What is Arbitrage trading & how to do Arbitrage in Forex

When people discuss Forex trading, it is tantamount to trying to make profits by anticipating the future direction of a market. But have you ever wondered if there is a way to profit from the Forex market without having to choose the right direction of a currency pair? You may be interested to know that there are a number of market neutral strategies. Probably the least risky option is forex arbitrage.

Before we look at the specifics of forex arbitrage, let's talk about arbitrage in general. In short, arbitrage is a form of trading in which a trader attempts to profit from price differences between extremely similar instruments. Traders who use this strategy are called arbitrageurs.

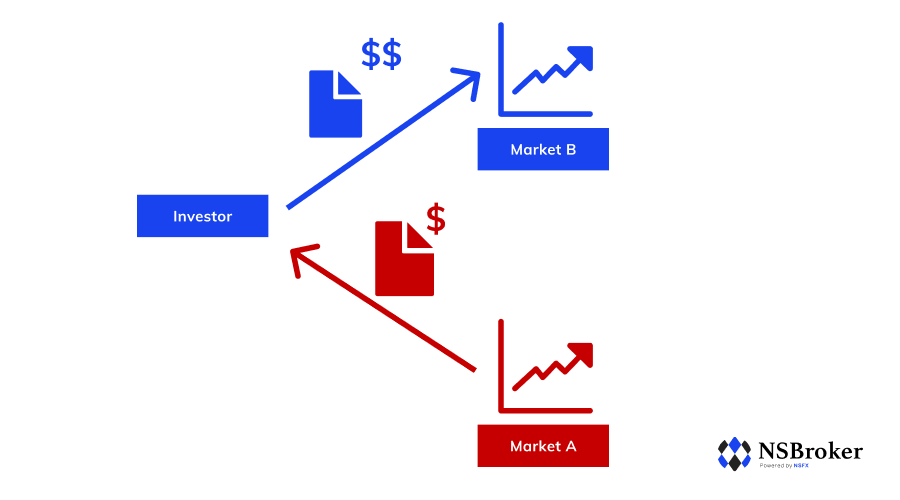

Arbitrageurs have the following objective: they buy in one market and simultaneously sell an equivalent size in another, contiguous market in order to profit from price differences between the two markets. Sometimes products and services that are virtually the same are traded in the financial markets. For example, some large companies are listed on more than one stock exchange. Theoretically, all listings of a particular stock should have parity in pricing, because after all, they are all shares of the same company.

In reality, the flow of information to all parts of the world is not very direct, and the markets do not trade with full efficiency. Therefore, when both exchanges are open, it is possible that prices may differ between the exchanges. The first person who noticed the price difference could: buy the share on the exchange with the lower price and sell it on the exchange with the higher price. Do you want to know the best part? This way you can potentially make a profit.

Forex Arbitrage Trading Definition

We have already briefly touched on this, but what is currency arbitrage actually, if you look at it more closely? Traders are essentially trying to arbitrate currency prices, and are doing the same thing as described above. They effectively aim to buy a cheaper version of a currency while selling a more expensive version.

After deducting transaction costs, the profit is the remaining difference between the two prices. A Forex arbitrage system could work in different ways, but the essence is the same. Arbitrageurs aim to exploit price anomalies. They might try to take advantage of price differences between spot rates and forward rates.

A future is an agreement to trade an instrument at a certain time at a fixed price. Forex broker arbitrage can occur when two brokers offer different prices for the same currency pair. In the retail FX market, prices between brokers are usually the same. Therefore, the feasibility of this strategy tends to be limited to the institutional market. This is also not the only type of arbitrage forex trading opportunity available in the spot market. Another type of currency arbitrage trading involves three different currency pairs.

Forex Arbitrage Trading Strategies

Forex Triangular Arbitrage

Forex triangular arbitrage is a method that uses offsetting transactions to profit from price differences in the foreign exchange market. To understand how to arbitrate FX pairs, we first need to understand the fundamentals of currency pairs. Let's go through some basic things briefly. When you trade a currency pair, you are actually taking two positions: buying the first currency and selling the second currency.

A currency cross is a currency pair that does not include the US dollar. A theoretical or synthetic value for a cross is derived from the exchange rates of the currencies concerned against the US dollar. For example, suppose the EUR/USD currency pair is trading at 1.1505 and the GBP/USD currency pair is trading at 1.4548. We can calculate an implied value for the EUR/GBP currency pair by dividing one by the other.

Example: 1.1505/1.4548 = 0.7908Why do we divide one by the other? Simply put, currency pairs can be treated as fractions with numerators and denominators.

Splitting the value by GBP/USD is equivalent to multiplying it by the inverse. Therefore: EUR/USD x USD/GBP = EUR/GBP x USD/USD = EUR/GBP. If the actual trading value of the EUR/GBP currency pair differs from that of the main pairs, there is an arbitrage FX opportunity. As the name suggests, triangular FX arbitrage consists of three trades. Let's assume that EUR/GBP is actually trading at 0.7911.

It is higher than our implied value, so we will sell it. We must also place two trades in the two related majors to create a synthetic EUR/GBP counter position. This will offset our risk and thus the lock-in profit. Since the price difference is small, we need to move in a substantial size for it to be worthwhile.

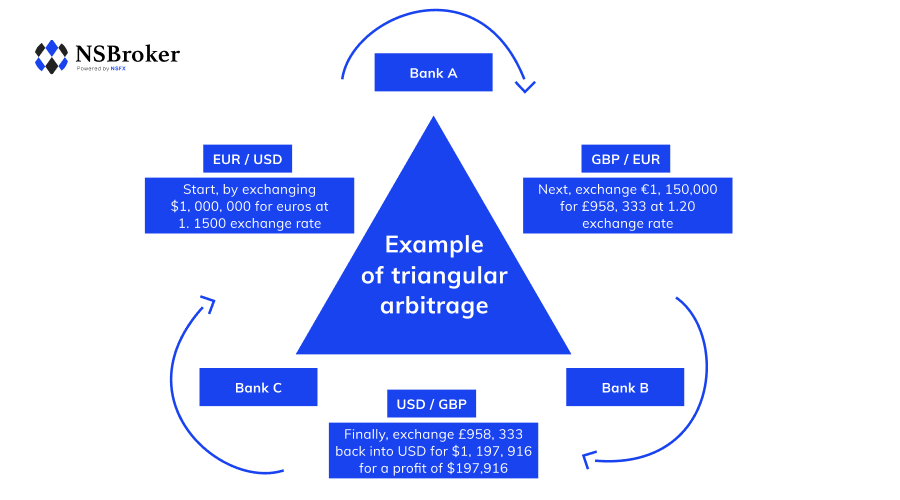

Let's go through the numbers to complete our example of this forex arbitrage strategy. Let's buy 10 lots of EUR/USD - one lot is 100,000 units of the former currency. When we buy a currency pair, we buy the first currency and sell the second. So we buy 10 lots x 10,000 EUR = 1,000,000 EUR.

Since we trade at a EUR/USD rate of 1.1505, we sell 1,000,000 x 1.1505 = 1,150,500 USD. At the same time we want to sell a corresponding amount of EUR in EUR/GBP. So we sell 10 lots of EUR/GBP, that is 1,000,000 EUR. Since we trade with a EUR/GBP rate of 0.7911, we buy 1,000,000 x 0.7911 = 791,100 GBP.

Finally, we also sell GBP/USD to complete the triangular transaction. This means we have no overall exposure to any of the three currency pairs. To reduce our exposure in GBP, we would sell the same amount we bought in EUR/GBP trading. Therefore we sell 791,100/100,000 = 7.91 lots GBP/USD. We trade at a GBP/USD rate of 1.4548, so we buy 791,100 x 1.4548 = 1,150,892 USD. Consider the implication: If you were physically exchanging currencies at these rates and in these amounts, you would end up at 1,150,892 USD after initially exchanging 1,150,500 USD into EUR.

So your profit would be as follows: 1,150,892 - 1,150,500 = 392 USD. As you can see, the profit is relatively small in relation to the large transaction size. Also note that we have not taken into account bid/ask spreads and other transaction costs. Of course, with a Retail FX Broker you do not exchange currencies. You would have made a profit on the trades, but you would still have to liquidate your positions. Remember that daily SWAP adjustments would quickly undermine the fictitious profit you have fixed.

Statistical Forex Arbitrage Trading

Although it is not a form of pure arbitrage, the statistical arbitrage forex takes a quantitative approach and looks for price deviations that are statistically likely to be correct in the future. This is done by putting together a package of above-average currency pairs and a package of below-average currencies. This package is created with the goal of shorting the over-priced and buying the under-priced.

The assumption is that the relative value of one package to another is likely to fall back to the average over time. With this assumption, you would want a close historical correlation between the two packages. So this is another factor that the arbitrator must take into account when compiling the original selections. You also want to ensure as much market neutrality as possible.

Risk-Free Profits

Arbitrage trading is sometimes described as risk-free, but unfortunately this is not really true. A well-implemented currency arbitrage strategy will present a relatively low risk, but implementation is only half the battle, as execution risk is a big problem. First, your clearing positions must be executed simultaneously or almost simultaneously. It becomes more difficult because the difference in arbitrage trading is small - a fluctuation of only a few points will probably wipe out your profit.

Other Problems with Arbitrage in Foreign Exchange Trading

Problems arise with the volume of people using the strategy. Arbitrage trading is basically based on price differences, and these differences are influenced by the actions of arbitrageurs. Overpriced instruments are pushed into the price by selling them. Underpriced instruments are pushed up by buying. As a result, the price difference between the two will decrease.

Eventually, it will disappear or become so small that arbitrage trading is no longer profitable. Either way, the arbitrage opportunity will disappear. The large number of participants in the foreign exchange market is usually a great advantage, but it also means that price differences can be discovered and exploited quickly.

As a result, the fastest player wins the game of Forex arbitrage. The fastest price feeds are essential if you want to be the one to profit. For example, our Admiral.Prime account offers execution speed at an institutional level: this is essential for this type of trading, as you will be competing against the fastest in the world. When you see how speed of execution can make all the difference, choosing the right arbitrage software can give you a competitive advantage. Don't hesitate to try new and varied strategies before you start trading real money.

Also note that the speed of the modern market means that you will probably need to use an automated trading system for successful arbitrage. After opening an account: your best move is to download the feature-rich and award-winning MetaTrader 4 Supreme Edition trading platform. Simply put, MT4 Supreme offers the ultimate automated trading experience, so why not try it out and see how you perform with Forex arbitrage strategies?

Forex Arbitrage Trading: Final Words

All trading systems are subject to the risk that profitability will decline over time. If new participants follow the same strategy, opportunities dwindle. Arbitrage is no different. The fierce competition in the foreign exchange market means that you may find that pure arbitrage opportunities are limited. However, you are likely to find the theory useful for exploring related strategies and other trading opportunities.