Investing and trading: major strategies

No matter what you do, having a solid and stable strategy is always a decisive factor that separates your success from failure. Trading and investing are no exception to this axiom. Moreover, in these areas, you can hardly achieve any success without a strategy (unless you are very lucky and your luck lasts longer than a few days, which is a very dubious option). Therefore, finding an effective trading strategy and adhering to its postulates is the key to your success in this area.

In turn, anyone interested in making such an activity their main source of profit should understand that there is a huge difference between trading and investing. Although these two areas seem similar in general, in reality, they differ significantly from each other. As a result, the strategies used in them are different to a significant level as well. This article will introduce you to this dichotomy and the strategies associated with each of its individual aspects.

Investing strategies

Often, people perceive investing and trading as two terms to denote the same concept. However, it is a completely inaccurate approach. Of course, these areas have a number of significant similarities. Both of them include the purchase and sale of assets and are associated with risks linked to the uncertainty about future market fluctuations. At the same time, one key difference between them is the long-term nature of investments, which contrasts sharply with trading based on short-term transactions.

In their majority, investment strategies have the form of stock acquisition. The stocks a trader purchases need to belong to profitable companies with good development prospects and the absence of obvious risks, which ensures their growth and potential. The presence of these features is very important because the investor's profits depend on the long-term success of the company. The bankruptcy of the organization whose stocks the investor acquires entails the loss of all invested funds.

Approaching their strategies, investors often rely on the existing models and utilize the metrics of real companies with top performance, such as Facebook, Google, or Amazon. However, they may also consider other companies as examples for modeling hypothetical development scenarios. It all depends on what strategic goal and investment style a person pursues.

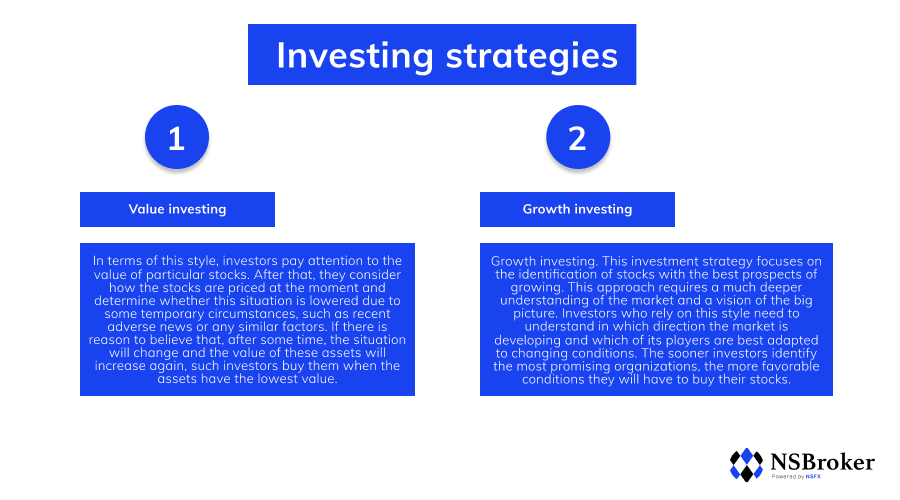

In this area, there are two main groups of styles that an investor can prefer. These include:

- Value investing. In terms of this style, investors pay attention to the value of particular stocks. After that, they consider how the stocks are priced at the moment and determine whether this situation is lowered due to some temporary circumstances, such as recent adverse news or any similar factors. If there is reason to believe that, after some time, the situation will change and the value of these assets will increase again, such investors buy them when the assets have the lowest value.

- Growth investing. This investment strategy focuses on the identification of stocks with the best prospects of growing. This approach requires a much deeper understanding of the market and a vision of the big picture. Investors who rely on this style need to understand in which direction the market is developing and which of its players are best adapted to changing conditions. The sooner investors identify the most promising organizations, the more favorable conditions they will have to buy their stocks.

These are the two most common investment strategies. Of course, the whole list of possible investment models is not limited to these two aspects. Depending on the personality and style of the investor, he or she may come up with other ideas for the most optimal investment techniques. However, these models present the essential dimensions of investing that should be considered by all who want to succeed in this area.

Trading strategies

The dimension of trading is related to investment and, at the same time, radically different from this area. Although traders can also buy company stocks, it is just one of the many assets they deal with. Also, even when buying such stocks, traders aim to acquire them cheaper and sell them more expensively, making a profit from the difference in prices caused by market fluctuations. Unlike investors, traders do not need the company whose stocks they buy to succeed in the long run. It is only important to ensure that at the time they decide to sell their shares, they are worth more than at the time of purchase.

While investment models are fairly straightforward and limited in variety, the list of strategies applicable to trading is extensive and diverse. There are at least five basic strategies that a trader can use to get rich on the acquisition and profitable realization of various assets.

Their list includes the following models:

- Day trading. As the name suggests, under this model, traders try to complete all transactions within one trading day. As a result, the price fluctuations they deal with are minimal, which leads to the need for numerous transactions in order to obtain a significant profit from this trading model.

- Swing trading. The main difference between this model and day trading is the periods during which the asset is held by the trader. While in terms of day trading, the opening and closing of positions are carried out within one day, swing traders hold assets for several days or even weeks before realizing them. To best determine when to buy and sell assets, swing traders rely on both fundamental and technical analysis.

- Position trading. Unlike the two previous models, which can be considered short-term, position trading is long-term in nature. Adherents of this model hold purchased assets for many weeks or months. To succeed with this strategy, a person should rely on sound technical information, resorting to weekly and monthly charts and, thus, anticipating long-term market dynamics.

- Algorithmic trading. This model relies on the application of computer analysis of market conditions to determine the most effective steps that a trader can take. To use it, a person enters all the essential information about the market in a special program, after which it provides the most likely scenario of market dynamics and the most appropriate measures to be taken.

- Seasonal trading. Traders who use this strategy take into account the typical seasonal patterns in which markets have historically developed and build their decisions based on this information. There are several classic seasonal patterns that have proven to be relatively reliable and worth considering. For example, usually from May to October, the stock market brings low returns, which makes it logical to sell assets at the beginning of this period and re-invest after its ending.

What trading platform to use?

Having mastered the fundamentals of trading and familiarizing yourself with the basic strategies applicable to it, you can begin to take the first serious steps in this field. One of the most important aspects of the initial trading stages is choosing the platform that suits you best. Along with ease and clarity of use, your trading platform should also be characterized by the availability of a wide range of technical tools that will allow you to analyze and predict market trends most accurately.

Of all the platforms that exist today, the one that most fully meets the criteria outlined above is MetaTrader. This platform has numerous variations available to users, including MetaTrader 4, 5, and WebTrader. The convenience of these platforms is guaranteed by a wide range of trading tools and support for strategies related to all assets, from forex and indices to stocks and commodities. Also, it is equally important that MetaTrader provides the user with access to a variety of advanced indicators, such as Bollinger Bands, Ichimoku, RSI, and many others.

In their combination, the above features make MetaTrader platforms convenient and reliable for beginners. At the same time, people have different tastes, and if you like another platform better, do not hesitate to choose it. You just have to make sure that it is comfortable and easy to use.