VSA Method: How to Trade Volumes

Among the many models of trading, the VSA Method deserves particular attention. It has been crafted by Tom Williams, an outstanding investor, at the end of the last century. Interestingly enough, Williams did not have an objective of creating a new strategy. Instead, he tried to better process an existing model known as the Wycoff method. While he was doing it, Williams identified a field for improvement, which he did not hesitate to use, thus coming up with his now-famous VSA Method.

Considering the circumstances of its emergence, in its essence, the VSA Method has a significant volume of similarities with the Wycoff model, with high reliance on bar spreads and trading volumes. At the same time, compared to its "ancestor," the VSA is rather simplified and more understandable to trading newcomers.

How it works

VSA" is an abbreviation for "Volume Spread Analysis." This process relies on the idea that any market always goes through one of the three possible stages. The first of these stages is accumulation, a process with sideways dynamics during which the positions of market participants are accumulated. Throughout it, the asset increases its volume to prepare for the movement waiting ahead. During this time, the price keeps on being flat for a considerable period, while major agents operating in the market keep being inactive and waiting for a price impulse. The wideness of the price's swing directly depends on the longevity of this stage.

The second stage can obtain either a form of decline or growth. It is a vertical process during which a down- or uptrend takes place. At this point, the spring accumulated during the previous step is finally released. After this, a trend is being shaped, starting its movement and developing towards either top or bottom points.

In the third stage, the distribution occurs. In simple terms, it is the process of players vending their assets to others. During this stage, the positions that have been opened while trading was passing the accumulation stage are being closed, and the profits are taken. If the traders are unwilling to end the cycle at the distribution stage, they may turn it into an accumulation stage once again, thus, relaunching the process from the beginning.

Prevailing patterns and timeframes used for the VSA

There are several essential patterns that all those interested in using the VSA should pay attention to. These are the Up, Down, and Level Bars. They denote the moments when the bar's closing price is higher, lower, and equal to that of the previous bar, respectively. As for the timeframes used for this model, they range between M5 and H4. The frames over D1 make the model erratic. In turn, the timeframes smaller than those mentioned above may be unreliable due to an excessive number of false signals they provide.

Conceptual basis of the VSA model

The VSA paradigm relies on one central idea, according to which the most influential market players generate the quotations' movement on the grand scale, hence, controlling the field. A common approach states that if a large player acquires a particular asset in a considerable volume, this asset's price starts growing. Meanwhile, the contrary operation leads to the opposite results, and the price declines.

However, the actual state of affairs is somewhat different. For instance, if a huge market player decides to acquire a large number of assets (let's imagine that it's over a thousand items), there is a possibility that such a volume will be lacking in the market at that moment at all. Meanwhile, in view of the market liquidity, it could take a long time to accumulate these assets in the required size.

Since the strategy of a trader using the VSA model depends on his or her knowledge of asset volumes, a question arises about how to determine this indicator for Forex. Many traders rely on future volumes in this regard. However, this strategy has limited capacity due to the insufficient scope of instruments it provides. Another possible alternative is the application of tick volumes as volume indicators.

A trader who possesses the information on the asset volumes acquired and sold by major players has an advantage over the others. If the reversal is not predicted in an observable future, they can imitate the positions of these large players, relying on their expertise, authority, and the insights the latter (presumably) have. In other situations, they can rely on the principles and patterns described in the next paragraph.

Using the VSA model for trading

In its essence, the VSA method relies on monitoring and predicting potential reversals and other significant shifts in market dynamics. These shifts usually occur at the top and low points of a market's movement.

Horizontal channel breakaway

When the flat is consolidated, the quotations get close to the channel's upper part. In such cases, the tick volumes indicator demonstrates a large candle, indicating an increase in the volume. After this, the channel's border breaks, and an uptrend develops. Meanwhile, you should keep in mind that, after such a breakaway, every next candlestick's closing price is higher than that of a previous one. These signals are primarily used to indicate the uptrending market dynamics.

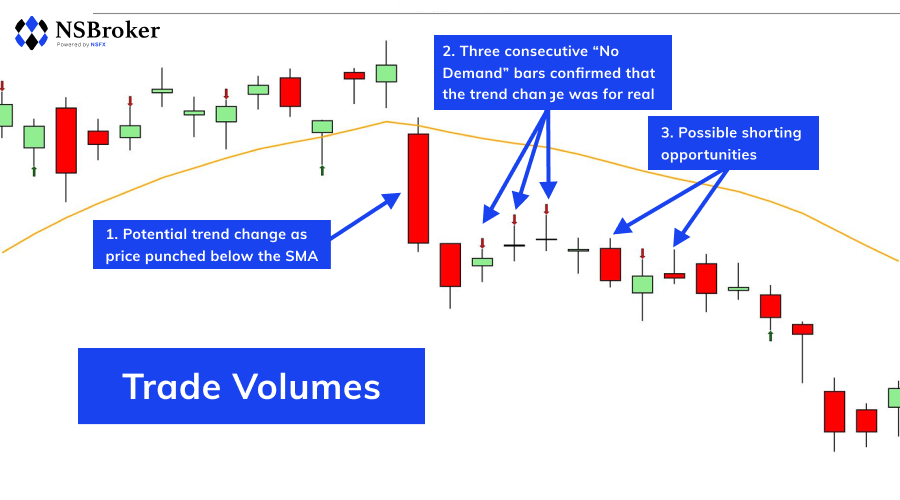

Trend reversal

When the price starts its steep growth, market players tend to close the positions. By doing this, they take their profits, restoring the increase in trade volumes. Under such conditions, the number of sellers exceeds that of the buyers. In this situation, the possibility of a reversal becomes highly probable.

Final words

This article has only described the VSA model in general detail. It is sufficient to understand the essence of this method; however, if you want to start using it in your practical activities, you need to get a more comprehensive, in-depth knowledge of the mechanisms and principles underlying it. Although the model is relatively simple, it still requires your time and efforts aimed at comprehending it. Another thing you should keep in mind is that the VSA does not grant you with a working strategy but provides you with a framework in terms of which you can develop your own approach, the one that you consider the most suitable to your trading style and personality. Therefore, even after comprehending it, you will still have some work to do.