Using Turtle Strategy For Trading

Turtle Strategy is one of the oldest trading models. Its long-term use in the markets guarantees its reliability and profitability. This article will inform you about the basic principles of this strategy and ways to apply it in practice.

The development and growing popularity of trading has steadily led to the emergence of numerous strategies, among which traders can choose the ones that suit them best. Some of them are complex and multilevel, requiring significant professional effort to use. Others are relatively simple and straightforward, which is also perfectly normal. In trading, the simplicity of the strategy in no way indicates that it is worse than others. In some cases, choosing a simple strategy can lead to a much better trading performance than vice versa. One of the most significant examples that confirm the correctness of this statement is the Turtle Strategy.

What is the Turtle Strategy

The main postulates of the Turtle Strategy (TS) were developed by Richard Dennis approximately four decades ago, in the 1980s. Interestingly enough, the creation of this strategy was immediately followed by a bet that Dennis made with his colleagues, in which he taught a group of novice traders this strategy from scratch and made them effective professionals. Thus, Dennis immediately demonstrated that the strategy he invented was not just a theoretical development but a model quite suitable for practical application.

Turtle Strategy is a diverse trend-based strategy that operates within daily metrics. Its popularity is caused by the fact that trying to catch trend movements is a highly popular approach among traders. Under the Turtle model, the basic idea on which traders rely is that trades in which losing trends occur should be closed immediately; in turn, the operations caught in the flow of a winning trend should be left alone to allow profits to grow.

Although this rule sounds easy and straightforward, in reality, few can follow it, primarily through psychological aspects. Thus, people tend to react to losses with excessive worries, while they are an integral part of the Turtle model. Also, this paradigm is aimed at transactions with the highest profit, which can also be psychologically pressuring for traders who may prefer to enter a more stable environment, where profits will be relatively low but, at the same time, the risks will not exceed certain acceptable values.

For example, let's simulate a situation in which a trader loses part of the profit in a trade that is not a losing one. In other words, the trader is faced with a slight fluctuation of the uptrend, which, however, does not go downhill. In such a situation, it may be emotionally difficult to keep oneself from closing the deal to avoid risking the profits that could be lost in case of further fluctuations. However, the Turtle Strategy stipulates that such a deal should not be closed, allowing profits to continue growing. It is easy to see why following such tips can be difficult for a trader.

Opening and closing signals in Turtle Strategy

The main idea on which the rules of trading according to the Turtle model are based is that all trends should be used. When a trader sees a trend, they need to open trades within it so as not to miss the moment when it becomes profitable. In this case, the reaction to trends is not determined by sophisticated analysis and predictions, resembling rather a kind of ""random shots"" to catch the target. Due to this fact, the Turtle strategy is often criticized as too straightforward and primitive in its approaches. However, as long as it is effective, other aspects that characterize the strategy are of secondary importance.

Traders can use breakouts to determine when to open orders. In some cases, technical indicators used in trade can immediately show the points at which it is better to enter the market and leave it.

Opening the position

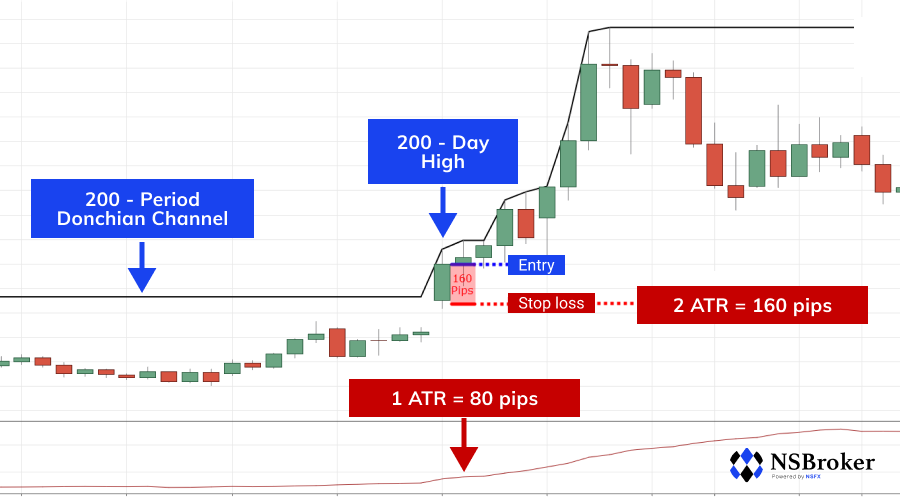

Usually, when using Turtle trading, you need to open your position at the moment of the channel’s breaking out. It is not necessary to anticipate the candlestick’s closure; as soon as the prices approach the border of the channel and start going beyond it, you may open a buying position. At the same time, some experts advise skipping this trade if the previous one was profitable; on the contrary, you need to enter the market if the previous trading operation resulted in a loss. Not all traders support this position because the direct correlation between the losing character of the previous transaction and the winning nature of the next one cannot be rationally justified. However, experts acknowledge that as the number of losing deals increases, your chances of winning the next deal increase. Also, it is important to remember to use pending orders when opening new positions. In particular, you can calculate the Stop Loss using the ATP indicator.

Closing the position

Closing the position, it is necessary to consider it in the context of a ten-day channel. When the price reaches the top point in the ten-day channel, it is necessary to close the selling position. In turn, the buying position closes when the price reaches the bottom of the channel. Thus, the confirmed presence of a strong trend is a signal to enter the market, while a breakout signals the need to close positions. Traders should also remember that strong trends always require pullbacks and corrective activities. Trading within this model requires self-control and patience so that you do not leave the market too early and do not lose the opportunity to make significant profits. Follow the rules, wait for the right moment to enter the market and close the deal, and you will be able to use the Turtle Strategy to your greatest advantage.