Forex Weekly Forecast & FX Analysis August 24-28

Technical analysis of the Forex currency market for the upcoming week August 24-28, 2020

EUR/CHF

We have been talking about absolutely identical things for at least three weekly reviews of this currency pair. For the Euro vs. the Swiss franc, there is a side corridor with the borders of 1.0714 and 1.0800. The corridor is strong enough, which is confirmed by all the indicators, which are also close to neutral values at the corridor formation distance. Last week led to an attempt to break through the corridor up, but it did not succeed. Remarkable is the fact that the level of moving averages slowly changes the tilt to a horizontal one, meaning a flat, and increases. Consequently, it is possible to trade within a range, but given that the upper level is the strongest and most sensitive, to which the price most often reaches.

NZD/USD

The general trend for the New Zealand dollar against the U.S. dollar continues to show a downward trend. This can be clearly seen in the price chart and all the indicators that are developing in their external areas. A very important characteristic of the current market segment is the 0.6492 level testing. It should be added that there was a strong rebound in the testing of the level, and the price itself moved far away from both the trend line and moving averages. Consequently, we can expect that the price will continue moving upwards to close this gap, but after that the market will return to its main dynamics.

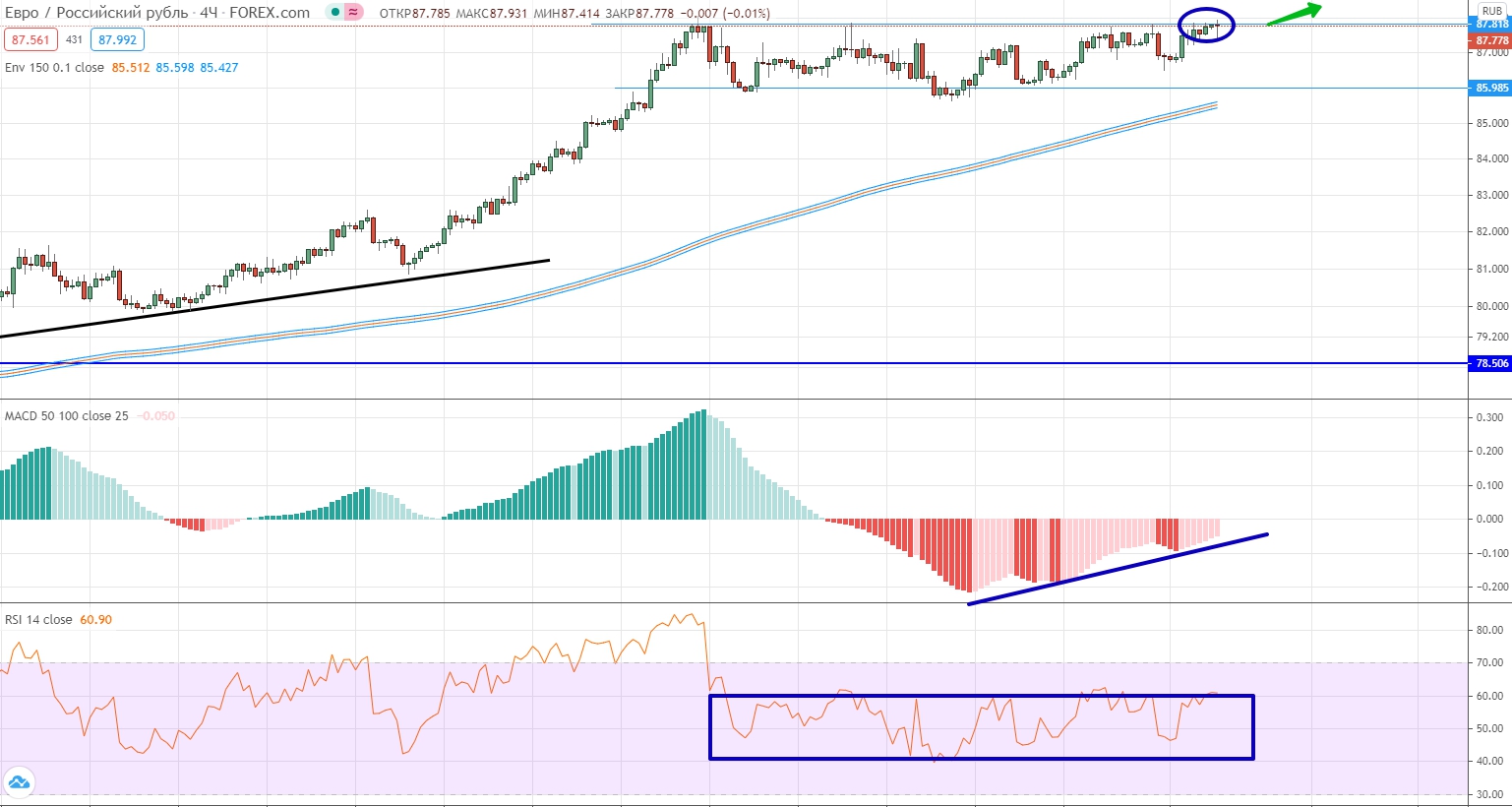

EUR/RUB

For the euro against the Russian ruble, what we talked about last week remains relevant: a side corridor with borders of 85.98 and 87.82. As long as the price is inside this corridor, it is not recommended to trade. Separately, please note that the histogram is already looking up and approaching zero values, demonstrating the possibility of soon entering the positive zone. If you look at the price chart, the market is very close to rising above the price corridor. If this happens, it will be possible to trade upwards. Otherwise, we do not trade.

AUD/CHF

The sideways corridor of 0.6501 and 0.6585 is still relevant for the current currency pair. The corridor is very strong and is confirmed by all the indicators. Moreover, the strength of the corridor is confirmed by the level of moving averages, which are within this corridor and have predominantly horizontal dynamics. However, if you look at the level of moving averages, it is already trying to form a downward slope, which theoretically should allow you to consider trading downwards in the medium term. However, we are still working in the range for the coming week.

GBP/CAD

For this currency pair there is every reason to believe that the market has a potential for upward movement. First of all, this can be traced back to the indicators, which have reached a local minimum and now look up. If you look at the price chart, the market has risen above the downtrend line by testing the level of moving averages and bouncing upwards from it. Thus, we can say that if we consider the level of moving averages separately, it acts as an uptrend line, and thus we can trade upwards.

NZD/CHF

The global trend for this currency pair is downward. This trend can be clearly seen both by trend lines and by its position relative to moving averages and important levels. The downward trend is especially evident in the histogram, which cannot go into positive territory for a long time. We now have a situation where the histogram has slightly risen to the positive area, but is already close to zero. If the histogram closes again below zero, we can trade downwards.

USD/CNH

The main prevailing trends for this currency pair are downward. The market keeps falling for a long time and updating local lows. The prevailing trend is also visible for oscillators that are below 60 and unable to rise above it. The histogram does not provide any signals for trading. Therefore, we can use the basic tenets of technical analysis whether to trade in the downtrend direction.