Learning Price Action Trading For Beginners

Did you know that price action trading strategies are one of the most frequently used methods in today's financial market? Regardless of whether you are a short or long term trader, analyzing the price of a security is perhaps one of the easiest, but also one of the most powerful ways to gain an advantage in the market.

After all, every single trading indicator in the world is derived from price, so it makes sense to actually study, understand, learn from and use it for your trading. In this article we cover everything you need to know about trading price actions (price movements), such as What is a price action and why should you consider trading price actions in the Forex market - and also - how to trade four price action strategies.

What is Price Action?

The term "price action" is simply the study of the price movement of a security. In Price Action Trading, traders would try to analyze the historical price to find clues as to where the market might move next. The most commonly used Price Action indicator is the examination of price bars, which provide details such as the opening and closing price of a market and its high and low price levels during a given period.

The analysis of this information is the core of Price Action Trading. When answering the question "What is Price Action" one could say that it is really the study of the actions of all buyers and sellers actively involved in a particular market. By analyzing what the rest of the market participants are doing, it can give traders a unique advantage in their trading decisions.

All trading platforms in the world offer candlestick charting - proof of how popular price action trading is.

Using Price Action Indicator

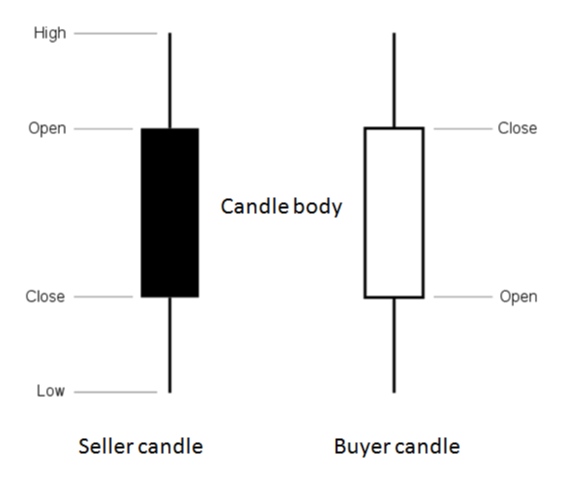

As mentioned above, we now know that price actions are the study of the actions of all buyers and sellers actively involved in a given market. The most commonly used Price Action indicator is the candlestick chart, as it provides the trader with useful information such as the opening and closing price of a market, as well as the highest and lowest price level in a user-defined period. Let's look at an example:

If you were to look at a daily chart of a security, the above candlesticks would represent the value of an entire day. Both candles give a trader useful information:

- The highest and lowest price levels tell us the highest price and the lowest price achieved during the trading day.

- The seller candle, represented by a black or sometimes red body, tells us that the sellers won the battle on the trading day. This is because the closing price is lower than the opening price.

- The buyer candle, represented by a white, sometimes green body, tells us that the buyers have won the battle of the trade. This is because the closing price is higher than the opening price.

Using this simple candle setup is one of the first steps in creating a Price Action strategy. For example:

- When after the sellers candle, the next candle reaches a new low, it is a sign that the sellers are ready to sell the market further. This weakness will cause some traders to initiate short positions or hold the existing short positions.

- When after the buy candle the next candle makes a new high, it is a sign that buyers are willing to buy the market further. This strength will cause some traders to initiate long (buy) positions or hold the long positions that already exist.

This type of price action analysis is only one way to use candlesticks as a price action indicator. However, the candlesticks themselves often form patterns that can be used to form a price action strategy. Before we look at these patterns, let us first examine where they work best.

Price Action Forex Trading

Since Price Action Trading includes the analysis of all buyers and sellers active on the market, it can be used on any existing financial market. This includes foreign exchange, stock indices, stocks, commodities and bonds. You can view instruments within all these markets on candlestick charts and thus implement a price action strategy on them.

However, the foreign exchange market has some specific advantages for price traders, such as:

- Open 24 hours a day, five days a week - a true representation of buying and selling on all continents High liquidity - allows you to trade in and out of markets within nanoseconds;

- Small spreads - some, not all currency pairs offer deep spreads that could keep traders' commission costs low;

- Leverage - Forex trading is a leveraged product, meaning you can control a large position with a small deposit. This could mean big profits, but also big losses, so please trade responsibly.

These are just some of the reasons why forex trading with price actions is popular. In the next section we will use the Price Action Forex as examples before moving on to a Price Action Forex scalping strategy.

Best Price Action Trading Strategies

A trading strategy requires three different elements: the why, how and what.

The "why" is the reason why you are considering trading in a particular market. This is where Price Action Patterns (Pric Action Patterns) come into play. Through your price action analysis you gain an advantage over what is likely to happen next - whether the market rises or falls.

The "how" is the mechanics of your trade. Essentially, it is the way you will trade. This analysis involves knowing your price levels for entry, stop loss and target. After all, trading is all about probabilities, so you must protect yourself and minimize losses if the market moves against your position.

The "what" is the result of trading. What do you want to achieve? Is it a short term or long term trade? This depends on how you lead the trade to profitability and how you keep yourself when the result is not what you want.

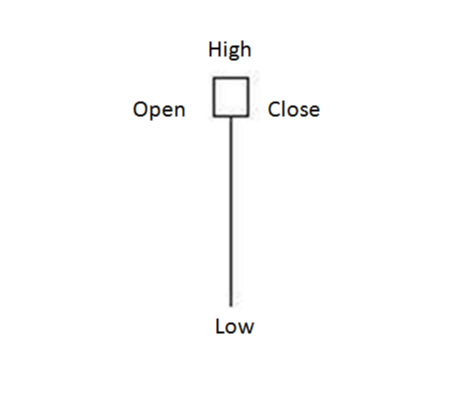

Price Action Strategy #1 - The Hammer

The hammer-price action pattern is a bullish signal that indicates a higher probability of the market moving up than down, and is mainly used in emerging markets. Here is an example of what a hammer candle looks like:

bottom and choose to hedge their positions. This leads to the market recovering, so that the buyers also enter the market. The opening and closing price levels should both be in the upper half of the candle. Traditionally, the closing price can be below the opening price, but it is a stronger signal when the closing price is above the opening price level.

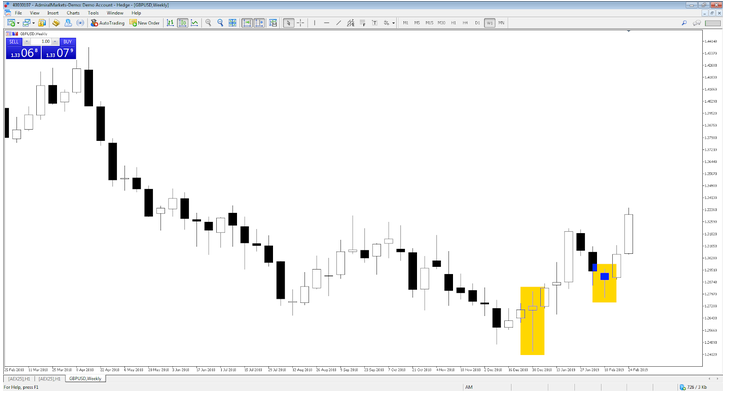

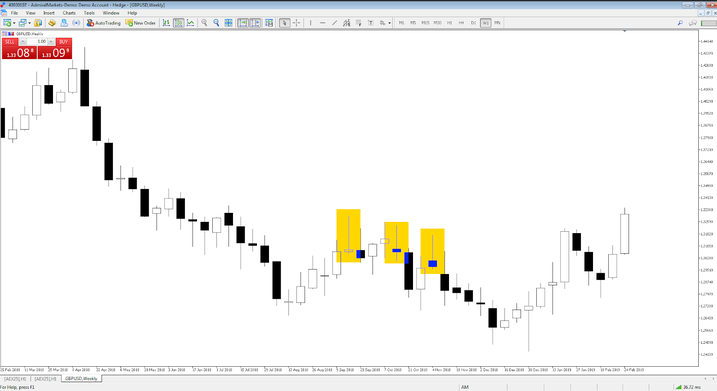

In the GBP/USD price action forex chart above, there are two examples of a hammer pattern - both highlighted in the gold boxes. By analyzing the opening, closing, high and low prices, the pattern indicates that a higher movement is likely. In these examples, the price rose after the candles were formed. Of course this will not always be the case, but how could you have acted?

THE ENTRY: A possible price level for entering a trade could be when the next candle finally manages to break the high of the hammer candle. The high of the Hammer Candle - which formed in the week of February 10, 2019 - is 1.2959. Therefore, an entry price could be 1.2960.

THE STOP LOSS: A possible stop-loss level could be at the low point of the Hammer Candle. When the market triggers the entry price, but no other buyers enter, it is a warning sign that the market may need to go further to find buyers. Therefore you should not want the stop loss to be too close to your entry. With the hammer candle low at 1.2727, a possible stop loss could be 1.2726.

THE GOAL: There are several ways to exit a trade at a profit, such as exiting at the end of a candle when the trade is profitable, targeting support or resistance levels, or using trailing stop losses. In this case, targeting the previous swing high would result in a price target of 1.3200.

THE TRADE: With an entry price of 1.2960 and a stop loss of 1.2726, the total risk of the trade is 234 pips. Trading at 0.1 lot would mean that if that trade triggered the entry price and then hit the stop loss, the total loss would be $234. In this case, the market traded higher than the target price, resulting in an approximate trading profit of $240.

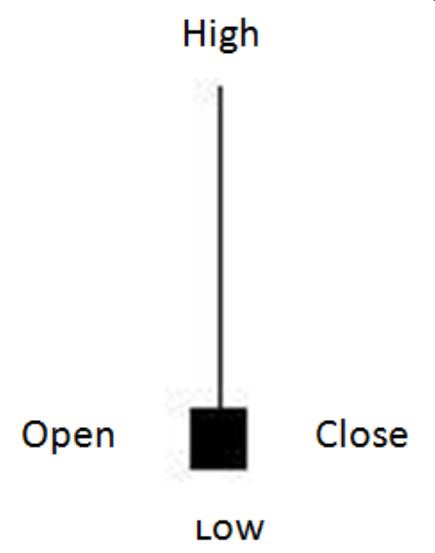

Price Action Strategy #2 - Shooting Star

The Shooting Star price pattern is a bearish signal that indicates a higher probability that the market will move less than higher, and is mainly used in down trending markets. In essence, it is the opposite of the hammer pattern. Here is an example of what a shooting star candle looks like:

A shooting star shows buyers how to take the market to a new high. However, the buyers are not strong enough to stay at the high level and decide to secure their positions. This leads to a decline in the market, so that sellers also enter the market. The opening and closing prices should both be in the lower half of the candle. Traditionally, the closing price can be above the opening price, but it is a stronger signal when the closing price is below the opening price level.

In the above price action forex chart for GBP/USD there are three examples of a shooting star - all highlighted in the golden boxes. By analyzing the open, tight, high and low price levels, the pattern indicates that a downward movement is likely. In these examples, the price has fallen after the candles were created. Of course this will not always be the case, but how could you have traded it?

THE ENTRY: A possible price level to enter a trade could be if the market finally manages to break through the low of the shooting star. The low of the third shooting star candle - which formed in the week of November 4, 2018 - is 1.2957. Therefore, an entry price could be 1.2956.

THE STOP LOSS: A possible stop-loss level could be at the level of the shooting star candle. With the shooting star candle high at 1.3173, a possible stop loss could be 1.3174.

THE GOAL:There are several ways to end a trade at a profit, such as exiting at the end of a candle if the trade is profitable, targeting support or resistance levels, or using trailing stop losses. In this case, targeting the previous swing low would result in a price target of 1.2663.

THE TRADE: With an entry price of 1.2956 and a stop loss of 1.3174, the total risk of the trade is 218 pips. Trading at 0.1 lot would mean that if that trade triggered the entry price and then hit the stop loss, the total loss would be $218. In this case, the market traded lower to reach the target price, resulting in an approximate trading profit of $293.

Price Action Strategy #3 - Harami

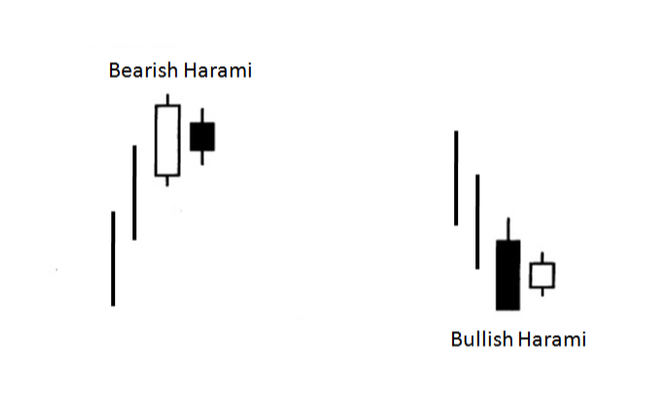

The Harami Price Action pattern is a two-candle pattern representing indecision in the market and is mainly used for breakout trading. It can also be called "Inside Candle Formation" because a candle forms within the range of the previous candle, from high to low. Here is an example of what a bearish and bullish Harami candle formation looks like:

A bearish harami is formed when the high to low range of a seller candle develops within the high and low range of a previous buyer candle. Since there has been no continuation to form a new high, the declining harami represents an indecision in the market that could lead to a downward breakout.

A bullish harami is formed when the high to low range of a buyer candle develops within the high and low range of a previous seller candle. Since there has been no continuation of a new low, the bullish harami represents an indecision in the market that could lead to an upward breakout.

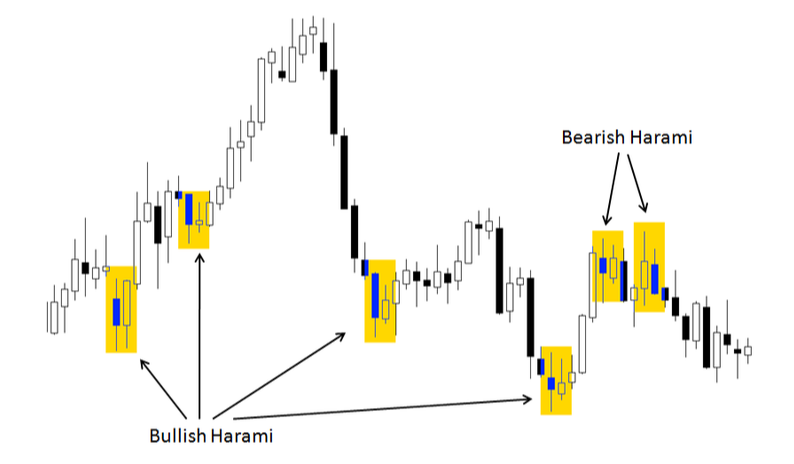

Here are some examples of bullish and bearish Harami patterns that form over a period of time:

So how can you trade these patterns as a price action trading strategy? There are many ways and not one perfect way. However, many traders use this as a stand-alone breakout pattern. Here are some possible rules to build on.

How to Trade with the Bearish Harami

- Identify declining Harami patterns (the high and low segment of a seller's candle that develops within the high and low range of a previous buyer's candle);

- Take a pip below the low point of the last candle;

- Place a stop-loss one pip above the high of the previous candle (to give the trade some breathing room) Aim for a personal reward for risk, i.e. the same number of pips you risk from the entry price to the stop-loss price;

- If the trade was not triggered by opening a new candle, cancel the order. If the trade was triggered, leave it in the market until the stop loss or target is reached.

Price Action Strategy #4 - Scalping

There are a variety of forex price actions available to traders. However, since scalping means making very short term trades several times a day, there are more filters that are needed to trade a price action.

One important filter can be to find markets that are in a "trend", which helps traders to see who is in control of the market - the buyers or sellers. Moving averages (MA) are a useful trading indicator that can help to identify this. Since scalpers look for short-term movements, faster moving averages - such as the twenty-period moving average and fifty-period moving average - are often used.

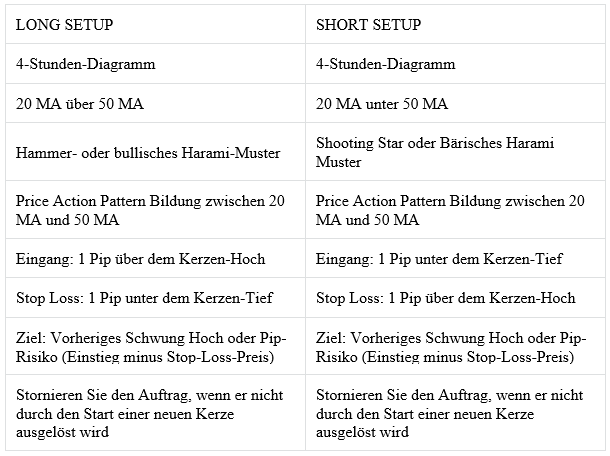

Now let's create some rules for a possible Forex Price Action Scalping strategy that combines moving averages for trend and price action for entry and stop-loss levels.

This is just an example to make you think about how to develop your own trading methodology. Any strategy will win and lose trades, so manage your risk sensibly. Now let's look at the strategy in action.

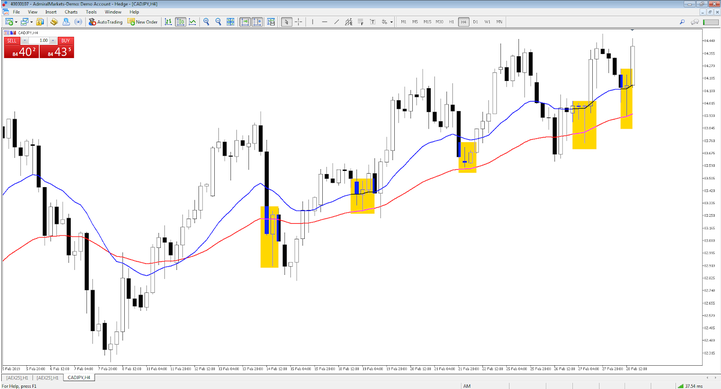

The CAD/JPY chart above shows a recent steady uptrend. Consider this on the 4-hour chart:

The moving average with twenty periods (blue line) is above the moving average with fifty periods (red line). This corresponds to part of the above rules for the Price Action Forex Scaling Strategy. The next steps are to identify price actions for forex setups that develop between the moving averages.

Conclusion

Price Action Trading is a powerful tool and is used by traders all over the world. Is it time for you to integrate it into your trading?