How to Trade Bill Williams Fractals

If one has to look at the ranging highs and lows of any given stock, let alone the entire market, it would be entirely reasonable to come to the conclusion that the prices move at random. However, this theory was entirely disproven by Bill Williams, who postulated that in reality the prices move in a fractal pattern.

What is a fractal pattern?

Fractals can be surmised as a price movement that occurs periodically during the happenings of a much more sizeable price movement within the market.

Williams fractal theory is typically used to detect price movement within either the upper or the lower end of the price index. The method of identifying a rising fractals trading pattern is by locating a minimum of 5 consecutive bars, where the peak will be in the centre and the two secondary high price levels will be on either side of the boundary. The reverse is true for identifying the decreasing pattern of Williams fractal strategy.

William’s fractal theory is beneficial for a wide variety of reasons, one of the main ones being that they provide novices with an efficient set of guidelines, as well as providing innate stop loss barriers for price. In addition, they provide analysts with the potential to identify trends while negating potential for subjective influences on the behalf of the analyst.

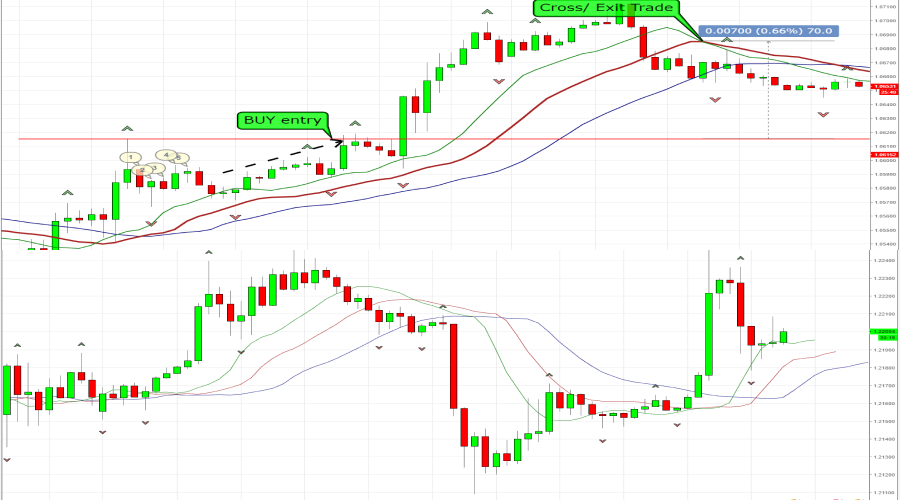

Fractal Blaster Trading Strategy

It is important to note that in order to successfully identify Bill Williams 3 lines of either peaking or decreasing price, that a Williams alligator indictor will deliver the highest rates of effectiveness. Williams fractal theory requires that all fractals must be measured against a common indicator in order to assess their validity, the most popular of these is the alligator which is made up of three consistently-adjusting averages.

In accordance with the fractals trading strategy, one should avoid committing to a purchase of a stock or other asset if the fractal is below the alligator’s teeth. Furthermore, if the fractal surpasses the alligator’s teeth, then it is not advisable to sell on the asset, but that the position should instead be held. The main rule of thumb that is always upheld states that one should never buy or sell until a fractal indicator has managed to move beyond the borders of the alligator’s teeth.

If this seems to be a bit confusing to grasp, then do not fret for there are many software packages built to assist with the understanding of fractals indicators and their implications. One such example of a software is cTrader, although the premier fractal indicator MT4 or MetaTrader4 is an ideal option.

Conclusion

Bill Williams fractal theory has been an instrumental boom to the world of trading and will surely be useful for the years to come. For those eager to get to grips with the basic of fractal theory and potentially apply it to their own countries exchange, then a program such as MT4 would be ideal. It is important to note that even with a profitable strategy such as fractal theory there is always inherent risk and all investors need to be aware of this, prior to entering the market.