Wöchentliche Forex-Prognose und FX-Analyse 16 - 20 November

EUR/CHF

Last week the euro strengthened its positions very strongly against the Swiss franc. After a period of calm, when there was no volatility and unambiguous direction, there was a strong growth, during which this currency pair added more than 100 points in just a few hours. Now the market is trying to gain a foothold above the 1.0800 level. There is no unambiguous movement, but it should be noted that the current position for trading is not the best. We need to let the market finish working with the current level. If the working out occurs upwards and the price consolidates above the level of 1.0810, we are trading upward. If the price drops below 1.0780, trade down.

NZD/USD

The New Zealand dollar has significantly strengthened its positions against the US dollar, forming local maximum values on the price chart. This can be seen especially clearly in the oscillators, which have been in the overbought area for a long time. Usually, after such a strong growth, the market needs a correction. This fact is reinforced by the fact that the price has moved away from the trend line and the line of moving averages. There is a high probability that normalization may occur, but this requires a downward movement, and only after that can we expect a return to the main upward movement.

EUR/RUB

Recent weeks allow us to talk about the presence of x trend lines: global ascending and local descending. It is characteristic that the current market stage is characterized by a neutral position, since no one line dominates the other. At the same time, the price is close to neutral indicators and is testing the level of moving averages. The indicators also do not give any specific signals for trading, since none of the direction of movement is dominant. In this regard, one can expect only consistent up and down movement in the area of the moving averages.

AUD/CHF

In the current market situation, the Australian dollar against the Swiss franc is in the process of correcting the main upward movement. The upward movement turned out to be quite strong, and it is well read, first of all, by indicators that increase their indicators and update local maximums. Nevertheless, the correction has already been formed, but the upward movement is still very strong and trading options can only be considered in the direction of this movement. The optimal entry point will be close to the 0.6585 level.

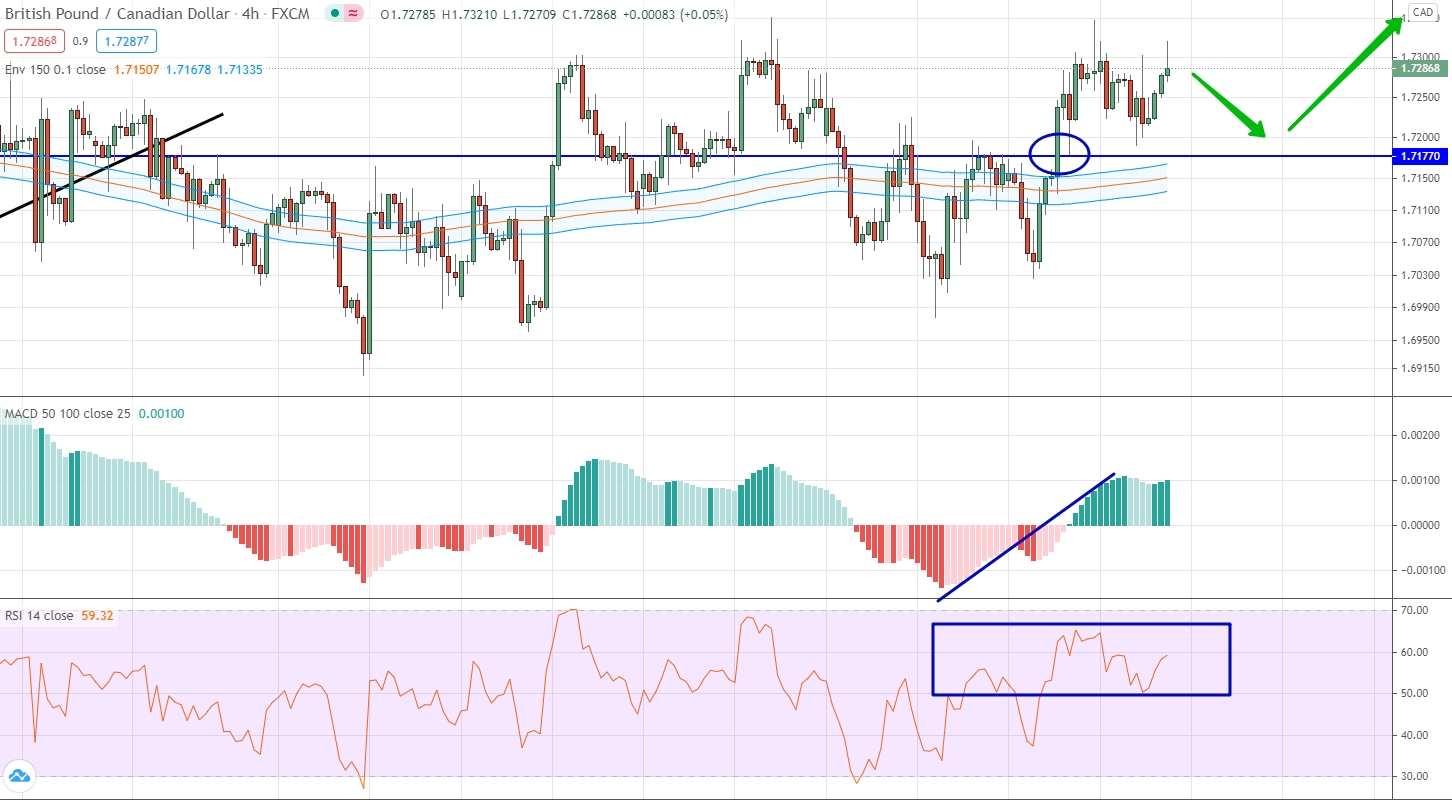

GBP/CAD

This currency pair is making attempts to rise above the level of 1.7177. The fixation above this level took place last week, and at the same time the price consolidated above the level of the moving averages. We draw your attention to the fact that the indicators indicate, first of all, the fact that there is no need to expect an unambiguous and strong trend now. All indicators are close to neutral values and often change their direction of movement. On the price chart, this is confirmed by the presence of long shadows in both directions for most candles. As a result, it is possible to consider only options for trading up, but for this you need to wait for a downward correction to the designated level.

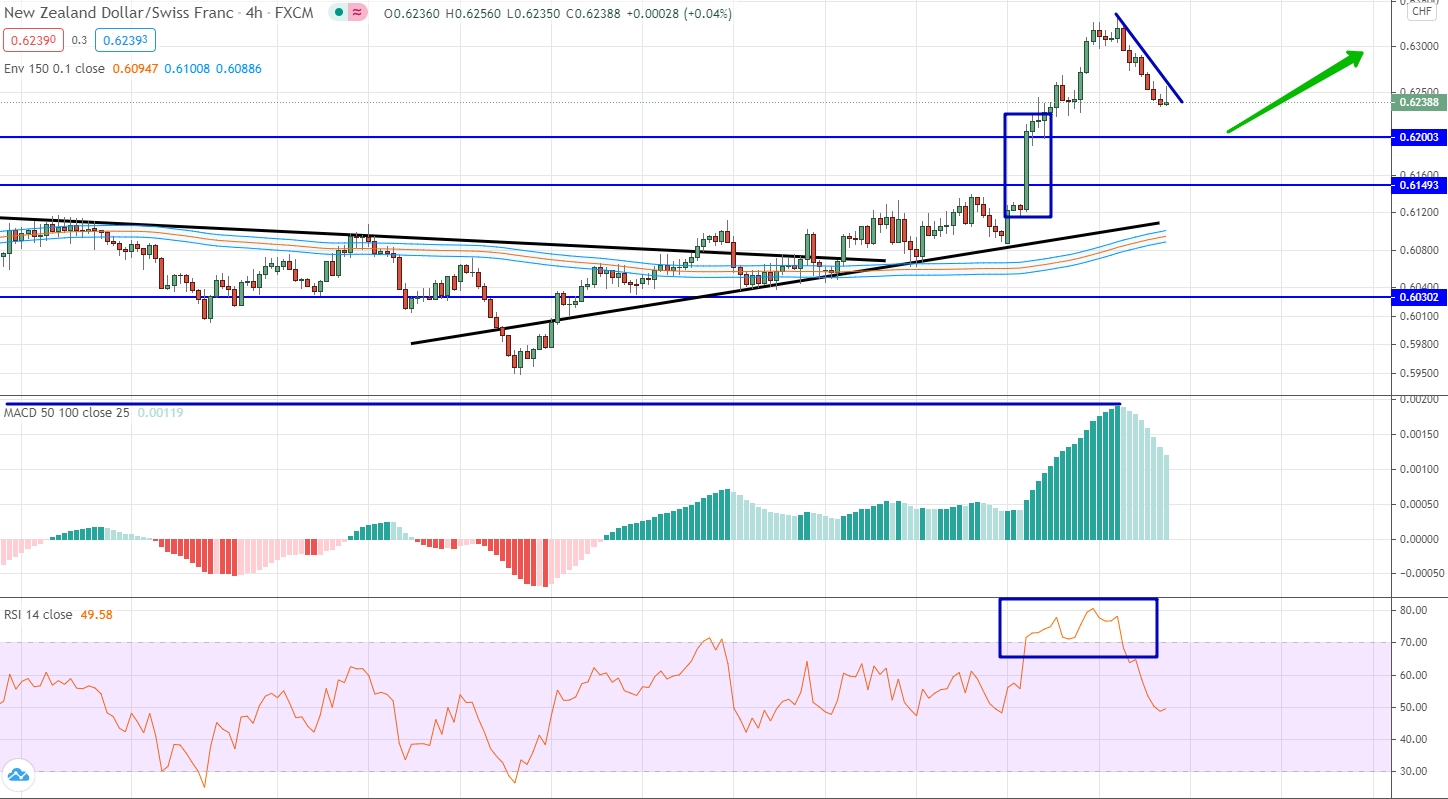

NZD/CHF

For this currency pair, the dominant trend is the uptrend, which only strengthened its significance last week by making another impulsive upward movement. This led to the fact that the price and all indicators were at their local maximum values. For the first time in a long time, the oscillator rose into the overbought area and has been there for a long time. In this situation, we can talk about the domination of upward dynamics and the ability to trade only upward, but for this you need to wait for the completion of the current correction. This can happen at any time, but the optimal entry point will be around the 0.6200 level.

USD/CNH

The dollar against the Chinese yuan last week traded mostly in the negative area. Nevertheless, the end of the week is characterized by the absence of volatility and the formation of candles with a very short body on the price chart. This process is confirmed by all indicators. As a result, we can deduce the additional level 6.6301. If the market consolidates above this level, then it will be possible to trade bullish. Otherwise, it will be possible to consider only options for trading down.