How to Use Keltner channel indicator

A grain trader Chester Keltner first introduced the Keltner channel indicator in the 1960s. The indicator was re-introduced (revised version) by American financier Linda Raschke in the 1980s. In this article, we'll discuss this potent moving average band indicator you can use to improve your trading.

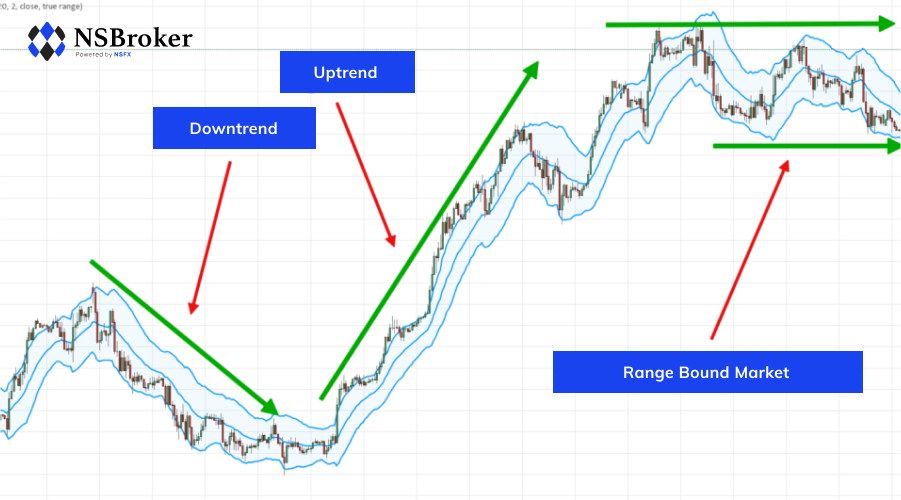

The Keltner channel indicator is an envelope indicator, and just like all other envelope indicators, it uses two bands (one lower band, and one upper band) to create a dynamic channel around the price range of a charted instrument. The Keltner Channel happens to be a trend following indicator used to identify reversal with channel breakouts and channel direction. The channels can also be used to indicate overbought and oversold when the trend is flat.

Keltner channels are very similar to the Bollinger bands, the difference being that the Keltner channel, is based on Average True Range (ATR) In contrast, the Bollinger bands are based on standard deviation.

Chester W. Keltner developed the Keltner channel.

Keltner channel indicator Explained

A key feature to note when trading an indicator method such as the Keltner channel trading strategy is that like all indicator channel; it is a lag time. Indicators are derivatives of price, meaning that the result that you see via an indicator will come via a calculation using the price that you see on your chart. The price comes first, and the indicator second.

As humans, we sometimes allow emotions and beliefs to affect our moves, and these emotions become very potent, especially when money is on the line.

Channels are designed to surround the general price action of the charted instrument. Anything seen outside the general movement of price can be considered an extreme movement. When a price makes an excessive move in a direction or the other, is the time watch out for potential trading opportunities because it is evident that the volatility has changed.

The Keltner channel bands that surround the price in the channels' moving average can be used as an alert for potential trading opportunities. It is critical to note that the Keltner channel bands are not a physical barrier to price just as moving averages do not magically support the price. The band is a measure of the volatility in the case of the bands and the consensus when we refer to the moving average.

The Keltner channel is plotted with two bands (the upper band and the lower band), and through the middle is a 20 Exponential Moving Average (EMA). Using the moving average as a zone of general agreement in price, when price moves away from it, one side is favored over the other, the further the price moves away, the more we can expect a snapback in the price. The moving average can also act as a landing zone after the price makes a snapback.

Keltner Channel Trading Strategy

A strategy for trading the Keltner channel is to regard a close above the upper band as a strong bullish signal while a close below the lower band is a strong bearish sentiment and buy and sell with the trend. This unique indicator tool allows you to select your moving average type, the color of the painted channel, and the sound alert when the price leaves the channel.

There are certain Keltner channel settings that can be changed depending on your platforms; these includes:

- Moving average length (will determine the lag time of channel)

- Average true range (ATR) – this sets the width of the channel.

- Band multiplier (uses ATR reading)

- Moving average type (Exponential Moving Average, or Simple Moving Average)

- ATR type (Exponential Moving Average, or Simple Moving Average)

A band multiplier is a significant number because it is going to determine how tight the upper and the lower bands are to the price. If the bands are tight, you get a lot of excursion to the bands and beyond. This may be ideal for those scalping with the Keltner channel but not suitable for those looking for a longer-term place through the instrument. Keltner channel trading strategy is also useful in day trading, and you could twist the band multiplier to suit your trading needs.

Keltner Channel Breakout System

The Keltner channel is often confused for the Bollinger bands, but they act differently in terms of reaction to price. The difference is the Bollinger bands are calculated using a standard deviation while the Keltner uses the Average True Range (ATR). Some traders, however, utilize both the Bollinger bands and the Keltner channel to show a Bollinger squeeze. When we have Bollinger inside the Keltner, the squeeze is on. In a trade setup, the movement of the bands outside the channel is a trigger; this trigger will signify that there is a probable surge in price.

The original Keltner channel trading system uses a 10-period EMA, but it caused traders to be whipsawed around far too much. Over time, the well-received Keltner channel settings became a 20-period EMA, 20-period ATR, and 2.25 multiplier. You can test various settings, but in the end, we are merely looking for the price engaging with either side of the channel.

The trading pullback is best done in a market that has exhibited a strong push in a direction where you want to see a conviction in a market swing that indicates another move in the same direction. Using a Keltner channel, we can travel outside the bands as an indication there was conviction in the swing. If you are trading in a downtrend, you want to see price travel to the lower channel and plot outside the channel. For an aggressive trader, a shadow plot is sufficient for making a move.

An excursion outside the channel indicates an extreme from what was considered standard price action. When prices are at the channel, it is an alert to look for a price pullback around the 20 periods EMA.

Conclusion

The Keltner channel trading system is not complicated, but do not be misled by the simplicity as there is a lot to be done on the part of the trader in determining the overall trend direction. When used alongside price action analysis, the Keltner indicator can do more than identify trend direction and providing profitable trade signals.