MFI Indicator Overview

Bill Williams developed the Market Facilitation Index (BW MFI) during a period of radical change in approaches to technical market analysis. This talented theorist and practitioner presented a new vision of forecasting and assessing trends in the book "Trading Chaos," which provided traders with both separate indicators and full-fledged trading systems.

In today's article, we'll look at the legendary trader's indicator in greater detail.Despite the work's exotic title, Williams was able to find simple solutions to the price chaos of quotes. By automatically comparing the current volume value to the price range, the BW MFI, or "Market Simplification Index," visualizes the impact of traders' trades on the current trend.

The significance of Bill Williams' contribution to market analysis theory is reflected in a separate section of the MT4 terminal called "Indicators," which contains six tools written by him. This set also includes BW MFI, which can be found in many common trading terminals.

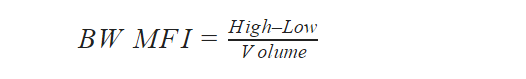

The formula of the MFI Indicator

The study and description of the influence of volumes on the trend began in the early twentieth century; by the middle of the century, these estimation methods had received their own direction - Volume Spread Analysis (VSA). Traders have been analyzing current trading volume by visually comparing it to the price range on a chart at the time of this writing by Bill Williams.

The VSA theory was based on four fundamental concepts:

- Spread - the distance between the minimum and maximum of a bar (candlestick)

- Close price to determine candlestick direction;

- Volume;

- Relative changes in trading volumes and spread over the previous period

Bill Williams encapsulated all of this in the BW MFI Market Simplification Index formula:

In order to account for VSA's fourth postulate, the calculation results were displayed on the graph in the form of a four-color histogram, depending on the change in the numerator and denominator indicators in comparison to their previous values.

- The histogram's bar turns green as the numerator (High - low) and denominator (Volumes) increase.

- When the numerator and denominator both decrease at the same time, the result is brown.

- The blue color is assigned to a rise in a trading range on a fall in volume.

- The neutral pink color appears when the numerator falls, accompanied by a sharp increase in volume in the denominator.

Only three of the four rules described above are covered by the formula. The trader must independently determine the closing price of the candle and the trend direction by analyzing the chart.In trading terminals, the Volumes parameter is expressed in physical terms: the number of shares or derivatives contracts (futures, options). Only ECN accounts can obtain the real volume of currency on the Forex market; in other cases, the Metatrader terminal displays the number of ticks - Buy / Sell transactions.

Characteristics of the MFI BW Indicator

The Market Facilitation Index, like many volume indicators, is only used as a signal filter in trading systems. The indicator's primary colors are green histograms, which confirm the trend in the direction of the candlestick closing price. If it is lower than the opening price, the trader should wait for the following events:

- Further fall of the currency pair;

- Breakout of the nearest support level;

- The beginning of a new trend.

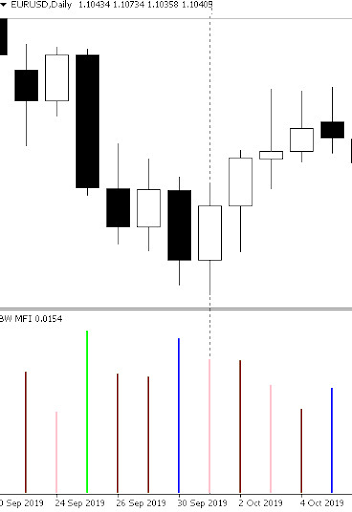

To apply the last point correctly, it is important to understand that the histogram is tied to one candlestick. The picture below shows a downtrend (1), but the rising candlestick (2), which corresponds to the green BW MFI histogram, has become the beginning of a long-term upward movement of the EUR/USD pair.

This fact did not cancel a similar signal of the trend strengthening on the correction at point (3). Several growing green bars in a row confirmed the strength of the positive trend (4 and 5).

The blue bar, which indicates divergence - the direction of the trend that is not confirmed by trading volume - is the second most important BW MFI signal. Market makers or crowd inertia continue to move in the absence of support from the big players. This means that a strong speculative pullback could occur at any time in the market, which current Buyers or Sellers will be unable to resist due to low trading liquidity.

Divergence extends to the current candle: if it is falling, as in the figure below in case (1), then you should expect an upward rebound. Sometimes the trading volume decreases for objective fundamental reasons, which does not mean a decrease in demand for the currency. In case (2), a strong downward trend coincided with the summer period, when the number of transactions and players on the market traditionally decreases.

Pink and brown also predict fading or possible trend reversal. Bill Williams singled out a "squat bar" with a falling trading range on rising trading volumes. It matched the pink bar as the most likely predictor of a reversal. The brown color coincided with a "fading bar", often called a "stub" in candlestick analysis, whose trading volumes would be extremely small.

The size of the histogram bars is highly sensitive to volatility - the trading range in the numerator, which means that an increase in the indicator values indicates an increase in the trading range. A decrease in the BW MFI histograms indicates that the market volume has increased, but the range has returned to “normal” weighted averages.

The boundary of the volatility mode change is defined by modern market theory as a trigger indicating the potential need to optimize the trading system settings. If BW MFI has moved to a significantly new level of average indicators, a trader should take a closer look at the statement to limit the number of losing trades.

Final words

The BW MFI indicator divides market fluctuations into four components, which are conveniently represented by different colors. The tool does not need to be adjusted because it automatically adjusts to the timeframe. Both of these factors make the indicator simple to use for inexperienced traders. Despite all of the tool's benefits, keep in mind that it is only a signal filter within the analyzed candlestick. The conditions for entering the trading system should always come first - BW MFI just confirms or rejects transactions.