How to Trade Renko using Charts

Trading has been a profitable business for years. With the advancement in modern technology, a large majority of businesses have opted to go fully online rather than using traditional office spaces and man power. Same has been the case with trading.

Online trading has been amassing attention over the past couple of years. The unfortunate global lockdown has shut down almost all of the businesses. As a result, many businesses have found out ways to keep their work going online rather than waiting for the uncertain end of the lockdown situation.

With people trapped inside their homes, a large majority of people have found their attention diverted towards online trading and like any other business, you cannot do successful trade without having a good plan at hand.

Anyone who has been a part of online trading in any capacity knows that there is one thing that is abundant in the field and that are charts. Charts are the bread and butter for a trader as they are one of the biggest indicators for traders which help them improve their strategies and make better financial decisions.

A Renko chart is one those charts which is widely used by many traders on almost a daily basis. This chart was developed by the Japanese. This is a chart that is based upon price movements alone unlike other price charts which are developed depending upon both the price and a standard time interval. An interesting note here is that this chart is called “Renko” which is derived from the Japanese word “Renga” which means bricks. This explains the shape of the charts which is made up of a series of bricks.

Now that we have the answer what are renko charts, let go towards the second questions that pops into our minds. How to trade renko using charts?

Why use Renko Charts

There are a lot of renko trading strategies out there which prove to be quite effective but there are also a lot of different advantages that this type of chart offers which makes using this chart quite tempting and efficient. Probably the biggest advantage that the chart offers is the simplicity in its use. This chart does not have any time parameter and simple moves along with the changes in price alone.

This makes Renko chart especially helpful for day traders but that does not mean that these are only used by day traders. These charts can easily be used in any trading timeframe.

Rekno charts remove the noisier parts of the candlestick charts as they do not move ahead until there is a fixed price movement. This makes these charts more efficient in showing the actual direction that the market is taking.

How to Read Renko Charts

Reading a renko chart is quite simple. As there is no time parameter involved, we know that each brick represents a fixed price movement in either direction. This fact alone makes these charts quite simple to read and analyze. Both the direction and the color of the brick will change when the price of the previous brick is exceeded. This means that the price will most likely swing in the opposite direction.

Let’s talk some specifics. Each one of the bricks is a price of $0.25. While the size of the brick is same in a specific graph, the brick size can be adjusted by the individual traders depending upon their trading objectives. For example, traders will use different brick sizes on their charts depending on whether they are planning on going long or short in their trading positions. Similarly, high-cap positions will use different brick size than the standard one.

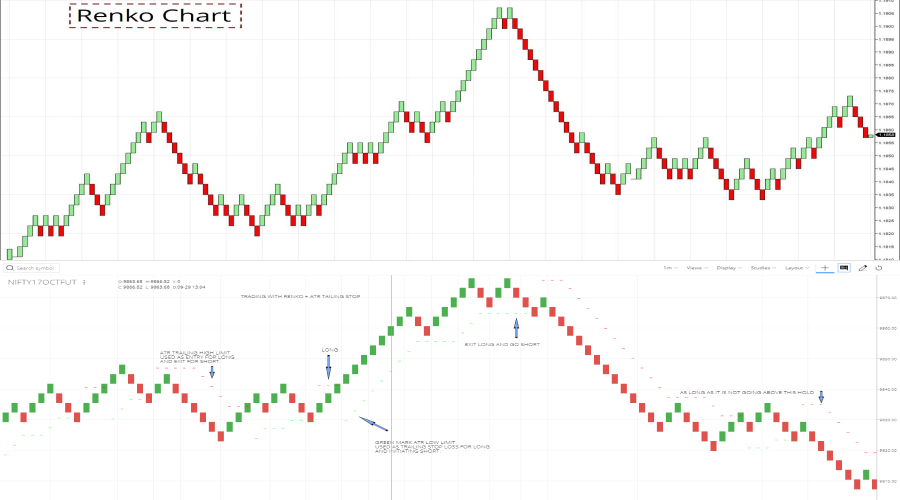

It is wise to use an ATR (Average True Range) which constructing bricks. The ATR is derived from the closing price of a specific stock. This shows that Renko is a lagging indicator.

There are a lot of renko strategies and renko trading systems out there in the market and many of these makes using these charts all the more efficient and easier.

Renko Chart Strategy

Before going into the details of what are some of the proven stocks and forex renko strategies, an important question would be whether it is worth it to use these charts and strategies. Having this question answered would be quite helpful in making up your mind and whether you want to dive into the details of these strategies.

Like any other indicator and chart out here which is available for the traders, renko has its uses as well as disadvantages as well. So, whether someone should be using it or not is completely a personal choice which depends upon the individual trader and their long-term trading goals. If renko chart will help you achieve those goals more easily, go for it for sure, otherwise there is always the option of sticking to the more conventional charts like the candlestick chart.

The biggest selling point of renko charts is their simplicity. They remove the noise from the candlestick charts due to the lack of any time parameter involved. This enables the traders to have clear view on where the market is actually headed. The trend is easier to assess from these charts as they present a very clear picture of the situation. So, if your goals would become easier to achieve when you are using renko charts, there is absolutely no reason to not use them.

With that out of the way, let’s take a look at some renko trading strategies.

Support and Resistance Renko Strategy

For this strategy, you can sync the candlestick and renko charts together. The renko chart will be free of any noisy areas and will help you identify the range and the breaks very easily.

The chart shows there has been a strong resistance going on. The breakout candle shows the point where the resistance has finally been broken. This, however, is not a confirmed breakout and the situation can reverse very easily. In case that this was a fake breakout, the price will fail back into the range.

The next candle is the confirmation candle which will tell us whether the breakout really occurred or if it was a fake breakout. The confirmation candle here shows that the breakout has occurred and the trend is going upwards, which continues to be the case until there is an eventual close.

Renko charts help you see these trends very clearly because they only move forward after a fixed amount of price movement. So, with the use of these charts, you can easily follow up on these trends and make a profit out of the breakout.

There is an Adaptive Renko MT5 (Meta Trader 5) Indicator available as well which further help you with identifying these trends. Renko Charts MT5 indicator is a technical tool which will help you identify trends, patterns and gauge trailing stops.

Trend Line Breakout Renko Strategy

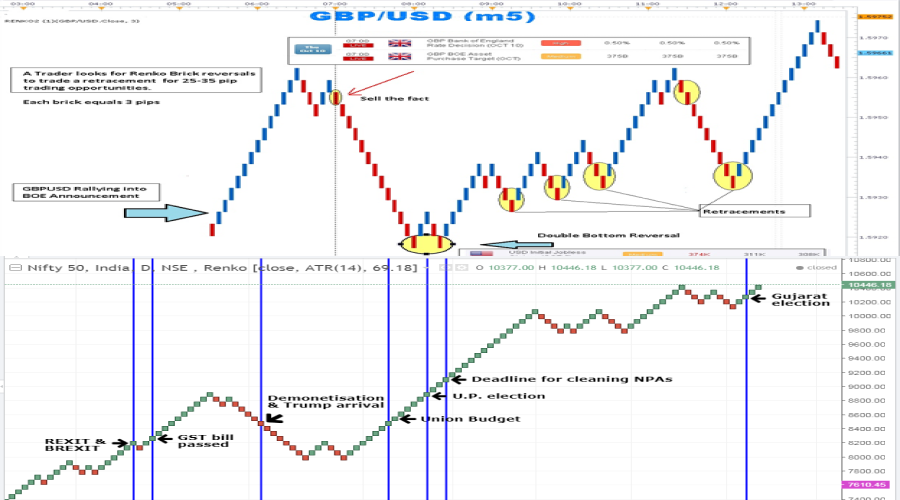

Trend lines breakout or continuation can be tracked better with these charts. The trading price lines should be marked on the renko charts. Some relevant prices like daily highs or lows, double bottom or a double top and even a diagonal price trend or a pattern. Marking these is not only easier on renko charts but also, they will be easier to track and implement in you trading plans.

Like in the above-mentioned strategy, the main selling point is the fact that these trends are so simple to follow and identify on the renko charts as compared to the candlestick charts or other price charts.

The chart above shows the trend breakout after a bullish trend. It is also shown that there can be a fake breakout but the confirmation candle is there to make sure that the breakout has occurred and the trend is about to be reversed. This makes it easier for the traders to plan their trading sessions and to make sure that they do not trade directly into them. Generally, the diagonal trend lines or chat patterns tend to breakout with continuation in the same trend, as is shown in the chart above.

Parabolic SAR Renko Strategy

Parabolic SAR strategy, also known as Parabolic Stop and Reverse Retracement is also a widely used and effective strategy using renko charts. Retracement in itself is considered a very safe way to trade. Parabolic SAR or PSAR is one of the lesser-known indicators out there but it is still worth studying because this indicator offers a number of great uses.

Originally PSAR was designed for a stop and reverse trading system, but its use changed over time. Now, the most optimal use for this indicator is for identifying optimal entry and exit points for trading positions. This use as a trade execution signal is where PSAR shows its true potential.

The chart above shows the visual aspect of the indicator. It is plotted along side the price data. As shown, the indicator is series of dots that are put above and below the price fluctuations.

The PSAR dots can be seen fluctuating with the price. When the dots are present below the price chart, it usually presents an uptrend. The prices tend to go higher. As the price progresses, the dots become closer to each as well.

When the indicator shifts and goes from being below the price chart to above it, this means a reversal and thus a shot positions are preferable in this situation.

The situation for a downtrend is the opposite as that of the uptrend. The series of dots appear above the price chart and they become closer to each other as the price keeps on going further down. When the indicator shifts above the price chart, it means that price will now follow a bullish trend when moving forward, thus favoring long side of the market.

Renko Trading Strategy by Jide Ojo

For those who are looking to learn more about the renko trading systems and how these strategies work, they should take a look at renko trading strategies by Jide Ojo. The strategy he teaches is a price-driven strategy and the most unique part is the fact that this strategy does not need the use of any indicator. He will teach you how you can go about building your own renko charts which suit your trading style and objectives and then a simple renko strategy which will help you end up on the right side of the market more often than not.

The strategy involves simply checking trade setups for a couple of minutes every day and if you find a high probability trade setup, you should place an order. That is the basic overview of the whole strategy.

You can use a demo account to trade with this strategy for a FREE 60-days trial and there is a money back guarantee so it is worth a try.

In short, renko charts are not only simpler, they offer a lot of utility in trading setups as well. Renko charts can be easily added in your thinkorswim charts for easier access as well as a broader view on the market and price trends. There is also a renko chart scalping trading system which will help you profit using the rules of the scalping strategy but since we will be using renko charts, there are some extra rules involved which will make it coherent with the renko trading system.

These strategies, though quite effective, are by no means set in stone and have some potential for losses. There is no “perfect” strategy out there but these renko trading strategies are tested and are being used for a long time.

Trading is an evolving business and there is always room for more. Learning more technical indicators and more trading strategies will most likely translate in more profits. So, learning these renko strategies are totally worth it. As a newbie trader who is looking to get into the business or a veteran who is looking for something more, there is always room for improvement.