Cypher Pattern Trading Strategy Explained

What is a Cypher Pattern?

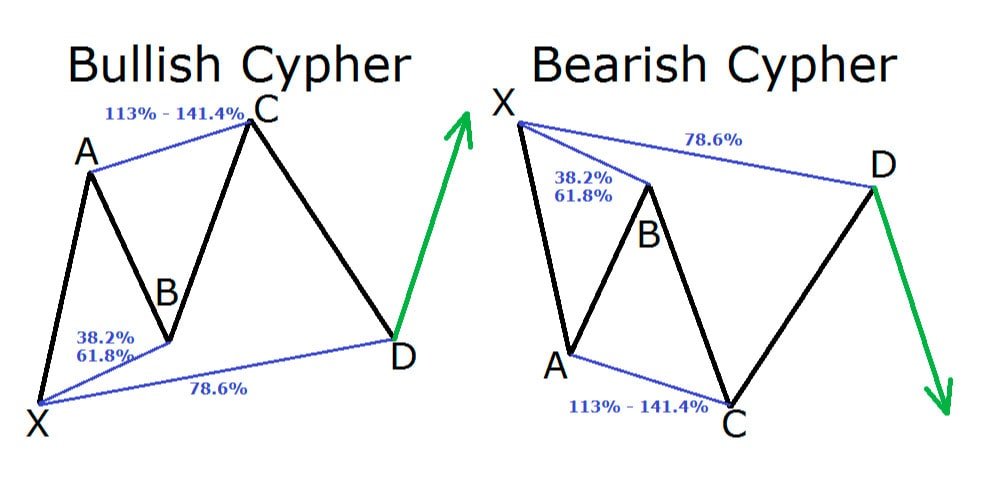

A cypher harmonic pattern is a specific geometric pattern found in all kinds of markets. Cypher patterns can be either bearish or bullish.

What are the Rules for Identifying a Cypher Pattern?

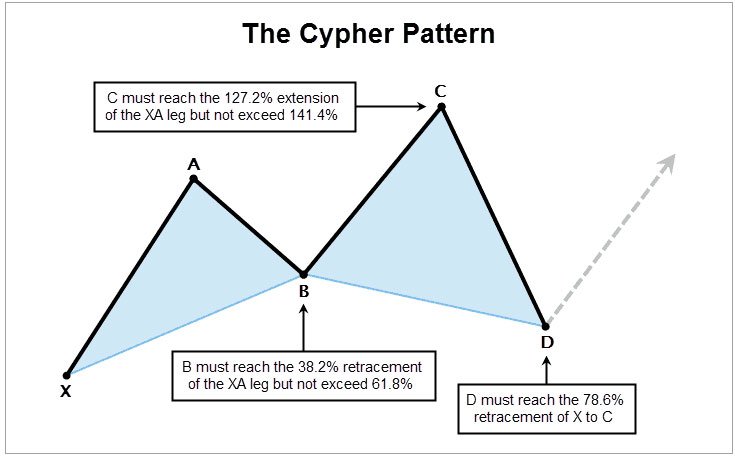

A cypher pattern is made up of five points, typically labeled X, A, B, C and D. The lines between each of these points are called legs. These legs are referred to as XA, AB, BC and CD respectively. The XA leg begins the pattern.

Here are the rules for identifying a cypher pattern:

- The B point stands at the end of the AB leg, which is a retracement of the XA leg. The B point must lie between a 0.382 and 0.618 retracement of the XA leg;

- The C point lies at the end of the BC leg and should be a 1.272 to 1.414 projection of the XA leg;

-

Point D should be a precise 0.786 retracement of the line between X and C (XC). The D point is the end of the pattern.

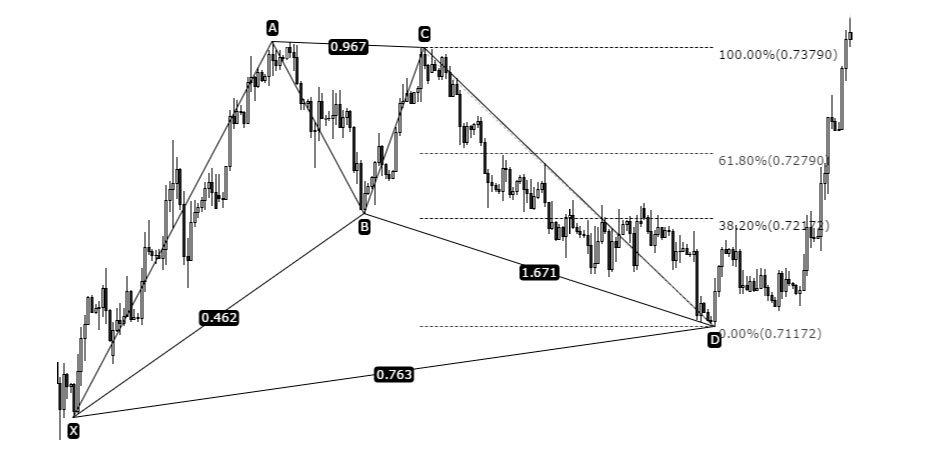

How to Use the Cypher Pattern in Forex?

Your first take-profit is at the 0.382 retracement of the CD line and the second take-profit is at 0.618 of the CD line. For risk management, you could close half of the position at the first take-profit and close the rest of the position at the second take-profit. The entry point is at point D, at the 0.786 retracement of the XC line. The stop-loss should be set below the X point at 10 or more pips below for intraday traders, or somewhere between 20 and 30 for those trading on the daily charts. It is a good idea to adjust your stop losses after your take-profits have been triggered. You could, for example, move the stop loss to the entry point when the first take-profit is hit. This will prevent a market reversal back across the D point from wiping out your previous gains.

The only real caveat to the rules above is that neither the B point nor even the wicks of the candle that produces the B point should ever touch the 0.786 retracement level of XC. If this occurs, the retracement is considered too deep and this is not a good cypher pattern. Since the risk of the trade is the distance between the entry point and the stop loss, and the reward is the area between the entry point and the take-profit—you may encounter a cypher pattern with a poor risk-to-reward ratio. This ratio can be improved by waiting for the CD leg to retrace below the 0.786 level of the XC line and enter the trade there.

If you like this strategy, you might also be interested in this What is the Most Profitable Trading Strategy?Bearish Cypher Patterns and Bullish Cypher Patterns

The bullish cypher pattern resembles the letter M. A bearish cypher pattern is just an upside-down bullish cypher pattern and looks like a W (or an upside-down M if you’d rather think of it that way). The proportions are exactly the same in either case. The entry levels, stop loss levels and take-profit levels are all the same. Obviously, the orientation will be different depending upon whether the pattern is bullish or bearish, but the trade is performed exactly the same way.