Forex Weekly Forecast & FX Analysis February 15 - 19

EUR/CHF

For the euro against the Swiss franc, we still state the fact that the currency pair is prone to sideways movement. This time the price was below the important level of 1.0800. Below the price is limited by another equally important level of 1.0787. Together, these two levels form a very narrow sideways range, within which the market does not allow us to trade. In fact, we just wait until the price breaks out of this range and trade in the direction of the breakout. Downward movement is most likely.

NZD/USD

For the New Zealand dollar against the dollar, the American market is mainly characterized by sideways movement and no clear trend. First of all, it can be clearly seen from indicators that are close to neutral values and practically do not move away from them. Also, the absence of a trend can be traced in the price chart, where volatility is present, but it is not unidirectional, since the price oscillates down and up. Taking into account that the current price is near the level of 0.0720, we can expect that the price will go down and open a downward contract.

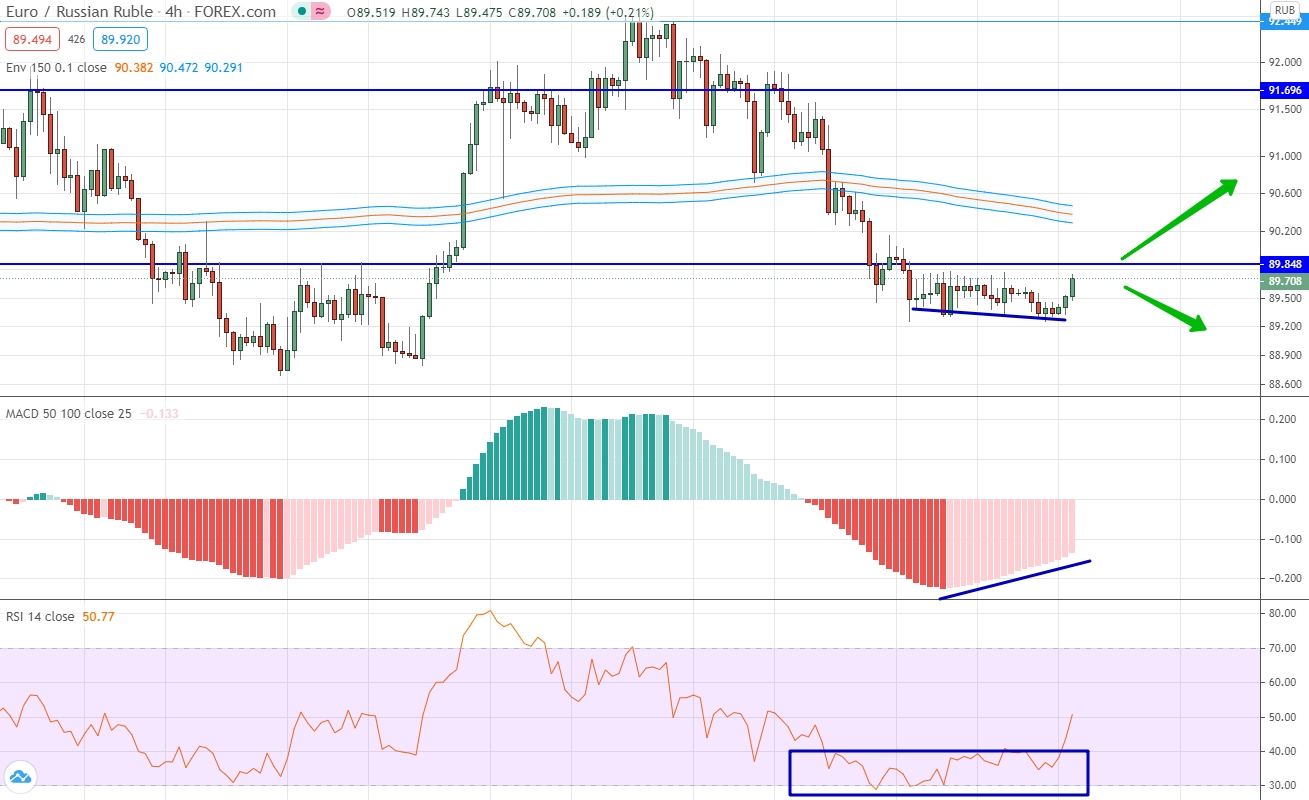

EUR/RUB

Last week, the Russian currency significantly strengthened its positions against the euro. The downward movement turned out to be quite strong, as a result of which the price was below the moving average level and below the important level of 89.84. Please note that the indicators and the price turned out to be at local minimum values, but it is very important to consider the price movement and the movement of the histogram from the minimum value together. In this part of the market, there is a clear divergence, when the price looks down, and the histogram is already starting to gain upward momentum. Thus, we can consider options for trading up, but such a trade is possible only if the price turns out to be above the level of 89.84.

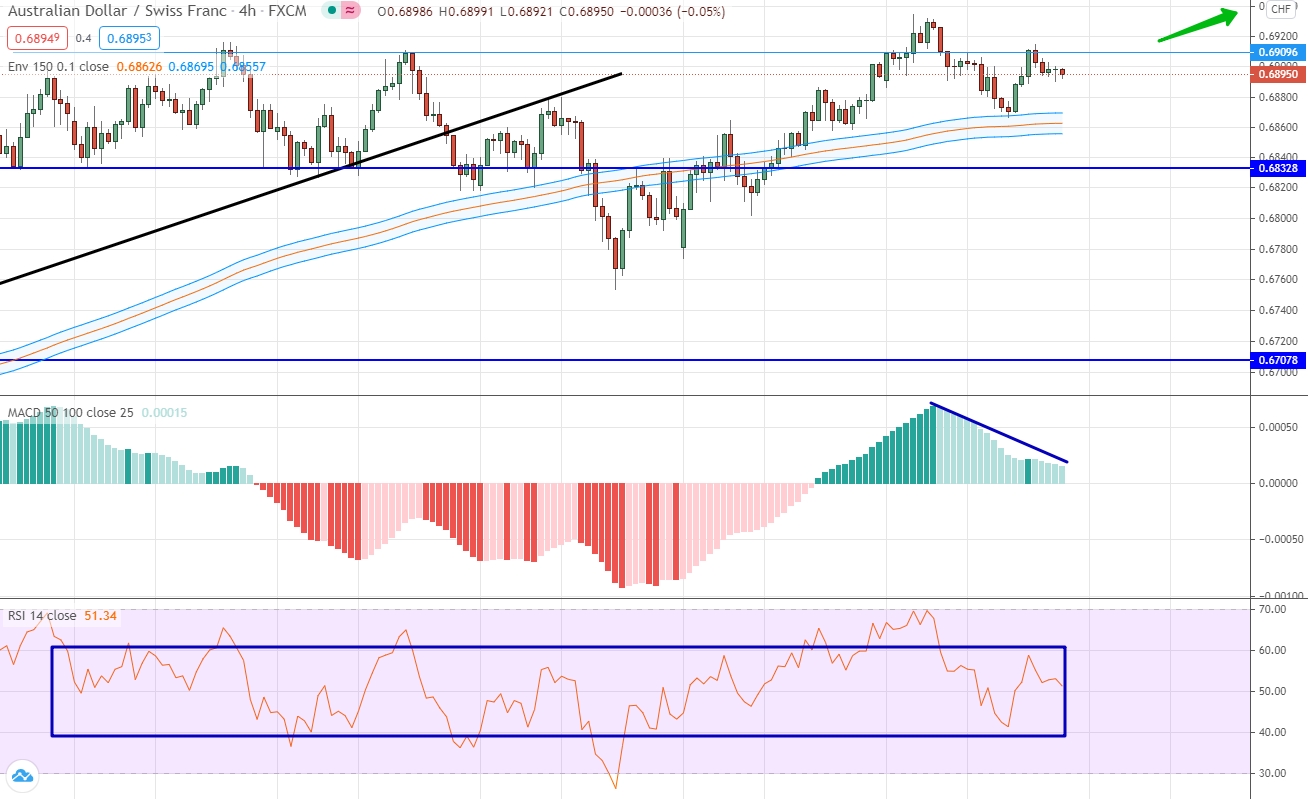

AUD/CHF

The aussie is still trading within the 0.6832 and 0.6909 sideways range against the Swiss franc. The range is very well confirmed by the oscillator, which throughout the formation of this side range develops within the range from 40 to 60. All exits outside these ranges lead to an almost instant return to neutral indicators. At the same time, if you look at the level of moving averages, then it looks up one way or another and is constantly growing. Thus, we are talking about the dominance of an uptrend, and it is strengthening at least due to the fact that the price and the level of the moving averages have become equal. Thus, you can trade up, but only after the sideways range is broken in the direction of growth.

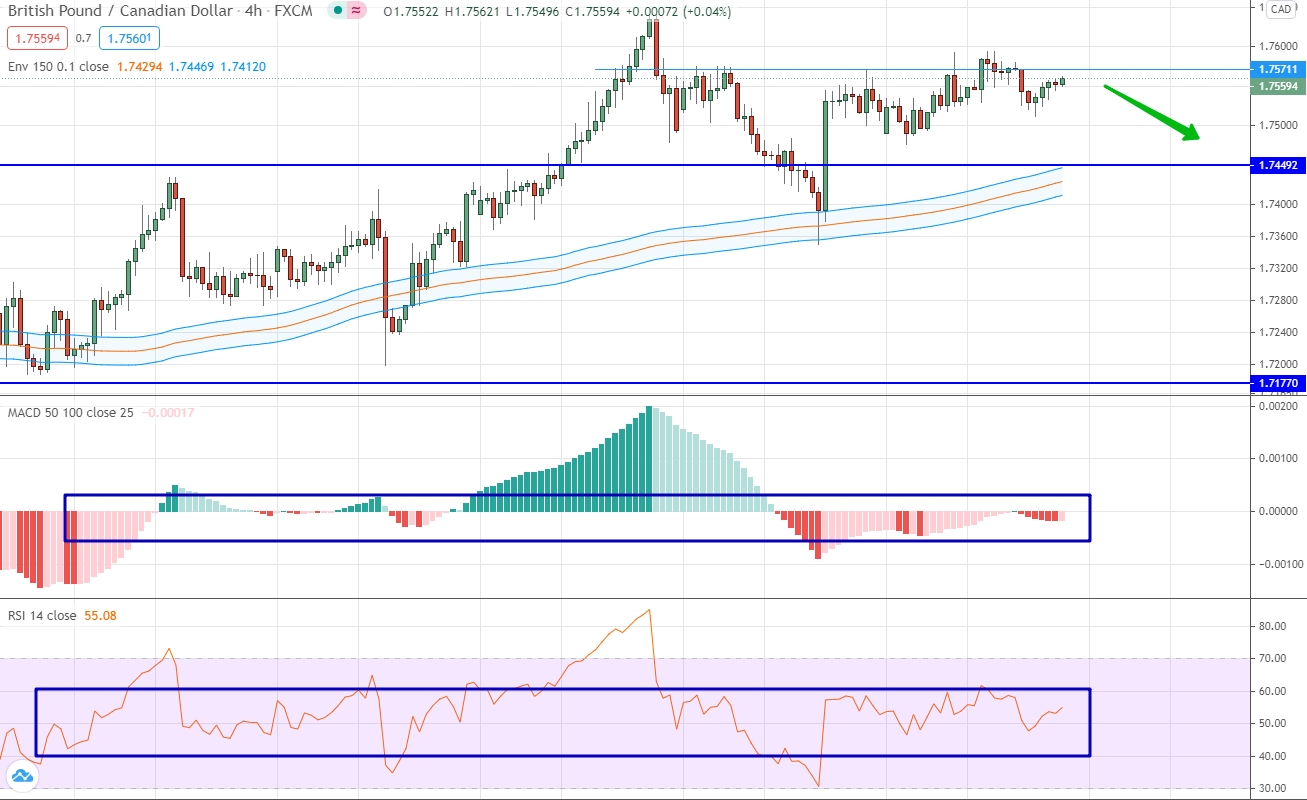

GBP/CAD

The British pound has entered a sideways correction against the Canadian dollar, allowing it to form a sideways range with the borders of 1.7449 and 1.7571. If you pay attention to the indicators, they confirm this sideways corridor, or at least indicate the absence of a strong and clear trend in the current market segment. After all, all indicators are plotted near neutral values and only slightly move away from them in the direction of growth, when there was a very strong upward movement last week. Thus, we expect the price to move downwards, all of which is now at the upper border of the channel.

NZD/CHF

For the New Zealand dollar against the Swiss franc, 0.6420 is the main price level. Please note that this level until the current stage of the market practically coincides with the levels of moving averages. The significance of the average levels is very high, because if you look at the historical data, then only on the visible part of the chart we note at least three situations when the price reached the moving averages and stayed close to it, and after that there was a rollback and a fairly impulsive upward movement. We can talk about the same for the current stage. Thus, we are considering options for trading up.

USD/CNH

The past week turned out to be extremely negative for the US dollar against the Chinese yuan, as the US currency fell significantly. In fact, what we talked about in the previous weekly review has happened. Now, in order to pay attention to the fact that the price turned out to be at the minimum values for itself and these values are confirmed by all indicators. We can also pay attention to the fact that the price very often tests the level of moving averages. Therefore, we can expect that this will happen this time too, so we open an upward contract expecting that the price will test the moving averages.