The Two Fingers Forex Trading Strategy

The “Two Fingers” strategy is based on the idea of finding a long-term trend on a daily chart that lasts for several days or weeks. As we know, all trends have pullbacks, and it is at these moments that you need to enter the market. The search for a suitable moment to enter the market must be performed at a shorter time interval.

How to apply the strategy?

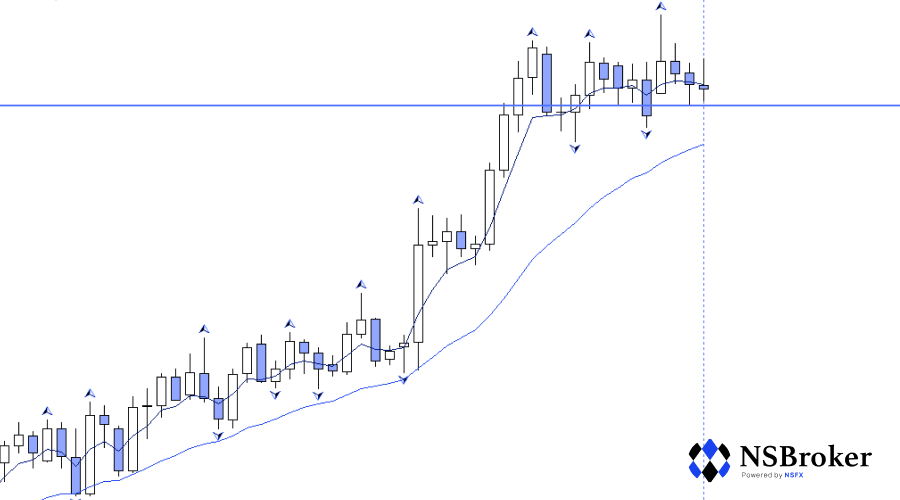

First, you need to open the daily chart and identify the trend on it using moving averages. The creator of the strategy recommends using moving averages with periods of 5 and 22 for these purposes. If the moving averages with a period of 22 are located above the moving averages with a period of 5, then the market is in a downtrend. If there is a moving average with a period of 5 on top, then there is an uptrend in the market. Having identified a global trend, we need to wait for the appearance of fractals. A classic fractal looks like 5 candles with a peak in the middle. We need to wait for such a formation against the trend to appear. That is, if the market is in a bullish trend, we are waiting for a lower fractal, and if it is bearish, an upper one.

At the moment of completion of the second candlestick after the fractal, we draw a horizontal line at the highest point of the candlestick (the lowest one in the presence of a downtrend), after which we move on to the four-hour chart. On the four-hour chart, we must wait for the OsMA indicator to breakthrough level zero. At the moment of the breakout, the price must be located below the straight line we have built. This is to make sure that our forecast is still correct. If the price was higher, it would mean that we just missed the signal to enter the market. In such a situation, you can safely enter the market. The creator of the strategy recommends entering the market using pending orders. It is recommended to set the Sell Limit order below the low of the signal candle. When placing such an order, we will not lose anything if the price unexpectedly reverses.

Setting stop-loss and take-profit levels

Do not forget to set stop-loss and take-profit for your orders. There are a lot of approaches to do it. You can place a stop behind the previous extreme on the 4-hour chart or behind the signal candle on the daily chart. If you prefer longer-term trading, place your stops on the daily chart. In general, the creator of the strategy advises setting a stop where it is more reliable. It is recommended to close deals at the pullback of the OsMA indicator through the zero level. Upon reaching a certain profit, you can also make the open position loss-free and then wait for the pullback of the moving averages on the daily chart. You can also exit the market based on graphical analysis, as the strategy creator does. He frames a price channel and plots a Fibonacci grid on the daily chart. Feel free to use support and resistance levels for these purposes. It is also possible to carry out additional top-ups at the time of the breakthrough. But this is more suitable for those cases when the transaction is held for a longer time.

Additional information

Based on this trading strategy, a special robot was created that issues a signal at the The Two Fingers Strategy is a fairly simple and reliable trading system that has proven to be highly effective. This method of creating positions can be recommended to those speculators who are not ready to spend a lot of time behind a computer screen. In trading, one should strictly observe the norms of money management to exclude large drawdowns of the deposit. The size of the order should not exceed 1% of the size of the used deposit.

Summary

The strategy is very easy to use and works great. That is why, despite its recent appearance, it has attracted the interest of many traders. Especially, this strategy appealed to those market players who have little time to trade.