Forex Weekly Forecast & FX Analysis August 10 - 14

EUR/CHF

The euro against the Swiss franc is still developing within the side corridor 1.0714 and 1.0800. We see at least 3 attempts to fix the price above the designated corridor, but each time a pullback followed. The corridor is confirmed by all indicators that are close to neutral values and do not show any dynamics. Interestingly, the rollbacks after the three designated peaks in their minimum values allow drawing a trend line that looks up. This will be the main signal for the next week. We are trading up to the level of 1.0800. Next, we need to see how the market will work out this level.

NZD/USD

The New Zealand dollar against the American dollar continues to strengthen within the limits of lateral corridors. We see at least the third case when the price gradually increases, but the movement is very smooth and within the sideways trends. This can be clearly seen in the oscillators above all. Last week resulted in a situation when indicators do not provide any useful information for trading. The only thing we note is that the price is close to the level of 0.6585, and at the same time it is testing the level of moving averages. This is an important indicator, which should complement the fact that moving averages also have positive dynamics. Therefore, it is possible to trade upwards.

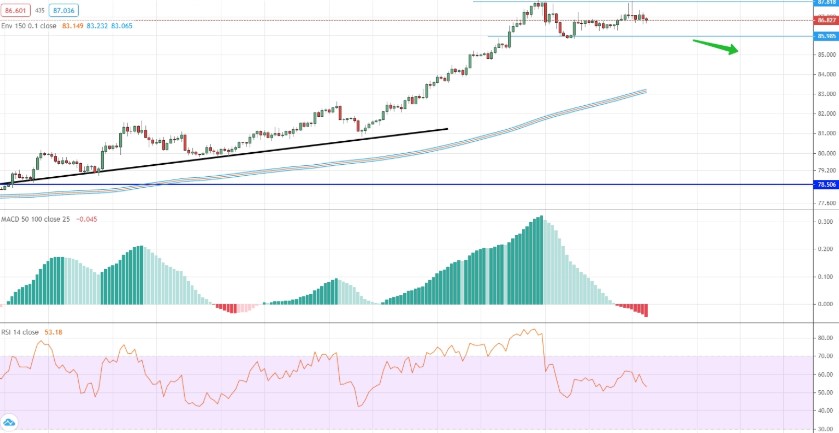

EUR/RUB

The upward trend for the euro against the Russian ruble is still relevant. Nevertheless, it is important that the price has moved far upwards from the trend line and from the moving average line. If we consider the last week, the price concave itself within a fairly narrow sideways corridor 85.98 and 87.81. As long as the price is inside this corridor it is impossible to trade. In the future we will see in which direction this corridor will be broken through, in that direction and it will be possible to trade.

AUD/CHF

This currency pair is one of the most ambiguous for analysis. First of all, it is due to the fact that the indicators do not give any signals to work at all. The only thing we state is the fact that the price develops within the sideways trend of 0.6501 and 0.6585. The price is close to the upper line, which means that we can expect a downward movement. Besides, we work on oscillators and on the principle of bounce from the level.

GBP/CAD

The British pound against the Canadian dollar is developing in an upward trend. Before any analysis of the price, it should be noted that the moving averages rose above the level of 1.7177, which is a powerful signal. In addition, we consider the last movement when the correction took place. This movement is primarily interesting when comparing price and histogram indicators. The price looks upwards, and the histogram looks downwards. In fact, it's a divergence. The divergence confirms the main trend movement and this fact can easily be defined as a divergence. Therefore, it will be interesting for us trade in upward options.

NZD/CHF

This currency pair is developing within a downtrend. The downward movement has already led to the fact that the price turned out to be on the local for itself, at least in more than 2 months. If we consider the price movement relative to the trend line, it has moved from the left to the right, which weakens the trend. Besides, all the indicators are looking up. This clearly contradicts the price, which is falling significantly. Therefore, there are good chances to open up an upward position.

USD/CNH

The main thing to give up on this currency pair is that it is developing in a downtrend. This is the main idea, which we can work with. Here it is important to note that recently the oscillator was in the oversold area, but the price bounced up significantly afterwards. Although the histogram is below zero, it shows its weakness, although it did not reach local lows, which means that it still has the potential for downward movement. It is also very important that the price is as close to the level of moving averages as possible. If you look at the history, within the current trend, whenever the price was approaching the level of moving averages, there was a strong downward slide. We expect this to happen in this case as well.