Triangle Chart Patterns

Continuation patterns are some of the vital components of day trading strategies. These valuable structures play critical roles in decision making as far as the Forex market goes. Traders of all levels find these patterns exciting as they render a more comprehensive insight into future price movements and the probability a trend resumes or not. While there are quite a number of them, this article targets one of the prevalent on-chart continuation formations— the triangle chart pattern. At then of this article, you should be able to know what a triangle chart pattern is, its forms, and how to trade it like a pro.

A triangle pattern is a consolidation pattern formed at mid trends. It indicates the continuation of a prevailing price trend. This characteristic is why it falls under the continuation pattern category. It is typically depicted by sketching trend lines along with a converging price series, which suggests a pause in the current trend. As soon as the upper and the lower level of a triangle interact, traders usually expect an eventual breakout from the triangle. As a result, many breakout traders and investors use triangle formations for identifying breakout and entry points.

It is suitably named triangle patterns because the upper and lower trend lines ultimately meet at the zenith on the right side, thereby forming a corner. The connection of the start of the upper trend line to the start of the lower trend line completes the other two corners and creates a triangle. The upper trend line can be formed by connecting the highs, whereas the lower trend line is formed by connecting the lows.

Triangle pattern stock

The triangle pattern informs traders about the stock market and the current situation therein. They function almost the same way in the stock market, like any other trading. Hence, knowledge on how to interpret the market scenario helps traders in the decision-making process and broadens their understanding of the market dynamics.

Cost-effective trading has to do with connecting the dots in the stock market and combining the clues provided by your chart patterns to build a classy trade scenario. When trading triangles, you have to understand the market dynamics and not just to hunt and to wait for trade signals. Some of the trendiest triangle for profitable trading includes ascending, descending, and symmetrical triangles.

Triangle breakout trading

Before attempting to trade triangle breakouts, there are few things to put into consideration.

- Identify the type of triangle on formation by using the upper and lower trendlines

- Pick out the direction of the trend before the consolidation period

- Your strategy should include a dependable risk management clause should there be a false breakout.

The basic idea behind trading triangle breakouts comes in two ways. The first is to sell at a lower value when the stock price plummets below the lower trendline of the triangle. Secondly, it is to buy assets when prices move above the upper trendline of a triangle.

The breakout approach applies to all triangle types. The application is the same irrespective of the type of triangle, whether ascending, descending, or symmetrical. No two traders draw exact triangles; hence, the exact entry point in the stock market may vary from one trader to another.

One of the main objectives of the triangle breakout strategy is to secure profit as the price moves away from the triangle. A trader can initiate a short trade if the price breaks below triangle support with a stop-loss order placed above a recent swing high, or just above triangle resistance. On the other hand, a long trade is initiated if the price breaks above triangle resistance with a stop-loss order placed below a recent swing low.

Types of triangles chart

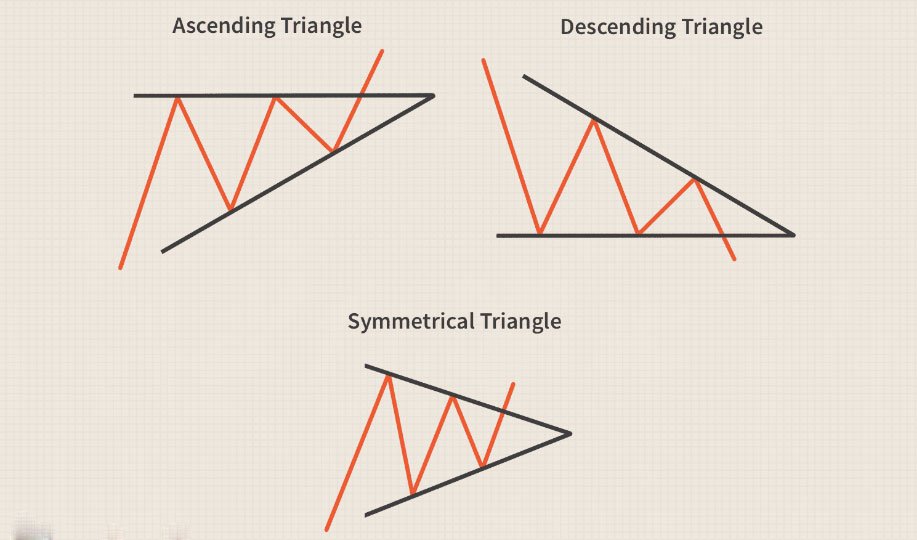

The triangle formation comes in three forms and remains the most familiar patterns to day traders.

Triangles usually indicate a decrease in market volume that could surge again in a very short time. This pattern creates a logical insight into current market conditions, as well as the type of conditions that may be forthcoming. It also provides trading chances as the triangle is forming and once it completes. There are three types of triangles chart formations, namely: Symmetrical, Ascending and Descending triangles.

Symmetrical Triangle

The symmetrical triangle occurs once the up and down movements of an asset price converge at a point where they both form a triangle. When this happens, it indicates an impending breakout is about to take place. The symmetrical triangle formation shows that the market is producing lower highs and higher lows. There could have been a clear trend, but since the buyers and sellers are reluctant to push the price, it creates a perfect set-up for congestion.

The connection between the swing highs through a trend line and the swing lows with a trend line create an asymmetric triangle with the two trend lines are pushing towards each other. A triangle can occur once two swing highs, and two swing lows are connected with a trend line. Traders usually wait for the price to form three swing highs or low before drawing the trend line. This move is because prices may move up and down in a triangle pattern on many occasions.

Ascending Triangle

The ascending triangle is a bullish formation formed during an uptrend. An ascending triangle is produced by a rising swing low, and swing highs that attain similar price levels. Whenever a trend line is drawn alongside the similar swing highs, it forms a horizontal line. The trend line that connects the rising swing lows is angled upward, thereby creating an ascending triangle. The ascending triangle can be drawn when two swing highs and two swing lows are connected with a trend line. Prices are being confined to a smaller area yet reaching a similar high point on each move up.

Descending Triangle

A descending triangle is an upturned edition of the ascending triangle and also considered a breakdown pattern. Descending triangles is a bearish chart pattern that is used in technical analysis and is formed when lower swing highs and swing lows attain similar price levels. Accordingly, when a trend line is drawn along the similar swing lows, it forms a horizontal line. The trend line that is connecting the falling swing highs is angled downward, as a result, create the descending triangle. Once two swing highs and two swing lows connect with a trend line, one can draw a descending triangle. Hence, prices congregate at a smaller area, yet it reaches a similar low point on each move down.

Conclusion

Triangle chart patterns are among the most significant chart patterns in forex trading, with the basic types of triangles being ascending, descending, and symmetrical triangles. Knowledge of how to interpret and trade triangles is an excellent skill to acquire for both traders and investors. The day traders technically require a broader range of strategies than simply trading triangles. However, the knowledge of how to trade triangles can equally be applied to trade other chart patterns as well, such as ranges, wedges, and channels.