;

- AB is then a move in the opposite direction of XA and should reach a Fibonacci extension of 0X of between 113% and 161.8%;

- BC is an extension of XA of between 161.8% and 224%. The BC leg should also extend beyond point O by 113% of the XO leg.

For the bullish Shark pattern, we buy at point D, which is at the 113% extension of 0X. We place the stop loss below the 115% extension of 0X.

A rising 0X segment identifies a bullish Shark pattern, while a falling 0X marks a bearish shark pattern.

How to Draw Harmonic Patterns

You can draw these patterns using trendlines in almost any Forex trading platform. There are also trading indicators and other software that can draw or help identify these patterns for you. If you are using MetaTrader 4 or MetaTrader 5, simply searching for “harmonic pattern indicator mt4” or “harmonic pattern indicator mt5” will help you find a Harmonic price patterns indicator that fits your needs. A harmonic trading indicator can really streamline your trading if you choose not to have a more hands-on and manual approach. It is true that drawing harmonic patterns can be subjective. Some of the ratios given here for each trading pattern are different from what others give. This is because of the subjective nature of harmonic patterns trading. You may choose to let some of the moves exceed their specified ratios, but it should be strongly recommended that you stay within the recommended ranges as a beginner. Once you have become much more knowledgeable about harmonic patterns and can afford to bear the risk of doing so, feel free to experiment as much as you like. But recognize that this is a slippery slope. Cheating a little might be okay, but cheating a lot can get you in big trouble. Harmonic patterns trading defines the ratios of each of these moves for a reason and it is wise to stick within them as much as possible.

Conclusion

Harmonic trading patterns are powerful tools to deliver profitable trades, which are the bread and butter of Forex and all other kinds of trading. These seemingly magical ratios are found in nature and have been trusted time and time again to deliver excellent trading opportunities in all types of markets. As mysterious as they may seem, harmonic price patterns simply identify recurring cycles in the market and deliver to the traders who study a way to take advantage of a statistically advantageous situation in markets. Harmonic trading patterns are complicated, but once understood these patterns offer simplicity in the form of knowing with a high probability when and where the price will reverse itself. Using a harmonic indicator Forex can really open itself up to you in terms of trading opportunities that you would never otherwise see. You can always trade harmonic patterns without a harmonic indicator if you choose and there is nothing wrong with wanting to do things this way.

There are pros and cons to every trading method. That’s why it’s best to combine your strategies into a larger body of knowledge. Focusing too much on harmonic price patterns can cause you to miss larger trends or ranging markets. Focusing on finding trends could cause you to miss an opportunity to exploit harmonic patterns. A well-rounded strategy that brings multiple different paradigms together offers the best chance for successful Forex trading.